Merger and Acquisition (M&A) Financing

advertisement

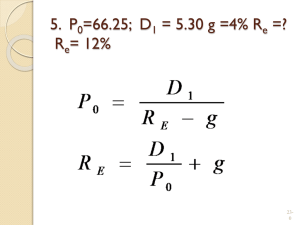

Abstract Merger and Acquisition (M&A) Financing Course prerequisites: Students are expected to be familiar with principles of strategic management and basics in finance & statistics. A course dedicated to the valuation, structuring, financing and negotiating of M&A transactions Lecturer: Kapranova L Course Description: “Mergers and Acquisitions” introduces the students to the topic of M&A and links strategic with financial considerations. M & A gives first insights into the academic literature in the field, but also covers practical aspects. Through discussions and case studies Student will learn a clear process for integrating the strategic, managerial, economic, and financial decisions that affect the execution of mergers and acquisitions, and understand why the acquisition strategy is related to all elements of the process, including valuation, negotiation, deal structure, due diligence and integration. This course addresses crucial questions including:Why do mergers that looked great on paper fail in reality? How does one value companies acquiring, or being acquired? What is the best negotiation strategy? What does it take to make the "synergy" come to life? How can a merger be funded in such a way as to retain the merged entity's flexibility? When do leveraged buy-outs make sense, and how can they be financed? One goal for students is to develop a critical appreciation of the key finance criteria in a proposed acquisition, so as to grasp the main strengths and risks of the company's strategic and financial alternatives Main Mergers and Acquisitions topics include: Valuation Methods and Financial Analysis; The Strategic Rationale for Acquisitions; Motives for acquiring/merging businesses; Reasons of diversification, enhanced earnings per share, and financial synergy are questionable; Strategies for Successful Due Diligence and Post-Acquisition Integration Effective Negotiation with a counterparty (public/private, strategic/financial); Evaluating and pricing Mergers and acquisition; Estimate the value of a potential acquisition using the comparative analysis, weighted average cost of capital, and adjusted present value approaches; Identifying and implementing operational and control synergies; Negotiating the terms of the deal; Financing the acquisition/ Course objectives and learning outcomes: 1) Obtain insights into M&A history and trends, economic and managerial motives. 2) Get insights into the empirical academic literature in the field of mergers and acquisitions. 3) Understand major challenges to merger success and learn how to overcome them. 4) Learn how to assess potential M&A candidates. 5) Learn about acquisition valuation. 6) Understand key factors in M&A deal-making. 7) Learn how to manage post-merger integration. Main topics: Part 1 Corporate Finance, Strategy and the Economics of M&A: Course Introduction; M&A and their alternatives; History of M&A in the World; Theories on M&A; M&A performance; Investment, financing, payback and risk management; Mergers and acquisitions: when do they make sense? The distinguishing features of successful and unsuccessful deals; Research evidence on which mergers add value, and which destroy value; The four sources of acquisition value. Part 2 Valuation for Mergers and Acquisitions: Asset-based and balance-sheet approaches; Market valuea approaches; Multiples and comparables; Enterprise value and EBITDA; Establishing required rates of return; Free cash flows to equity; Free cash flows to firm; Dividend- and cashflow-discount models; Synergy analysis; Sensitivity analysis; Part 3 Negotiating the Terms of a Merger: Role of investment bankers and other advisors; Developing a negotiating stance; Understanding sellers' goals and constraints; Dealing with defensive strategies: poison pills and other devices; Dealing with rival bidders; Dealing with private owners; Structuring the deal: How much should we pay? How should we pay? Closing the deal. Part 4 Acquisition Finance: Finding the optimal capital structure: debt, equity or mezzanine? Capital structure considerations; Senior secured bank financing. Asset-based finance. Bridge financing Subordinated seller notes Mezzanine debt Refinancing strategies High-yield bonds Private equity sources