What is the Stock Market?

advertisement

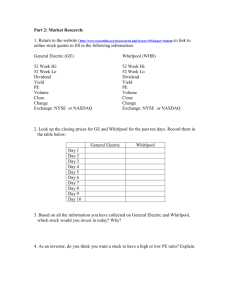

WHAT IS THE STOCK MARKET? STOCK EXCHANGE The Stock Market is often referred to as an exchange Why? To exchange means to trade An stock exchange is a highly organized market where stocks and other forms of exchanges are sold and bought HISTORY First similarities to the investment process occurred in the 1600’s in the East Indies In New York City, stock brokers would make trades on the streets NEW YORK STOCK EXCHANGE In 1792, 24 stockbrokers signed the Buttonwood Agreement that started the New York Stock Exchange This group of stock brokers was very exclusive They moved their operation indoors, to a coffee shop NEW YORK STOCK EXCHANGE The stock brokers that were not a part of the group of 24 continued to make trades in the street By 1901, the NYSE had grown to become a financial powerhouse AMERICAN STOCK EXCHANGE Made up of the group of investors that was not included in the group of 24 that created the NYSE Known as “curbstone brokers” because they traded outdoors, regardless of the weather Anyone could be a part of this group Took chances on smaller companies, emerging companies and new investment opportunities MERGERS Merger-two companies that are combined together to create one In 2007, Euronext, the European stock exchange merged with NYSE In 2008, the American Stock Exchange also merged with NYSE/EURONEXT Global marketplace-bringing together of world markets in one exchange NASDAQ National Association of Securities Dealers Automated Quotations Largest electronic screen based trading market in the U.S. Created in 1971 World’s first ever completely electronic exchange NASDAQ VS. NYSE NASDAQ Trades occur electronically, on a telecommunications network NYSE Trades occur physically on the trading floor Dealer’s market Auction market MARKET PERCEPTIONS The NASDAQ and the NYSE are viewed differently PERCEPTION OF THE NASDAQ Technology, internet and electronics Stocks considered to be uncertain and risky Lists companies that are growth oriented and expected to grow at an above average rate COMPANIES LISTED ON THE NASDAQ Facebook Microsoft Harley Davidson Weight Watchers Sony Papa John’s PERCEPTION OF THE NYSE Companies are more well-established Blue chip companies-companies with a national reputation for quality, reliability and the ability to operate profitably in good times and bad The stock of blue chip companies is known as “blue chip stock” BLUE CHIP STOCK Why is it called blue chip stock? In the game of poker, which is a game of chance and risk, the blue chip has the highest value Hence, the name “blue chip stock”-stock in companies with high value BLUE CHIP STOCKS As a result of their high level of financial strength and market reputation, blue-chip stocks traditionally carry substantially less risk than other stocks. They are generally regarded as safe, sound investments. EXAMPLES General Electric AT&T Proctor & Gamble Chevron Wal-Mart Boeing LISTING A COMPANY Deciding which exchange to list your company on is important It usually comes down to cost COST NYSE Entry Fee: $250,000 (One time fee) Yearly fee: based on the number of shares, maximum of $500,000 NASDAQ Entry fee: $50,000-$75,000 (one time fee) Yearly fee: based on the number of shares, $27, 500 PUBLIC VS. PRIVATE Both the NASDAQ and the NYSE are public companies Both are also traded on the stock market BULLS AND THE BEARS Figure of speech used to describe the condition of the stock market Bull market- a market in which stock prices are rising, encouraging buying Bear market-a market in which stock prices are falling, encouraging selling VALUE OF STOCKS Stock prices change every day as a result of market forces. By this we mean that share prices change because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall. The stock price also reflects the growth that investors expect in the future CHOOSING STOCKS You have to figure out what news is positive or negative for a company Every investor has their own ideas and strategy Price movement of a stock indicates what investors feel a company’s stock is worth VALUE The amount of money a company makes (profit) is what gives the stock value, or makes it worth money If a company never makes money, they won’t stay in business Public companies must report their earnings 4 times a year Investors pay close attention to the earnings reports when they are released MARKET CAPITALIZATION There are two areas that determine a company’s worth Market capitalization is a big factor in determining a company’s worth on the stock market Stock price multiplied by the number of shares outstanding Example: a company that trades at $100 per share and has 1 million shares outstanding has a lesser value than a company that trades at $50 that has 5 million shares outstanding ($100 x 1 million = $100 million while $50 x 5 million = $250 million) MAIN POINTS TO REMEMBER At the most fundamental level, supply and demand in the market determines stock price. Price times the number of shares outstanding (market capitalization) is the value of a company. Comparing just the share price of two companies is meaningless. Theoretically, earnings are what affect investors' valuation of a company, but there are other indicators that investors use to predict stock price. Remember, it is investors' sentiments, attitudes and expectations that ultimately affect stock prices. There are many theories that try to explain the way stock prices move the way they do. Unfortunately, there is no one theory that can explain everything.