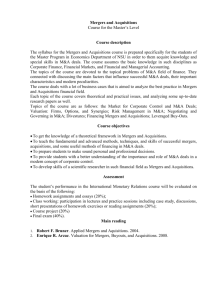

RF129 - Mergers and Acquisitions Course Outline 2015

advertisement

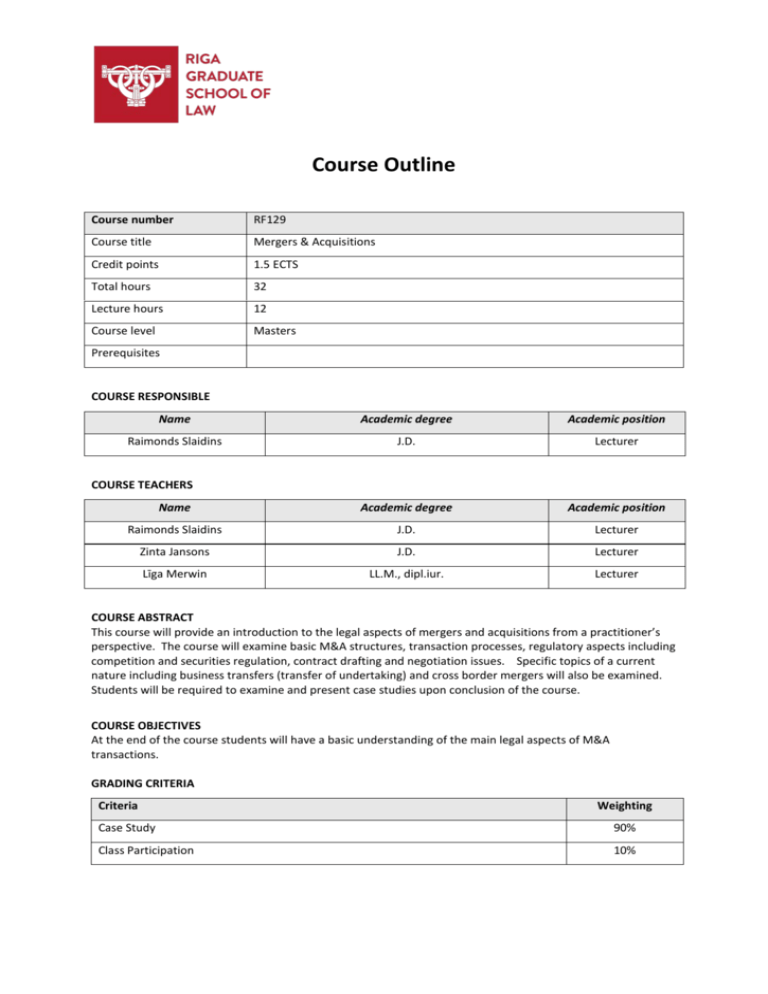

Course Outline Course number RF129 Course title Mergers & Acquisitions Credit points 1.5 ECTS Total hours 32 Lecture hours 12 Course level Masters Prerequisites COURSE RESPONSIBLE Name Academic degree Academic position Raimonds Slaidins J.D. Lecturer Name Academic degree Academic position Raimonds Slaidins J.D. Lecturer Zinta Jansons J.D. Lecturer Līga Merwin LL.M., dipl.iur. Lecturer COURSE TEACHERS COURSE ABSTRACT This course will provide an introduction to the legal aspects of mergers and acquisitions from a practitioner’s perspective. The course will examine basic M&A structures, transaction processes, regulatory aspects including competition and securities regulation, contract drafting and negotiation issues. Specific topics of a current nature including business transfers (transfer of undertaking) and cross border mergers will also be examined. Students will be required to examine and present case studies upon conclusion of the course. COURSE OBJECTIVES At the end of the course students will have a basic understanding of the main legal aspects of M&A transactions. GRADING CRITERIA Criteria Weighting Case Study 90% Class Participation 10% COURSE PLAN – MAIN SUBJECTS No. Main subjects Planned hours 1 Introduction 2 2 Structuring of M&A Transactions 2 3 Financial Aspects of M&A Transactions 2 4 Other issues 2 5 Due Diligence 2 6 Regulatory Issues 2 7 Transaction documents 2 COURSE PLAN – SESSIONS Session 1 Session subjects and readings Introduction M&A drivers Role of advisors Lecture/seminar Lecture Structuring of M&A Transactions Share purchase Asset purchase Reorganization Joint venture 2 Financial Aspects of M&A Transactions Forms of consideration/Pricing issues Various M&A financing models Lecture Other issues Cross Border Mergers Transfer of Undertaking 3 Regulatory Issues Licensing Disclosure State/governmental agency approvals (banking/securities regulation, privatization) Competition/merger control Letters of intent Share purchase agreement Ancillary contracts (shareholders agreements, management agreements, other related agreements Lecture 4 M&A issues from an investment banker perspective Seminar Student presentations on case studies 2 COURSE LITERATURE No. 1 Author, title, publisher Course Notes and materials 3