Natural Resources for Sustainable Development

advertisement

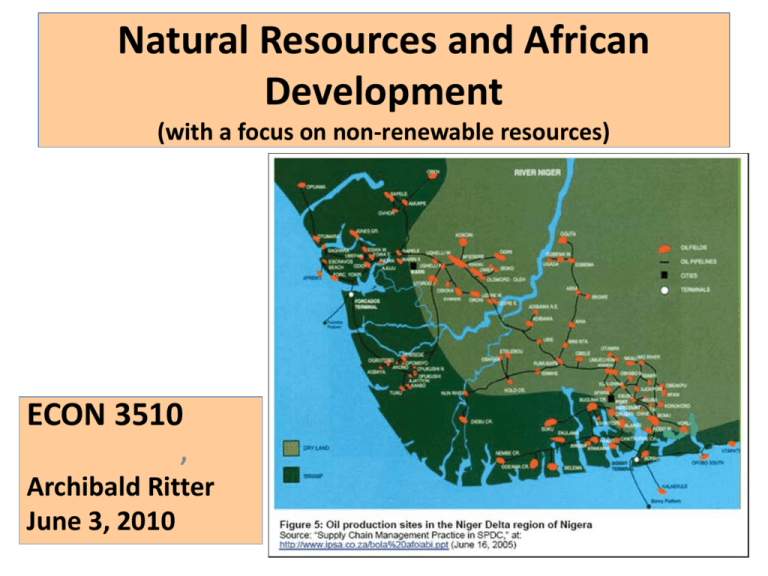

Natural Resources and African Development (with a focus on non-renewable resources) ECON 3510 , Archibald Ritter June 3, 2010 Note: The source for this is African Development Bank, African Development Report 2007, Oxford and New York: Oxford University Press, 2007, Chapters 1, 4, 5, and 6. (Skim chapters 2 and 3) To access this source on the Web, please “Google” the following title, and follow the link to an “Adobe” pdf. file: “African Development Bank, African Development Report 2007, Oxford and New York: Oxford University Press, 2007” Outline I. Some Historical Observations II. Current Role of Resources in African Development – – – Petroleum, coal, natural gas Minerals Forestry products III. The Main Mineral Sector Development Issues IV. “The Paradox of Plenty” – – – The “Resource Curse” Conflict States and Resource Wealth The New “Scramble” for Africa’s Resource Wealth V. Managing Resources Effectively for Equitable Development VI. VI. The New Scramble for Africa’s Resources I. Some Historical Observations Pre-Colonial metal-working; since time immemorial Scramble for Africa, motivated in part by desire for mineral wealth Cecil Rhodes and the British in South Africa ”Gold Coast” (which became Ghana) A Mineral Resource Treasure House? The Mineral Sector at Independence Non-Petroleum Mineral Activity decline from 1970s to 1990s; Petroleum continues strong 1995-2010 (+/-): Resumption of Mineral Exploration and Development Artisanal/Informal Sector Mining and Large scale Modern Mining II. Current Role of Resources in African Development Mineral Export Concentration, Selected Countries. 2005 (Percentage of Total Exports) Country Botswana Chad Ghana Kenya Nigeria S. Africa Tanzania Zambia Sub-Saharan Africa Main Export Diamonds 88.2% Oil 99.9% Cocoa 46 Tea 16.8 Oil 92.2 Platinum. 12.5 Gold 10.9 Copper 55.8 Oil 49.2 Other Exports Nickel 8.1 Manganese 7.2 Flowers 14.2 Coal 8; Gold 7.9 Fish 9.7; Copper 8.6 Cobalt 7 Diamonds 12.6; Nickel 7.8 Oil in the Niger Delta, Nigeria: +/- 89% of Gov’t revenue +/- 25% of GDP about 95% of export earnings; 13% of oil revenues to oil-producing states Impoverishment and environmental problems for local peoples (the Ogoni and other groups) Major Conflict in the Delta New Petroleum Play in Two African Regions A New Country? 2011: South Sudan III. The Main Oil and Mineral Sector Development Issues Benefits and Costs of Mineral and Petroleum Extraction: III. The Main Oil and Mineral Sector Development Issues 1. Price volatility generates macroeconomic instability (explanation in class) 2. Long-run downward price trends? 3. Short-term Character of some mining due to finite sixe of ore bodies or petroleum deposits 4. Enclave Character: limited linkages to economy 5. Further processing migrates abroad 6. Environmental Impacts 7. Impacts on Local Communities 8. Insufficient Returns to Governments Conclusion: Don’t Do Petroleum or Mining? Manage Petroleum and Mining Sectors Intelligently? 1. Mineral Price Instability Recent Mineral Commodity Prices, 2000-2009 400 350 Petroleum Copper Aluminium Gold 300 250 200 150 100 50 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 Source: OECD Development Centre, based on World Bank, 2009 2009(f) 2010(f) Example of Mineral Price Instability: Gold 2. Terms of Trade and Mineral Prices Current Concern: Is China’s demand for minerals softening? 4. Enclave Character: limited linkages to domestic economies Explain: – “Backward Linkages” (ability to provide the inputs needed for mining or oil) – “Forward Linkages” (ability to undertake further processing of the ores or petroleum) – “Consumption Linkages” Payments to people promoting increases in final demand) Depends on employment and income patterns and volumes 6. Environmental Impacts Varieties of Impacts: Water and Air Quality Tailings Noxious Wastes Land use and degradation 7. Impacts on Local Communities Local community receives the • environmental degradation and • often the loss of artisanal mine jobs • Social dislocations without the macroeconomic benefits Note case of gold mining in Tanzania, African Development Report, 2007, p. 150 8. Returns to Government: Taxation Tax Regimes and Revenues are Important Varieties of Taxes: Royalties (on metal content of ores extracted) Income from Production Sharing or State Ownership Corporate Income Taxes Personal Income Taxes on People in the sector Sales Taxes on sales to people in the sector Import Taxes on Imported Inputs Export Taxes Are revenues to Governments sufficient? IV. The Paradox of Plenty aka “Resource Curse” The “curse” Resource wealth generates great revenues for governments but also may tend to lead to relative economic stagnation and political problems – waste, corruption, political patronage systems, civil conflict & war i.e. an inverse relationship between resource wealth and genuine development Why? Economic factors: exchange rate, prices, econ. management Political factors via windfall revenues to Governments without need