58% of the Endowment Portfolio Would be Affected by Divestment

advertisement

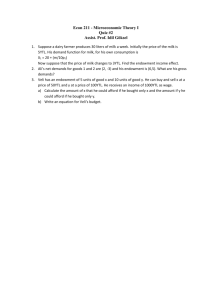

58% of the Endowment Portfolio Would be Affected by Divestment Market Value Target 6/30/13 Asset Category Allocation (Millions) Composition Separate portfolios and Public Equity (16)*# 34 523 commingled funds Semi-marketable (14) 24 364 All commingled funds Subtotal 58% $887 Private Equity Real Assets Fixed Income/Cash Total 19 14 9 100% 296 243 131 $1,557 Could Hold Fossil Fuel Stocks or Bonds All commingled funds All commingled funds Commingled funds and cash *indicates the number of managers in this category # 6% of endowment is separately held in Wellesley’s name. We vote these proxies. Yes Yes No No No The Cost of Divesting Separately Held Investments • • • • The endowment holds approximately 0.5% in the largest 200 publicly traded fossil fuel companies in three separately held accounts. These accounts represent 6% of endowment assets. Restricting the mandates of these managers is not possible, so divestment would require the College to terminate these manager relationships. Over the last 10 years, these managers have beat their benchmarks by 1.75% a year. Finding new managers who would perform as well and be willing to manage a restricted mandate is highly unlikely. Assuming that replacement managers earned the benchmark return, the cost of divestment would be: 6.0% x Exposure to terminated managers 0.10% Foregone return 1.75% = Performance that could not be replaced x $1,600 million Current endowment value 0.10% Reduction in endowment return = $1.6 million/year Cost per year The Cost of Divesting Separately Held and Commingled Holdings • • • • Investments with managers whose mandates allow ownership of public stocks and bonds represent approximately 58% of the endowment. Restricting the mandates of these managers is not possible, so divestment would require the College to terminate these manager relationships. We expect current managers in these asset classes to earn 1.6% more than benchmarks over the next seven years. Finding new managers who would perform as well and would be willing to manage a restricted mandate is highly unlikely. Assuming that replacement managers earned the benchmark return, the expected return of the endowment would be reduced by 1.6% a year. The dollar cost of divestment would be: 58% x Exposure to terminated managers 0.9% Foregone return • 1.6% = Performance that could not be replaced X 1,600 million Current endowment value 0.9% Reduction in endowment return = $15 million Cost per year This estimate is in line with the $200 million over 10 year cost estimated by Swarthmore, an institution with a similar investment strategy and endowment.