Natural Resources for Sustainable Development

advertisement

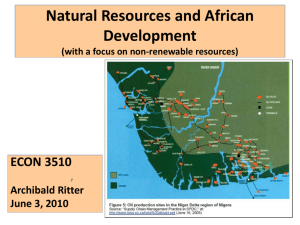

Natural Resources and African Development ECON 3510, Carleton University Arch Ritter May 29 & June 3 2014 Note: The sources for this section are 1. Class Notes 2. Collier Chapter 3 3. Optional: African Development Bank, African Development Report 2007, Oxford and New York: Oxford University Press, 2007, Chapters 1, 4, 5, and 6. To access this source on the Web, please “Google” the following title, and follow the link to an “Adobe” pdf. file: “African Development Bank, African Development Report 2007, Oxford and New York: Oxford University Press, 2007” Outline I. Some Historical Observations II. Current Role of Resources in African Development – – – Petroleum, coal, natural gas Minerals Forestry products III. The Main Mineral Sector Development Issues IV. “The Paradox of Plenty” – – – The “Resource Curse” Conflict States and Resource Wealth The New “Scramble” for Africa’s Resource Wealth V. Managing Resources Effectively for Equitable Development VI. The New Scramble for Africa’s Resources I. Some Historical Observations Pre-Colonial metal-working; since time immemorial European “Scramble for Africa”, motivated in part by desire for mineral wealth Cecil Rhodes and the British in South Africa ”Gold Coast” (which became Ghana) “Cote d’Ivoire” Today: A Mineral Resource Treasure House? I. Some Historical Observations, cont’d The Mineral Sector at Independence Foreign-owned; Major source of foreign exchange and taxes for many countries; weak linkages to domestic economies; Non-Petroleum Mineral Activity declined from 1970s to 1990s; Petroleum continued strong Some nationalizations; some multinationals retreat; Exploration and mine development stops; “Milking the cash cows to death.” 2000-2014 (+/-): Renewed Mineral Exploration & Dev’t New mines commence operation; Note: Artisanal/Informal Sector Mining and Large-scale Modern Mining Liberia’s Opportunity and Challenge Coming of Renewed Resource Wealth Iron Ore again; BHP Billiton and Mital-Arcelor Off-Shore Petroleum? Harnessing Resource Wealth Equitably and Productively Accessing Resource Wealth: Taxes and Linkages Pro-Poor Sharing of the Wealth Avoiding the “Curse of Resource Wealth” The Good Governance Imperative II. Current Role of Resources in African Development Mineral Export Concentration, Selected Countries. 2005 (Percentage of Total Exports) Country Main Export Other Exports Botswana Chad Diamonds 88.2% Oil 99.9% Nickel 8.1 Ghana Kenya Nigeria Cocoa 46 Tea 16.8 Oil 92.2 Manganese 7.2 Flowers 14.2 S. Africa Tanzania Platinum. 12.5 Gold 10.9 Coal 8; Gold 7.9 Fish 9.7; Copper 8.6 Zambia Sub-Saharan Africa Copper 55.8 Oil 49.2 Cobalt 7 Diamonds 12.6; Copper7.8 Oil in the Niger Delta, Nigeria: +/- 89% of Gov’t revenue +/- 25% of GDP about 95% of export earnings; 13% of oil revenues to oil-producing states Impoverishment and environmental problems for local peoples (the Ogoni and other groups) Major Conflict in the Delta III. The Main Oil and Mineral Sector Development Issues Benefits and Costs of Mineral and Petroleum Extraction: Possible Benefits: Taxes and Royalties and Government Programs they support e.g. education, health, security, infrastructure, state management Foreign exchange earnings: significant Job Creation and income generation? May be limited domestically; Specialized jobs to foreigners Linked economic activity generation? Limited Rising future prices trends? An encouraging future? III. The Main Oil and Mineral Sector Development Issues, continued: Possible Costs: Fluctuating foreign exchange earnings Declining price prospects? A discouraging future? [No] Profit repatriation Limited Direct Linkages Environmental costs Impacts on local communities III. The Main Oil and Mineral Sector: Main Development Issues 1. Price volatility generates macroeconomic instability (explanation in class) 2. Long-run downward price trends? [Not Likely] 3. Short-term Character of some mining due to finite sixe of ore bodies or petroleum deposits 4. Enclave Character: limited linkages to domestic economy 5. Further processing migrates abroad III. The Main Oil and Mineral Sector Main Development Issues continued 6. Environmental Impacts 7. Impacts on Local Communities 8. Insufficient Returns to Governments 9. Informal Sector Mining Conclusion: Don’t Do Petroleum or Mining? OR: Manage Petroleum and Mining Sectors Intelligently? 