for accountability to tax-payers, and also windfall revenues “up for grabs” among competing elites. Empirical Validity of the “Resource Curse” Countries that might have the “Resource Curse” – High mineral export dependence on one or a few minerals – especially petroleum exporters (“Oil Economy Syndrome” ) – High Foreign Exchange and Fiscal dependence on the resource export – High levels of Direct Foreign Investment in the resource sector Evidence re Performance: – Economic Growth (GDPpc) • Resource-rich countries are richer than resource poor (GDPpc; tax revenues; foreign exchange earnings) • Resource rich grew more slowly than resource poor (2.4% pa vs. 3.8% pa, 1981.2006 • Resource rich coastal states best off; • Resource scarce land-locked, worst off Evidence re Performance, continued: – Negative “Genuine Savings” “Genuine Savings” = Public & Private Saving - Depreciation + Education Spending - Natural resource depletion - Increase in pollutant stock - Worse Income inequality - Similar Human Development Indices - Civil Conflict: seems pervasive: - e.g. Nigeria; Chad; Sierra Leone, Liberia, Sudan But other resource poor countries also experience conflict: - e.g. Rwanda, Kenya, Somalia, Zimbabwe Explanation: “Dutch Disease” or “Oil Economy Syndrome” The Phenomenon in Brief: Export “boom” caused by a sudden increase in oil export prices or in resource export volumes, leads to an appreciation of the exchange rate with negative consequences, such as • a major reduction of traditional (pre-boom) exports; • unemployment of the factors of production in the traditional export sector; • an increased concentration on the resource export and reduced diversity of export structures; • damage to import-competing exports; Plus • an inflationary impact as the demand for non-tradable products increases, which further affects the real exchange rate; • irresponsible use or misuse of foreign exchange windfall receipts Examples: • Spain during its glory days with silver and gold inflows from pillage and later the rich mines of Mexico and South America from perhaps 1530 to 1700 • Countries undergoing a resource boom (e.g. Canada in a minor way in the 1950s, again in 2006-2008 with tar sands and oil prices) • Major oil exporting countries such as Nigeria (with 92% of its exports as petroleum in 2004); Chad (99%) etc. • The Netherlands after its North Sea natural gas boom and before the “Euro” Explanation, with diagram on the blackboard • The diagram represents the foreign exchange (in US dollars) market from the perspective of an oil exporter, in this example, Nigeria. Explanation 2: Other Economic Factors • Volatility of Foreign Exchange Earnings and Tax Revenues affects economic management and performance • Economic Policy Failures: – – – – Waste the funds extravagantly when available; Expand consumption Reduce other non-mineral taxes Undertake costly but unwise strategic investments 2. Socio-Political Origins: “Dutch Disease” becomes “Resource Curse” • Increased potential for corruption • Rent-seeking and winning is more profitable than productive economic actions; • Bad decision making: government does not have to respond to tax payers because rents come resources; • Resource revenues feed patronage systems, permitting authoritarian or predator regimes to remain in power; • Conflict among elites, regions, ethnic groups may be intensified. Civil Conflict, Fragile States and Resource Wealth Evidence that resource wealth increases incidence of civil war and conflict (see chart) - Oil & diamonds dominate; - Diamonds are easily “lootable” - But resource mis-management is also a key factor explaining poor economic performance and resource wealth Civil Strife linked to Resource Wealth, 1990-2002 Country Years Resources Angola 1975-2002 Oil, Diamonds Chad 2008- Oil Congo, Republic 1997 Oil Congo Dem. Rep. 1996-97; 19982007 Oil, Diamonds, Copper, Gold, Cobalt Liberia 1989-1996 Diamonds Nigeria 1975- 2009 Oil Sierra Leone 1983-2005 (+/-) Diamonds But note Rwanda, Somalia, Uganda, Kenya: were resources involved in these cases? Resource Wealth Management and Fragile States Predatory rule is enhanced by resource wealth: State power gives direct access to income from resources Resource income can finance patronage or clientele systems where rulers pay off support network; Support networks may be regional, ethnic, religious, or economic in character. Access to resource wealth by various channels: access to tax revenues, pay-offs from foreign companies; kickbacks; International spill-overs of civil conflict: diamonds escaping by neighbouring countries V. Managing Resources Effectively for Equitable Development Key Question: How can resource wealth be harnessed and utilized effectively to promote equitable and sustained development? Recall: Africa has a generous and under-utilized endowment of resources especially of nonrenewable resources (oil & minerals) 1. Central Requirement: Good Governance: Good Governance: “virtuous relationship between active citizens and a strong legitimate government dedicated to meeting peoples needs and