Strategic Financial Management

advertisement

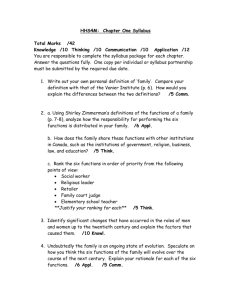

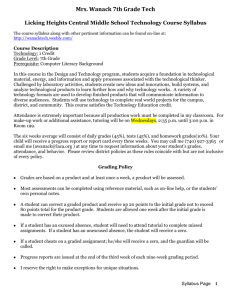

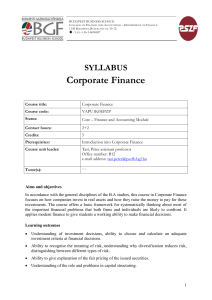

AMITY GLOBAL BUSINESS SCHOOL Module Syllabus Course BSc (Hons) in Accounting and Finance Module Title Module Syllabus no. (if any) Year offered Start date End date Syllabus / Content / Learning Outcomes Strategic Financial Management No of teaching hours Teaching Methods 24 Hours Lectures, tutorials, case-studies analysis, research journals and group discussion. Refer Module Guide as advised by the University Assessment Methods and Weightages Skills for maximising learning outcomes Dates of examinations, major assessments and assignments Recommended text MOD003577 2015 / 2016 Feb 2015 / Sep 2015 Feb 2018 / Sep 2018 The main aim of this module is to provide a rigorous grounding in the theory and practice of financial management at an intermediate and advanced level, and a thorough synthesis of the most important current research in financial management. Strategic Financial Management is concerned mainly with the assessment of the investment and financing decisions of firms. Within this module students will gain knowledge of the theoretical foundations underlying much of financial management practice and learn how those theories should be applied in practice. This module will explore the investment and financing functions of an organisation in great detail by covering such issues as sources of finance, cost of capital, risk and return, advanced investment appraisal, mergers and acquisitions and treasury management. Students will also be encouraged to critically engage with the subject area by reflecting upon the academic theories that underpin financial management practice. Theories of capital structure, market behaviour, mergers and acquisitions, dividend policy and share pricing will be incorporated into the syllabus to ensure a well rounded coverage of each topic. This module will be assessed through an assignment and an examination, enabling students a number of opportunities to demonstrate familiarity with and comprehension of the subject matter covered in class. Reading and research Refer to ARU website – (www.https://e-vision.anglia.ac.uk) Arnold, G. (4th edition) Corporate Financial Management, Financial Times Pike, R., Neale, B., and Linsley., (7th Edition). Corporate Finance and Investment Supporting Texts: Lumby, S. and Jones, C (7th edition) Corporate Finance: Theory and Practice, Thomson Brealey, R et al (latest edition) Principles of Corporate Finance, McGraw-Hill McLaney, E. (7th edition) Business Finance, Theory and Practice, FT Prentice Hall Additional reference texts (if any) Additional Remarks (if any) FRM-007 Page 1 of 2 Version 1.0 AMITY GLOBAL BUSINESS SCHOOL Lesson No. 1 2 3 4 5 6 7 8 FRM-007 Learning Outcome Financial Objectives and Strategies The Financial Environment Financing Decision: Short term Funds Working Capital and Cash Long-term Financing Decision including securities and derivatives Investment Decision: ARR, Payback, NPV and IRR Advanced Investment Appraisal: Tax, Risk, APV and International Issues Risk and Return: Portfolio Theory Capital Asset Pricing Model (CAPM) and Arbitrage Pricing Theory (Fama-French two, three and four-factor models) Cost of Capital: Weighted Cost of Capital (WACC) Capital Structure and Dividend Policy (Modigliani and Miller Propositions 1, 2, 3 and 4) Efficient Market Hypothesis (EMH) and Behavioural Finance Mergers and Acquisitions Risk management including foreign exchange and derivatives markets Page 2 of 2 Version 1.0