2013 FINANCIALS Sources of Funding For nearly five decades, Urban

advertisement

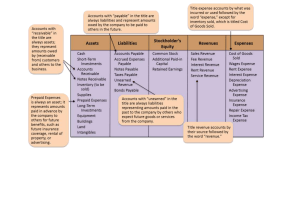

2013 FINANCIALS DEDICATED TO ELEVATING THE DEBATE ON SOCIAL AND ECONOMIC POLICY For nearly five decades, Urban Institute scholars have conducted research and offered evidencebased solutions that improve lives and strengthen communities across a rapidly urbanizing world. Our scholars’ objective research helps expand opportunities for all, reduce hardship among the most vulnerable, and strengthen the effectiveness of the public sector. OUR FUNDING Urban Institute receives funding from all levels of government to conduct research, evaluate programs, and offer technical assistance. We also receive funding from individuals, foundations, nonprofits, universities, and corporations that support our research, evidencebased policy development, outreach and engagement, and general operating activities. Sources of Funding ederal government ■ F rivate foundations ■ P 3% 4% 3% 1% 4% ■ Nonprofits & universities orporations & corporate foundations ■ C tate & local governments ■ S rban Institute endowment support ■ U 54% 30% ■ International organizations & foreign entities ■ Individuals Program Expenses etropolitan Housing and Communities ■ M 1.6% 1.0% .5% ealth Policy Center ■ H abor, Human Services, and Population ■ L 5.7% ■ J ustice Policy Center ■ Intl. Development and Governance ■ Income and Benefits Policy Center ax Policy Center ■ T enter on Nonprofits and Philanthropy ■ C ousing Finance Policy Center ■ H tatistical Methods Group ■ S 4.8% 21.8% 7.4% 8.0% 21.0% 10.7% 17.4% xecutive Office Research ■ E SUPPORT URBAN Our donors play a critical role in advancing evidence-based solutions. We encourage general support, which enables us to expand our work and quickly respond to emerging challenges. We also welcome contributions that may be directed to program areas. To make a secure online donation, please visit www.urban.org/support or contact Carrie Kolasky, Vice President for Development, at ckolasky@urban.org. OUR MISSION To open minds, shape decisions, and offer solutions through economic and social policy research 2013 Activities 2013 Assets and Liabilities OPERATING REVENUES Contract amounts earned Program and project grants General support grants and contributions Publication income Investment return designated for operations Interest and other income ASSETS $42,639,798 31,871,678 689,007 74,588 2,145,632 491,854 77,912,557 TOTAL OPERATING REVENUES $77,912,557 Cash and cash equivalents Endowment-related cash and cash equivalents Accounts receivable, net Contributions receivable, net Prepaid expenses Property and equipment, net Other assets Long-term investments TOTAL ASSETS $6,321,833 8,992,143 17,973,943 8,616,262 492,581 2,810,512 113,652 114,889,642 $160,210,568 OPERATING EXPENSES LIABILITIES Research expenses Incurred under contracts Incurred under grants Incurred for other research Total program costs Development Publication and public affairs costs Other costs TOTAL OPERATING EXPENSES Change in net assets from operations $40,586,847 26,421,559 7,076,546 74,084,952 390,620 Accounts payable Accrued payroll Accrued paid time off Other accrued expenses Deferred revenue 1,186,450 Deferred rent 1,706,265 TOTAL LIABILITIES $77,368,287 544,270 Unrestricted Interest and dividends, net $1,919,693 Permanently restricted Gain on long-term investments, net 13,611,734 TOTAL NET ASSETS Investment income allocation (2,145,632) TOTAL LIABILITIES AND NET ASSETS Contributions received TOTAL NON-OPERATING ACTIVITIES CHANGE IN NET ASSETS NET ASSETS AT BEGINNING OF YEAR NET ASSETS AT END OF YEAR 654,983 1,989,439 132,484 13,997,949 4,292,736 $26,401,055 NET ASSETS Temporarily restricted NON-OPERATING ACTIVITIES $5,333,464 121,129,698 11,679,815 1,000,000 133,809,513 $160,210,568 8,914 $13,394,709 13,938,979 119,870,534 $133,809,513 The Urban Institute is a nonprofit policy research organization. It has been incorporated and is operated as a public charity. It has received official IRS recognition of its tax-exempt status under section 501(c)(3) of the Internal Revenue Code. The Institute’s federal ID number is 52-0880375. Donations will be tax deductible and may be disclosed to the IRS and the public, unless given anonymously. We are committed to transparent accounting of the resources we receive. In addition to required tax filings, a copy of the Urban Institute’s audited financial statement is available to anyone who requests it.