1. Mineral Price Instability 2. Terms of Trade and Mineral Prices 2. Terms of Trade and Mineral Prices 3. Short–term Resource Life? • All mineral and petroleum resources are ultimately finite • Some ore or oil resources more finite than others • Many general resource areas are large despite finite mine or oil deposit life • The game: Translate resource wealth into general and sustainable human and economic development 4. Enclave Character: limited linkages to domestic economies Explain: – “Backward Linkages:” (ability to provide the inputs needed for mining or oil) – “Consumption Linkages” Payments to people promoting increases in final demand. Depends on employment and income patterns and volumes 5. Enclave Character continued: Further processing migrates abroad Explain: – “Forward Linkages” (ability to undertake further processing of the ores or petroleum) – Transportation costs and the nature of mineral sector production chains mean that most further processing migrates towards the final producers of metal-bearing products – mainly the high income countries plus China and India. 6. Environmental Impacts Varieties of Impacts: Water Quality Air Quality Tailings Noxious Wastes Land use and degradation 7. Impacts on Local Communities Local community receives the • environmental degradation and • often the loss of artisanal mine jobs • Social dislocations without the macroeconomic benefits Note case of Barrick gold mining in Tanzania, African Development Report, 2007, p. 150 Or the Ogoni people in Nigeria 8. Returns to Government: Taxation Tax Regimes and Revenues are Important Varieties of Taxes: • Royalties (on metal content of ores extracted) • Income from Production Sharing or Joint State Ownership or State Ownership • Corporate Income Taxes • Personal Income Taxes on People in the sector • Sales Taxes on sales to people in the sector • Import Taxes on Imported Inputs • Export Taxes But note the ways corporations can minimize tax payments: transfer pricing Are revenues to Governments sufficient? 8. Returns to Government: Taxation, cont’d But note the ways corporations can minimize tax payments: Transfer pricing; Are revenues to Governments and Countries sufficient? Assuring a Fair Return to the Nation • Transparency and Accountability • Adequate Taxation is vital • Joint Venture Ownership Forms? – Standard for petroleum; Common for minerals – To assure national interests • Domestic Input Sourcing • Procurement from domestic enterprises and local communities where possible • Maximum Employment in all possible areas • Further processing where realistic and viable 9. Informal Sector Mining Example: Liberia: Significant in gold and diamonds Perhaps 100,000 miners Advantages: Job creation, income generation for many people Support for local communities Labour intensive technology Low cost production Stronger linkages to domestic economy via input provision and income generation for many 9. Informal Sector Mining, continued Disadvantages: Minimal tax revenues; Low productivity mining; Superficial extraction: “high grading” Environmental despoliation often Health and safety issues Subsistence income generation Escape of foreign exchange earnings Possible links to illegality and crime (blood diamonds!) Formal or Informal Mining: Which is better? Policies towards Informal Sector Mining Major Dilemmas: Formal and informal mining both have advantages and disadvantages Case by case approach is reasonable e.g. Liberia: Iron Ore: no alternative to large scale formal mining Diamonds at this time, no formal mining in sight Gold: possible future coexistence of both? Policies towards Informal Sector Mining • Can state plus “legality and regulation” establish a presence in informal mining ? • Can it be taxed? • Can the state purchase the output? • Can the environment be protected and health and safety standards be upheld? • Can productivity and incomes be increased? IV. The “Paradox of Plenty” aka “Resource Curse” The “curse”: Resource wealth generates great revenues for governments but also may tend to lead to relative economic stagnation and political problems waste, corruption, political patronage systems, economic stagnation civil conflict & war i.e. Perhaps an inverse relationship between resource wealth and genuine development?? IV. The Paradox of Plenty aka “Resource Curse” Why? Economic factors: exchange rate, prices, economic management Political factors via windfall revenues to Governments without need for accountability to tax-payers, windfall revenues “up for grabs” among competing elites.; feeding corruption i.e. Resource wealth promotes dysfunctional political regimes (says Paul Collier) Empirical Validity of the “Resource Curse” Countries that might have the “Resource Curse” – High mineral export dependence on one or a few minerals • especially petroleum exporters (“Oil Economy Syndrome” ) – High Foreign Exchange and Fiscal dependence on the resource export – High levels of Direct Foreign Investment in the resource sector – The Canadian Case the 1950s and the 2010s? Evidence re Performance: – Economic Growth (GDPpc) • Resource-rich countries are richer than resource poor (GDPpc; tax revenues; foreign exchange earnings) • Resource rich grew more slowly than resource poor (2.4% pa vs. 3.8% pa, 1981.2006 • Resource rich coastal states best off; • Resource scarce land-locked, worst off Evidence re Performance, continued: Resource Bonanza countries experience: - Worse Income inequality - Similar Human Development Indices - Civil Conflict: seems pervasive: - e.g. Nigeria; Chad; Sierra Leone, Liberia, Sudan [But other resource poor countries also experience conflict: e.g. Rwanda, Kenya, Somalia] – Negative “Genuine Savings” “Genuine Savings” = Public & Private Saving - Depreciation + Education Spending - Natural resource depletion - Increase in pollutant stock Explanation #1: “Dutch Disease” or “Oil Economy Syndrome” Export “boom” caused by a sudden increase in oil export prices or volumes or mineral export prices or volumes, leads to an appreciation of the exchange rate with negative consequences Explanation, with diagram on the blackboard The diagram represents the foreign exchange (in US dollars) market from the perspective of an oil exporter, in this example, Nigeria. Explanation #1: “Dutch Disease” or “Oil Economy Syndrome” Negative consequences • a major reduction of traditional (pre-boom) exports; • unemployment of the factors of production in the traditional export sector; • an increased concentration on the resource export and reduced diversity of export structures; • damage to import-competing exports; • Damage to and unemployment in domestic manufacturing due to cheap imports Plus • an inflationary impact as the demand for non-tradable products increases, which further affects the real exchange rate; • irresponsible use or misuse of foreign exchange windfall receipts Examples: • Spain during its glory days with silver and gold inflows from pillage and later the rich mines of Mexico and South America from perhaps 1530 to 1700 • Countries undergoing a resource boom (e.g. Canada in a minor way in the 1950s, again in 2006-2014 with tar sands and oil prices) • The Netherlands after its North Sea natural gas boom and before the “Euro”: “Dutch Disease” • Norway now? Examples: • Major oil exporting countries such as Nigeria (with 95% of its exports as petroleum); • Chad (99% of its exports as petroleum) Digression: Do high levels of development assistance lead to currency appreciation and reductoion of other exports? Explanation #2: Other Economic Factors Volatility of Foreign Exchange Earnings and Tax Revenues affects economic management and performance Economic Policy Failures: High resource revenues: – Lead to extravagant Wastage; – Expanded consumption; – Reduction of other non-mineral taxes; – Undertake costly but unwise prestige expenditures or investments Explanation #3. Socio-Political Character: “Dutch Disease” becomes “Resource Curse” • Increased potential for corruption; • Rent-seeking and winning is more profitable than productive economic actions; • Bad decision making: government does not have to respond to tax payers because rents come resources; • Resource revenues feed patronage systems, permitting authoritarian or predator regimes to remain in power; • Conflict among elites, regions, ethnic groups may be intensified. Collier’s Thesis: • Resource Hyper-wealth promotes patronage, corruption, and autocracy • Democratic politics becomes deformed and dysfunctional, permitting the most corrupt politicians to thrive while the altruistic are displaced. • Contrast Norway and Chad See also: Geoffrey York, “South Sudan’s $4-billion query answered: Oil revenue stolen by corrupt officials Southern Sudan (Globe and Mail, June 6, 2012) Explanation #4: Civil Conflict, Fragile States and Resource Wealth Evidence that resource wealth increases incidence of civil war and conflict (see chart) - Oil, gold & diamonds dominate; - Diamonds are easily “loot-able” - But resource mis-management is also a key factor explaining poor economic performance and resource wealth Civil Strife linked to Resource Wealth, 1990-2002 Country Years Resources Angola 1975-2002 Oil, Diamonds Chad 2008- Oil Congo, Republic 1997 Oil Congo Dem. Rep. 1996-97; 1998- Oil, Diamonds, 2007 Copper, Gold, Cobalt Liberia 1989-1996 Diamonds Nigeria 1975- 2009 Oil Sierra Leone 1983-2003 (+/-) Diamonds But note Rwanda, Somalia, Uganda: were resources involved in these cases? Resource Wealth Management and Fragile States Predatory rule is enhanced by resource wealth: State power gives direct access to income from resources Resource income can finance patronage or clientele systems where rulers pay off support network; Support networks may be regional, ethnic, religious, or economic in character. Access to resource wealth by various channels: access to tax revenues, pay-offs from foreign companies; Capture of the State permits control of resourcre wealth International spillovers of civil conflict: diamonds escaping by neighbouring countries V. Managing Resources Effectively for Equitable