Installment Sales

advertisement

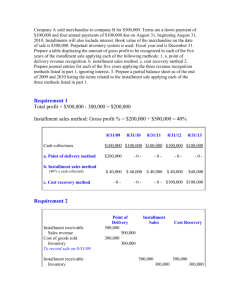

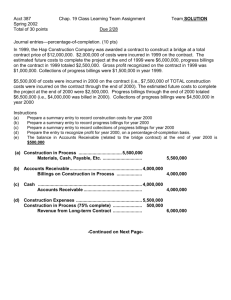

Chapter 9 Income, expenses and profits 1. Apply the revenue recognition principle. 2. Describe accounting issues for revenue recognition at point of sale. 3. Apply the percentage-of-completion method for longterm contracts. 4. Apply the completed-contract method for long-term contracts. 5. Identify the proper accounting for losses on long-term contracts. 6. Describe the installment-sales method of accounting. 7. Explain the cost-recovery method of accounting. Concepts Revenues Inflows of assets or settlements of liabilities during a period from delivering or producing goods or services. Expenses Outflows of assets or incurrence of liabilities during a period from delivering or producing goods or services. Revenue Recognition Recognition is the process of formally recording and reporting items in the financial statements. Revenue Recognition Definition Is the item an asset, liability, equity, revenue, expense, gain, or loss? Measurability Does it possess the attributes that permit reliable measurement? Relevance Will it make a difference to the decision maker? Reliability Is it a faithful representation? Revenue Recognition Revenue should be recognized in the financial statement when . . . It is earned, and It is realized or realizable. Revenue Recognition Revenue is earned when the earnings process is completed or virtually completed. Revenue is realized when cash is received. Revenue is realizable when claims to cash are received that can be converted into a known amount of cash. Revenue Recognition The decision as to when to recognize revenue focuses on three factors: The economic substance of the event takes precedence over the legal form of the transaction. The risks and benefits of ownership have been transferred to the buyer. The collectibility of the receivable from the sale is reasonably assured. Revenue Recognition Revenue recognized At delivery (point of sale) After delivery Before delivery of product or service Revenue Recognition Point of Sale Revenue is earned and realized at the point of sale. The product or service has been delivered to the customer and cash has been received or is receivable. This method is sometimes called the “sales method”or “delivery method.” Revenue Recognition Before Delivery Accounting for long-term construction contracts Completed-Contract Method Percentage-of-Completion Method Revenue Recognition Before Delivery Percentage-of-completion method is appropriate when . . . -- Contract specifies the amount of consideration to be exchanged and the terms of settlement. -- Buyer is expected to satisfy the obligation. -- Contractor can perform according to the terms of the contract. Measuring Progress Toward Completion Input Measures Effort devoted to project compared to total effort expected (cost incurred to date compared to total estimated costs) Output Measures Results to date compared to total results Measuring Progress Toward Completion Cost-to-Cost Method Total costs incurred to date Percent complete = Most recent estimate of total costs of the project Measuring Progress Toward Completion Cost-to-Cost Method Current Period Revenue Total Revenue from Contract × Percent Complete Total Revenue to Recognize - Revenue Recognized in Prior Periods Revenue Recognized in Current Period Illustration: Casper Construction Co. Contract price Cost incurred current year Estimated cost to complete in future years Billings to customer current year Cash receipts from customer Current year 2007 $675,000 150,000 2008 $675,000 287,400 2009 $675,000 170,100 450,000 135,000 170,100 360,000 0 180,000 112,500 262,500 300,000 A) Prepare the journal entries for 2007, 2008, and 2009. Illustration: 2007 $ 150,000 450,000 600,000 25.0% 675,000 168,750 Costs incurred to date Estimated cost to complete Est. total contract costs Est. percentage complete Contract price Revenue recognizable Rev. recognized prior year Rev. recognized currently 168,750 Costs incurred