IFM7 Chapter 17

advertisement

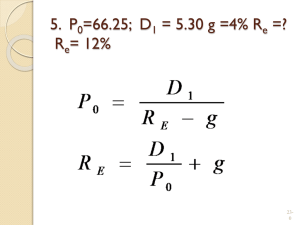

Mergers and Acquisitions M&A Market Market for Corporate Control Competition for control of firm assets Associated with Downsizing “It’s amazing that the basic cause of downsizing is so rarely acknowledged: these companies have more workers than they need or can afford to pay… If we must blame somebody for the layoffs, it ought to be you and me…. I haven’t met one person who would agree to pay AT&T twice the going rate if AT&T would promise to stop laying people off. These companies are responding to the constant pressure from consumers and shareholders.” - Peter Lynch, formerly of Fidelity’s Magellan fund M&A Introduction Purchase & Sale of Firms or Divisions Bidder Target Consideration Company Raiders Cash or securities offered Advisors I-Banks, Consultants, Attorneys, Accountants M&A Types Friendly - Mgmt support Hostile - Without mgmt support Horizontal 2 Competitors Vertical Williams Act ’68 made more difficult Target in same industry, but different production stage Conglomerate 2 Unrelated Firms Taxes Tax-free acquisition Business purpose; not solely to avoid taxes Continuity of equity interest Target stockholders have an equity interest in the combined firm Taxable acquisition Firm purchased with cash Capital gains Target stockholders require a higher price to cover the taxes Merger versus Consolidation Merger One firm is acquired by another Acquired firm ceases to exist Advantage: legally simple Disadvantage: approval of both stockholders Consolidation New firm is created by combining existing firms Takeovers Control transfers from one group to another Possible forms Acquisition Merger or consolidation Acquisition of stock Acquisition of assets Proxy contest Going private M&A Motivation ‘Synergy’ Whole is worth more than the sum of the parts Break-up Value Market Power Agency Issues, Hubris Diversification Avoid takeover attempts Synergy ΔV = VAB – (VA + VB) Synergy: ΔV > 0 Possible sources Δ CF = Δ Rev. - Δ Costs - Δ Taxes - Δ Cap Req. Increase revenue Reduce costs Lower taxes or capital requirements Revenue Enhancement Marketing gains Advertising Distribution network Product mix Strategic benefits Market power Cost Reductions Economies of scale Lower average cost by spreading overhead Economies of scope (vertical integration) Coordinate operations more effectively Reduced search cost for suppliers or customers Reduce contracting problems Lower Taxes or Capital Needs Taxes: Take advantages of net operating losses Carry-backs and carry-forwards IRS can prevent merger if sole purpose is to avoid taxes Unused debt capacity Capital Requirements: Reduce relative to the two firms operating separately Acquisitions Cash Acquisition NPV = VB* – cash cost Value of the combined firm Stock Acquisition Value of combined firm Cost of acquisition VAB = VA + (VB* - cash cost) VAB = VA + VB + V Depends on # shares given to target stockholders Depends on post-merger stock price Example Cash vs. Stock Sharing gains Taxes Cash acquisitions are generally taxable Control Target stockholders don’t participate in stock price appreciation with a cash acquisition Cash acquisitions do not dilute control Signal Stock acquisitions indicate your stock is overvalued M&A Valuation Market values Only incremental cash flows Appropriate discount rate Consider transaction costs After Valuation Friendly Work with management Hostile Toe-hold or Bear-hug Open market purchase Threaten target BOD with tender offer Proxy Fight Tender Offer Defenses Poison pills/put, greenmail, golden parachute, etc. Defensive Tactics Corporate charter Establishes conditions that allow for a takeover Standstill agreements / Targeted repurchase Poison pills (share rights plans) Leveraged buyouts Free-Rider Problem Purchase toe-hold Buy from large shareholders Two-tiered offer Value to Acquirer Target - 10 million shares, $9/share ~ Target’s value to bidder Target’s current market value Merger premium = $163.9 million = $ 90.0 million = $ 73.9 million Change in Shareholders’ Wealth Acquirer Target $9.00 0 5 $16.39 10 15 Bargaining Range = Synergy 20 Price Paid for Target Market Reaction Target shares increase +20% Bidder shares are stagnant or decrease Stock offers: -1.5% Cash offers: unclear Effect on competitors varies M&A Risk Overpayment Operating Risk Winner’s Curse Integration issues, culture Mgmt resources Continued subsidization of sub-par groups Financial Risk Leverage