Development Key Question: How can resource wealth be harnessed and utilized effectively to promote equitable and sustained development? Recall: Africa has a generous and under-utilized endowment of resources especially of nonrenewable resources (oil & minerals) 1. Central Requirement: Good Governance: Good Governance: “virtuous relationship between active citizens and a strong legitimate government dedicated to meeting peoples needs and aspirations through a representative , effective and accountable system” 1. Central Requirement: Good Governance: Good Governance, Elements: Rule of law; Representative political system and accountable leadership; Effective, transparent incorruptible administration; Effective tax regime and regulatory framework for enterprises Effective social programs Decentralization: 2. International Dimensions of Resource Wealth Management International efforts to collaborate in improving accountability and transparency in resource income management (i.e. to reduce corruption) A. Transparency Initiatives Extractive Industries Transparency Initiative: B. Human Rights, Social and Environmental Standards International Council on Mining and Metals UN Global Compact Timber Certification Scheme C. Conflict resources Governance Policies Kimberly Process (Diamond) Certification Scheme D. Financial Sector Governance Policies Anti-Money Laundering Initiative A. Transparency Initiatives Extractive Industries Transparency Initiative: • Aimed at gathering, reconciling, publicizing information on royalties and taxes on oil and minerals • Objective: ensure transparency, accountability, and absence of corruption • Most African and many other countries have joined Web Site: http://eitransparency.org/ B. Conflict Resources Governance Policies Kimberly Process (Diamond) Certification Scheme An international government led process designed to prevent trade in conflict diamonds; Established January 2003; Endorsed by UN General Assembly and Security Council Successful re labelling and blocking trade in “conflict diamonds” Unfunded; • operated by volunteers in two NGOs, Global Witness and Ottawa-based “Partnership Africa Canada” • therefore of dubious sustainability 3. Management of Natural Resource Revenues The task: To Optimize 1. Tax revenue generation and developmental impacts, 2. Benefits for future generations, while 3. Maintaining the health of the enterprises involved – foreign, domestic or state i.e. converting ephemeral resource revenues into sustained and sustainable human development for the long term 3. Management of Natural Resource Revenues a) Ensuring Revenues plus Appropriate Incentive structure for enterprises sustainability Requires sufficient revenues for firm to extract, re-invest, and undertake exploration for future mine development b) Timing and Composition of Resourcefinanced Expenditures: How should resource revenues be used? • • • • Domestic investment Domestic consumption Savings or Investment Funds Accumulation of foreign assets Generally focus on “pro-poor growth” i.e. an equity oriented development strategy. Stabilization funds or citizen dividends c) Stabilization funds: – Fat cow / Lean cow rationale (Joseph & the Pharaoh – a la Norway, Chile, or Alberta (the Heritage Fund) – Advantage: – Disadvantage: • they are “raid-able” • Citizens may object to postponement of expenditures • Future economic downswings may be underestimated Stabilization funds or citizen dividends, continued d) Immediate Disbursement to Citizens? – Interesting idea; a type of social justice? – ”Rent” payment to citizens may be equitable – Problems: –How then does government finance developmental activities –Will this reinforce the Dutch Disease effect of economic over-heating increased imports with little sustainable benefits? 4. Ensuring Fairness of Benefit Distribution to Local Communities 1. Ensure minimum disruption of local communities; 2. Generate jobs for local people (note problem with displacement of artisanal miners); 3. Revenue sharing with local communities and states or provinces; 4. Ensuring Fairness of Benefit Distribution to Local Communities 4. Local procurement of inputs; 5. Minimize environmental damage 6. Decommissioning and clean-up of mine-site 7. For Indigenous Peoples: Free, Prior and Informed Consent A caution: There is no automatic conversion of new resource wealth to broad-based, pro-poor, and sustainable development; this is a most difficult task. Conclusion: Optimizing the Socio-Economic Gains from Resource Development 1. Tough but Reasonable Tax Regime 2. Pro-Poor Allocation of tax-financed Social Expenditures 3. Domestic Procurement wherever reasonable 4. Domestic Labor use wherever possible 5. Fair Benefits to Local Communities 6. Environmental stewardship 7. Stewardship of the resource for the long term 8. Good Governance is Indispensable