currently (150,000) Income recognized currently $ 18,750 $ $ 2008 437,400 170,100 607,500 72.0% 675,000 486,000 (168,750) 317,250 (287,400) 29,850 2009 $ 607,500 607,500 100.0% 675,000 675,000 (486,000) 189,000 (170,100) $ 18,900 Illustration: 2007 150,000 150,000 2008 287,400 287,400 2009 170,100 170,100 Accounts receivable Billings on contract 135,000 360,000 180,000 Cash Accounts receivable 112,500 Construction in progress Construction expense Construction revenue 18,750 150,000 Construction in progress Cash Billings on contract Construction in progress 135,000 360,000 262,500 112,500 300,000 262,500 29,850 287,400 168,750 180,000 300,000 18,900 170,100 317,250 189,000 675,000 675,000 Illustration: Income Statement Revenue on contracts Cost of construction Gross profit Balance Sheet (12/31) Current assets: Accounts receivable Cost & profits > billings Current liabilities: Billings > cost & profits 2007 $ 168,750 150,000 18,750 2008 $ 317,250 287,400 29,850 22,500 33,750 120,000 9,000 2009 $ 189,000 170,100 18,900 - Companies recognize revenue and gross profit only at point of sale—that is, when the contract is completed. Under this method, companies accumulate costs of long-term contracts in process, but they make no interim charges or credits to income statement accounts for revenues, costs, or gross profit. Illustration: 2007 150,000 150,000 2008 287,400 287,400 2009 170,100 170,100 Accounts receivable Billings on contract 135,000 360,000 180,000 Cash Accounts receivable 112,500 Construction in progress Cash 135,000 360,000 262,500 112,500 180,000 300,000 262,500 300,000 Construction in progress Construction expense Construction revenue 67,500 607,500 Billings on contract Construction in progress 675,000 675,000 675,000 Illustration: Income Statement Revenue on contracts Cost of construction Gross profit Balance Sheet (12/31) Current assets: Accounts receivable Cost & profits > billings Current liabilities: Billings > cost & profits 2007 $ - 22,500 15,000 2008 $ - 120,000 57,600 2009 $ 675,000 607,500 67,500 - Two Methods: Loss in the Current Period on a Profitable Contract Percentage-of-completion method only, the estimated cost increase requires a current-period adjustment of gross profit recognized in prior periods. Loss on an Unprofitable Contract Under both percentage-of-completion and completed- contract methods, the company must recognize in the current period the entire expected contract loss. Illustration: Loss on Profitable Contract Casper Construction Co. Contract price Cost incurred current year Estimated cost to complete in future years Billings to customer current year Cash receipts from customer Current year 2007 $675,000 150,000 2008 $675,000 287,400 2009 $675,000 215,436 450,000 135,000 215,436 360,000 0 180,000 112,500 262,500 300,000 b) Prepare the journal entries for 2007, 2008, and 2009 assuming the estimated cost to complete at the end of 2008 was $215,436 instead of $170,100. Illustration: Loss on Profitable Contract Costs incurred to date Estimated cost to complete Est. total contract costs Est. percentage complete Contract price Revenue recognizable Rev. recognized prior year Rev. recognized currently Costs incurred currently Income recognized currently 2007 $ 150,000 $ 450,000 600,000 25.0% 675,000 168,750 168,750 (150,000) $ 18,750 $ 2008 437,400 215,436 652,836 67.0% 675,000 452,250 (168,750) 283,500 (287,400) (3,900) 2009 $ 652,836 652,836 100.0% 675,000 675,000 (452,250) 222,750 (215,436) $ 7,314 Illustration: Loss on Profitable Contract 2007 Construction in progress Construction expense Construction revenue Construction in progress Construction expense Construction revenue 2008 2009 18,750 150,000 7,314 215,436 168,750 222,750 3,900 287,400 283,500 Illustration: Loss on Unprofitable Contract Casper Construction Co. Contract price Cost incurred current year Estimated cost to complete in future years Billings to customer current year Cash receipts from customer Current year 2007 $675,000 150,000 2008 $675,000 287,400 2009 $675,000 246,038 450,000 