chapter 12 questions

advertisement

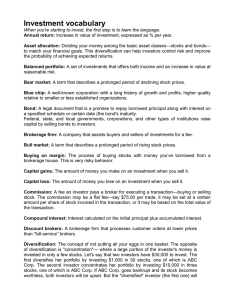

Facts and Ideas. Pg 300-301 1. You would earn a capital gain on your stock by buying stocks for a low price and then selling for more as the value goes up. 2. Common stock is different from preferred stock because common stock is a type of stock that pays a variable dividend and gives the holder voting rights, and preferred stock is a type of stock that pays a fixed dividend and carries no voting rights. 3. Investors that should choose income stocks are investors that are looking to make a quick profit, and investors that should choose growth stocks are investors who are looking to hold them so that the profit can grow. 4. Stocks of young companies often hold the greater risk because they may be one of the many small companies that will fail, but blue chip stocks are stocks of large corporations with a solid record of profitability. 5. Defensive stocks are not subject to the usual ups and downs of business cycles because it is one that remains stable and pays dividends during an economic decline. 6. The relationship between par value and marker value is that par value is and assigned dollar value, and market value is the price for which the stock is bought and sold in the marketplace. 7. What causes stock prices to rise and fall are the company, interest rates, the market, and earnings per share. 8. The largest stock exchange in the United States is the New York Stock Exchange, and a company gets listed on a stock exchange by meeting a minimum number of public shares and dollar market-value requirements. 9. A stock would be listed on the NASDAQ rather than the NYSE or American Stock Exchange because the NASDAQ is an electronic quotation system that brokers use that are operating in the OTC market, while NYSE and American Stock Exchange are listed in the stock exchange. NASDAQ is not listed in the stock exchange. 10. A bull market is a prolonged period of rising stock prices and a general feeling of investor optimism, which a bear market is a prolonged period of falling stock prices and a general feeling of investor pessimism. 14. In stock listings, P/E stands for price/earnings, s means that a stock has recently split, and pf stands for preferred stock. 15. Investors use stock indexes because it is a benchmark used to judge the performance of their investments.