aspirations through a representative , effective and accountable system” Elements: Rule of law; Representative political system and accountable leadership; Effective, transparent incorruptible administration; Decentralization: Effective tax regime and regulatory framework for enterprises Effective social programs 2. International Dimensions of Resource Wealth Management International efforts to collaborate in improving accountability and transparency in resource income management (i.e. to reduce corruption) A. Transparency Initiatives Extractive Industries Transparency Initiative: B. Human Rights, Social and Environmental Standards International Council on Mining and Metals UN Global Compact Timber Certification Scheme C. Conflict resources Governance Policies Kimberly Process (Diamond) Certification Scheme D. Financial Sector Governance Policies Anti-Money Laundering Initiative A. Transparency Initiatives Extractive Industries Transparency Initiative: • Aimed at gathering, reconciling, publicizing information on royalties and taxes on oil and minerals • Objective: ensure transparency, accountability, and absence of corruption • Most African and many other countries have joined Mauritania , Burkina Faso , Cameroon , Mozambique , Central African Republic , Niger Côte d´Ivoire , Nigeria , Democratic Republic of Congo , Equatorial Guinea , Gabon Republic of the Congo , Ghana , São Tomé e Príncipe , Guinea , Sierra Leone , Tanzania , Liberia , Madagascar , Zambia, Mali Web Site: http://eitransparency.org/ B. Conflict Resources Governance Policies Kimberly Process (Diamond) Certification Scheme An international government led process designed to prevent trade in conflict diamonds; Established January 2003; Endorsed by UN General Assembly and Security Council Successful re labelling and blocking trade in “conflict diamonds” Unfunded; • operated by volunteers in two NGOs, Global Witness and Ottawa-based “Partnership Africa Canada” • therefore of dubious sustainability 3. Management of Natural Resource Revenues The task: optimizing 1. revenue generation, developmental impacts, 2. benefits for future generations, while 3. maintaining the health of the enterprises involved – foreign, domestic or state i.e. converting ephemeral resource revenues into sustained and sustainable human development for the long term a) Ensuring Revenues plus Appropriate Incentive structure for enterprises Requires sufficient revenues for firm to extract, re-invest, and undertake exploration for future mine development b) Timing and Composition of Resourcefinanced Expenditures: How should resource revenues be used? • • • • Domestic investment Domestic consumption Savings or Investment Funds Accumulation of foreign assets Generally focus on “pro-poor growth” i.e. an equity oriented development strategy. Stabilization funds or citizen dividends c) Stabilization funds: – – – – Fat cow / Lean cow rationale (Joseph & the Pharoah a la Norway, Chile, or Alberta (the Heritage Fund) Advantage Disadvantage: • they are “raidable” • Citizens may object to postponement of expenditures • Future economic downswings may be underestimated Stabilization funds or citizen dividends, continued d) Immediate Disbursement to Citizens? – Interesting idea; a type of social justice? – ”Rent” payment to citizens may be equitable – Problems: – How then does government finance developmental activities – Will this reinforce the Dutch Disease effect of economic over-heating increased imports with little sustainable benefits? 4. Ensuring Fairness of Benefit Distribution to Local Communities 1. Ensure minimum disruption of local communities; 2. Generate jobs for local people (note problem with displacement of artisanal miners); 3. Revenue sharing with local communities and states or provinces; 4. Local procurement of inputs; 5. Minimize environmental damage 6. Decommissioning and clean-up of mine and minesite A caution: There is no automatic conversion of new resource wealth to broad-based, pro-poor, and sustainable development VI. The New Scramble for Africa’s Resources Major new participants in resource sector activity: China, India, and South Korea Concentrated in oil, minerals and now land for agricultural exports Major volumes of direct foreign investment Oil, minerals and agri. raw materials dominate African exports to Asia (86% to China in 2005) Possible positive effects: Possible negative effects: See The Economist, “Out-Sourcing’s Third Wave,” May 21, 2009 and and African Development Report 2007. pp. 131-136 Possible positive effects: Possible negative effects: Possible positive effects: Increased foreign exchange; economic growth; tax revenues, social expenditures …….. Integration of African countries into International System? Maybe in the longer term A lead-in to exports of manufactures for Asia? Tourism from Asia? Possible negative effects: Non-transparency Minimal concern re authoritarian regimes, human rights issues, corruption Diversion of resources from use for Africa to use for Asia Use of imported Asian labour; reduced domestic learning effects