135,000 246,038 360,000 0 180,000 112,500 262,500 300,000 c) Prepare the journal entries for 2007, 2008, and 2009 assuming the estimated cost to complete at the end of 2008 was $246,038 instead of $170,100. Illustration: Loss on Unprofitable Contract Costs incurred to date Estimated cost to complete Est. total contract costs Est. percentage complete Contract price Revenue recognizable Rev. recognized prior year Rev. recognized currently Costs incurred currently Income recognized currently 2007 $ 150,000 $ 450,000 600,000 25.0% 675,000 168,750 2008 437,400 246,038 683,438 64.0% 675,000 432,000 (168,750) 168,750 Plug 263,250 (150,000) (290,438) $ 18,750 $ (27,188) 2009 $ 683,438 683,438 100.0% 675,000 675,000 (432,000) 243,000 (243,000) $ - $683,438 – 678,500 = 8,438 cumulative loss Illustration: Loss on Unprofitable Contract 2007 Construction in progress Construction expense Construction revenue Construction in progress Construction expense Construction revenue 2008 2009 18,750 150,000 243,000 168,750 243,000 27,188 290,438 263,250 Illustration: Loss on Unprofitable Contract For the Completed-Contract method, companies would recognize the following loss : 2007 Loss on construction contract Construction in progress 2008 2009 8,438 8,438 Revenue Recognition After Delivery Product-financing arrangements. Sale with right of return. Collectibility of revenue is highly uncertain. Product-Financing Arrangements An agreement in which a sponsoring company sells a product to another company and in a related transaction agrees to repurchase the product. The sponsoring company -- Records a liability when the proceeds are received. -- No sale is recorded and inventory is not adjusted. Wait for a sale to outside party. Right of Return In some industries it is common practice that the sales terms allow customers the right to return goods under specified conditions and over long periods of time. Book Publishing Equipment Manufacturing Right of Return Recognize revenue at point of sale if, Selling price is fixed or determinable. Buyer is obligated to pay the seller and payment is not contingent upon resale of the product. Buyer is obligated even in case of theft or physical destruction. Buyer has economic substance apart from that provided by the seller. Seller has no obligation for future performance. Future returns can be estimated. Installment Sales When we are uncertain about the collectibility of the sales revenue, we should defer revenue recognition. Two commonly used accounting methods are the . . . Installment sales method. Cost recovery method. Installment Sales Installment Sales Method Sale and cost of sale recorded as usual. Compute gross margin rate on the installment sales. Recognize gross margin as cash is received. Gross margin not realized is deferred until a future period. Installment Sales Example Sam’s Appliances made sales of $200,000 in 2005 that qualified for the installment sales method of accounting. The items sold have a cost to Sam’s of $130,000. During 2005, Sam’s collected cash from installment customers of $90,000. The remaining amount will be collected in 2006. Prepare the journal entries to record the installment sales transactions during 2005. Installment Sales Example Sam's Appliances Installment Sales Dollars Percent Installment sales revenue $ 200,000 100% Cost of goods sold 130,000 65% Gross margin $ 70,000 35% Installment Sales Example GENERAL JOURNAL Date Description Installment Accounts Receivable Installment Revenue Page 34 Post. Ref. Debit Credit 200,000 200,000 Installment Sales Example GENERAL JOURNAL Date Description Installment Accounts Receivable Page 34 Post. Ref. Debit 200,000 Installment Revenue Cost of Installment Sales Inventory Credit 200,000 130,000 130,000 Installment Sales Example GENERAL JOURNAL Date Description Cash Installment Accounts Receivable Page 34 Post. Ref. Debit Credit 90,000 90,000 Installment Sales Example GENERAL JOURNAL Date Description Installment Revenue Cost of Installment Sales Deferred Gross Margin Page 34 Post. Ref. Debit