MERGERS AND ACQUISITIONS Chapter 23

advertisement

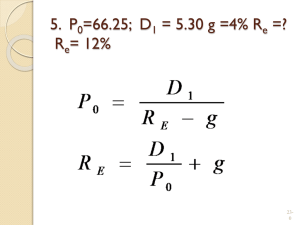

Chapter 23 MERGERS AND ACQUISITIONS HTTP://WWW.DELL.COM/LEARN/US/EN/USCORP1/SECURE/ACQ-DELL-SILVERLAKE Definition The phrase mergers and acquisitions (abbreviated M&A) refers to the aspect of corporate strategy, corporate finance and management dealing with the buying, selling and combining of different companies that can aid, finance, or help a growing company in a given industry grow rapidly without having to create another business entity. 231 Business valuation The five most common ways to valuate a business are asset valuation, historical earnings valuation, future maintainable earnings valuation, relative valuation (comparable company & comparable transactions), discounted cash flow (DCF) valuation 232 Chapter Outline The Legal Forms of Acquisitions Accounting for Acquisitions Gains from Acquisition The Cost of an Acquisition Defensive Tactics Some Evidence on Acquisitions Divestitures and Restructurings 3 Legal Forms of Acquisitions Merger or consolidation Acquisition of stock Acquisition of assets 4 Merger versus Consolidation Merger ◦ One firm is acquired by another ◦ Acquiring firm retains name and acquired firm ceases to exist Consolidation ◦ Entirely new firm is created from combination of existing firms 5 Stock Acquisition (1) A firm can be acquired by purchasing voting shares of the firm’s stock Tender offer – public offer to buy shares Circular bid – takeover bid communicated to shareholders by direct mail Stock exchange bid – takeover bid communicated to shareholders through a stock exchange 6 Stock Acquisition (2) No stockholder vote required Can deal directly with stockholders, even if management is unfriendly May be delayed if some target shareholders hold out for more money – complete absorption requires a merger 7 Acquisition Classifications Horizontal – both firms are in the same industry Vertical – firms are different stages of the production process Conglomerate – firms are unrelated 8 Takeovers Control of a firm transfers from one group to another Possible forms ◦ Acquisition ◦ Proxy contest ◦ Going private (LBO vs. MBO) 9 Alternatives to Merger Strategic alliance = agreement between firms to cooperate in pursuit of a joint goal Joint venture = an agreement between firms to create a separate, co-owned entity established to pursue a joint goal 10 Accounting for Acquisitions The Purchase Method ◦ Assets of acquired firm are written up to fair market value ◦ Goodwill is created – difference between purchase price and estimated fair market value of net assets 11 Gains from Acquisition Synergy Revenue enhancement Cost reductions Tax gains 12 Synergy The whole is worth more than the sum of the parts Synergies should create enough benefit to justify the cost 13 Revenue Enhancement Marketing gains ◦ Advertising ◦ Distribution network ◦ Product mix Strategic benefits Market power 14 Cost Reductions Economies of scale ◦ Ability to produce larger quantities while reducing the average per unit cost Economies of vertical integration ◦ Coordinate operations more effectively ◦ Reduced search cost for suppliers or customers Complimentary resources 15 Taxes Tax losses Unused debt capacity Surplus funds Asset write-ups ∆FA = ∆EBIT + ∆Depreciation - ∆ Tax ∆Capital Requirements 16 Reducing Capital Needs Firms may be able to manage existing assets more effectively under one umbrella Some assets may be sold if they are not needed in a combined firm 17 Diversification Diversification, in and of itself, is not a good reason for a merger Stockholders can diversify their own portfolio cheaper than a firm can diversify by acquisition 18 EPS Growth Mergers may create the appearance of growth in earnings per share If there are no synergies or other benefits to the merger, then the growth in EPS is just an artifact of a larger firm and is not true growth In this case, the P/E ratio should fall because the combined market value should not change 19 The Cost of Acquisition: Cash Acquisition The NPV of a cash acquisition is ◦ NPV = VB* – cash cost Value of the combined firm is ◦ VAB = VA + (VB* - cash cost) ◦ VB* = VB + ∆V 20 Valuation Formulas 1. VA* = VA + VT + S - C 2. Price per share = VA*/number of shares 3. PT = price per share*number of shares + C (for stock and mixed offers) 4. Target shareholders’ gain from transaction = PT - VT 5. VA* - value of the new company VA – value of the acquirer VT – value of the target company S – synergies C – cash paid PT – price paid for the target company VT – pre-merger value of the target company PT = price per share*number of shares 2321 The Cost of Acquisition: Stock Acquisition Value of combined firm Cost of acquisition ◦ VAB = VA + VB + V ◦ Depends on the number of shares given to the target stockholders ◦ Depends on the price of the combined firm’s stock after the merger ◦ A B ◦ Price $20 $10 ◦ # sh 25 10 ◦ Market value 500 100 22 Cash vs. Common Stock Cash price 150 VB* = VB + ∆V = 100 +100 NPV = 200 -150 =50 VAB = VA + (VB* - cost) = 500+ 200 – 150 =550 Share price = 550/25 = 22 Stock acquisition ($150 equiv. stock of A at $ 20) VAB = VA + VB + V =700 $150 in stock A is 7.5 shares (25+7.5=32.5 sh) 700/32.5=21.54 a share Cost of acquisition is 7.5*21.54=161.55 NPV = 38.45 2323 Cash vs. Common Stock Sharing rights Taxes Control 24 Defensive Tactics(1) Corporate charter ◦ Establishes conditions that allow for a takeover ◦ Supermajority voting requirement Targeted repurchase (Greenmail) Standstill agreements Exclusionary offers Poison pills Share rights plans 25 Defensive Tactics (2) Leveraged buyouts (LBO) Other defensive tactics ◦ Golden parachutes ◦ Crown jewels ◦ White knight 26 Evidence on Acquisitions Shareholders of target companies tend to earn excess returns in a merger ◦ Shareholders of target companies gain more in a tender offer than in a straight merger ◦ Target firm managers have a tendency to oppose mergers, thus driving up the tender price 27 More Evidence Shareholders of bidding firms do not earn much excess return in either a tender offer or a straight merger ◦ Anticipated gains from mergers may not be achieved ◦ Bidding firms are generally larger, so it takes a larger dollar gain to get the same percentage gain ◦ Management may not be acting in stockholders best interest ◦ Takeover market may be competitive ◦ Announcement may not contain new information about the bidding firm 28 Divestitures and Restructurings Divestiture = sale of assets, operations, or divisions to a third party Equity carve-out Spin-off Split-up 29