Credit 200,000 130,000 70,000 Installment Sales Example GENERAL JOURNAL Date Description Installment Revenue Page 34 Post. Ref. Debit 200,000 Cost of Installment Sales 130,000 Deferred Gross Margin Deferred Gross Margin Realized Gross Margin Credit 70,000 31,500 31,500 Installment Sales Example GENERAL JOURNAL Date Description Installment Revenue Page 34 Post. Ref. Debit Credit 200,000 Cost of Installment Sales 130,000 Deferred Gross Margin Deferred Gross Margin 70,000 31,500 Realized Gross Margin Cash collection in 2005 Gross margin percentage Gross profit to recognize 31,500 $90,000 × 35% $31,500 Installment Sales Example Balance Sheet Installment accounts receivable $ 110,000 Less: Deferred gross margin 38,500 Net Installment accounts receivable $ 71,500 Installment Sales Example Balance Sheet Installment accounts receivable $ 110,000 Less: Deferred gross margin 38,500 Net Installment accounts receivable $ 71,500 Installment accounts receivable Less: Cash collections Installment accounts receivable $ 200,000 (90,000) $ 110,000 Deferred gross margin Less: Gross margin recognized Deferred gross margin $ 70,000 (31,500) $ 38,500 Cost Recovery Method Like the installment sales method, cost recovery is used when we are uncertain about the collectibility of the sales revenue. No profit is recognized until cost of item sold is fully recovered. Cost Recovery Method Example Sam’s Appliances made sales of $200,000 in 2005 that qualified for the cost recovery method of accounting. The items sold have a cost to Sam’s of $130,000. During 2005, Sam’s collected cash from installment customers of $90,000. The remaining amount will be collected in 2006. Prepare the journal entries to record the installment sales transactions during 2005. Cost Recovery Method Example GENERAL JOURNAL Date Description Installment Accounts Receivable Installment Revenue Page 34 Post. Ref. Debit Credit 200,000 200,000 Cost Recovery Method Example GENERAL JOURNAL Date Description Installment Accounts Receivable Page 34 Post. Ref. Debit 200,000 Installment Revenue Cost of Installment Sales Inventory Credit 200,000 130,000 130,000 Cost Recovery Method Example GENERAL JOURNAL Date Description Installment Revenue Cost of Installment Sales Deferred Gross Margin Page 34 Post. Ref. Debit Credit 200,000 130,000 70,000 Cost Recovery Method Example GENERAL JOURNAL Date Description Cash Installment Accounts Receivable Page 34 Post. Ref. Debit Credit 90,000 90,000 No profit is recognized in 2005 because the cost of the item sold ($130,000) has not been recovered in the form of cash receipts. Once we collect $130,000 in cash, profit recognition begins. Cost Recovery Method Example Balance Sheet Installment accounts receivable $ 110,000 Less: Deferred gross margin (70,000) Net Installment accounts receivable $ 40,000 All gross profit has been deferred until we recover the $130,000 cost of the item sold. Revenue Recognition Before Delivery Completion of Production Accretion Basis Discovery Basis Revenue Recognition for Service Sales Specific Performance Method Proportional Performance Method Completed Performance Method Collection Specific Performance Used to account for revenue that is earned by performing a single act. Franchise revenue (SFAS No. 45) Bob’s Burgers Proportional Performance Used to recognize service revenue that is earned by more than a single act and when the service is rendered in more than one accounting period. Similar performance acts - equal amount for each act Dissimilar performance acts - in proportion to direct costs of each act Similar acts with a fixed period for performance Completed Performance Used when revenue is earned by performing a series of acts, and the last act is so important that revenue is only considered earned if it is performed. Collection Used to account for service revenue when the uncertainty of collection is very high. Revenue recognized when cash is received. Chapter9 Task Force Image Gallery clip art included in this electronic presentation is used with the permission of NVTech Inc.