File

advertisement

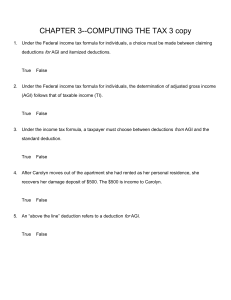

3/24/14 “Deductions, credits, & dependents” 1. What is the difference between a tax deduction and a tax credit? 2. What is a dependent & how do they effect your taxes? On desk: Deductions & credits wksht. Earn: $50,000 Deductions reduce amount $$ you are TAXED ON. Owe in taxes: $10,000 Credits reduce amount $$ you OWE in taxes. What is a dependent & how do they effect your taxes? dependent: • Someone who depends on you to live (child, grandma, cousin, etc.) • The more dependents you can claim, the more money you save on your taxes! (dependent credits) How much would your standard deduction be if you filed your taxes today? • Single = $6,100 • Married = $12,200 What is the difference between nonrefundable tax credits and refundable tax credits? Nonrefundable: • can reduce tax liability to zero, but not below • Refundable: • can reduce tax liability below zero, which means…? • Govt. can end up owing you money! Deductions ($ reduces income subject to tax) Credits ($ reduces amt. of tax owed) 3/24/14 Econ. Agenda 1. How to file your taxes, part one (class notes) 2. Adjusted Gross Income tax problems HW: finish AGI tax problems # 1 – 3 3/24/14 Class notes – how to file your taxes • Need at least 3 things: 1. Personal info. for you and your dependents (SSN, date of birth, address, etc.) 2. W-2 form – statement of your wages for past year 3. Correct tax form • Need to file BOTH Federal & State tax forms every year! • Tax due date? • April 15th! 576-98-4356 985869493 76,500.00 8,415.00 Google, Inc. 76,500.00 5,355.00 1600 Amphitheatre Parkway 76,500.00 1,530.00 Mountain View, CA 94303 Niza Hernandez 300 Primavera Street, Apt. A Impuesto, CA 90000 CA 76,500.00 2,295.00 76,500.00 765.00 3/24/14 Class notes – how to file your taxes • Adjusted Gross Income (AGI) • Amount of income you are taxed on (basically) • Total income minus all of your deductions • Income = $50,000 • Standard deduction = $6,100 • Student loan interest deduction = $1,500 • Charitable contribution to RIPR = $150 • Total amount in deductions? • = $7,750 • AGI = $50,000 – $7,750 = $42,250 3/24/14 Class notes – how to file your taxes • What form do I need to file my taxes? • 3 forms to choose from (federal taxes): 1. 1040 EZ • Shortest, least complicated: • Under $100,000 income, no dependents, under age 65, single or married filing jointly… 2. 1040A • Medium length, more complicated: • Same as 1040EZ but…any age, can claim dependents, owning stocks & other investments… 3. 1040 3/24/14 Class notes – how to file your taxes • What form do I need to file my taxes? • 3 forms to choose from (federal taxes): 3. 1040 • Longest, most complicated: • Any marital status, over $100,000 income, sold property, self employed, greater than $1500 in interest earned… • How do I file my taxes? • Online or paper (online refund comes faster) • Self with tax forms, pay a professional, or pay TurboTax, etc. • • • • • • 1040-EZ Short Marital status – Single, married filing jointly Age – >65 Dependents – none Interest income – <$1,500 Taxable income – <$100,000 • • • • • • • 1040A Medium Marital status – Single, married filing jointly Age – Any Other – Retirement payments – Own stocks – Student loans Dependents – yes Interest income – <$1,500 Taxable income – <$100,000 1040 • Long • Marital status – married filing separately, divorced • Other – Self-employed – Sold property – Own stocks – YES itemized deductions • Interest income – >$1,500 • Taxable income – >$100,000 Adjusted Gross Income Federal Tax Rates, 2013 Single If taxable income is more than … but not more than … the tax is … $0 $8,925 10% of the taxable income $8,925 $36,250 $892.50 plus 15% of the amount over $8,925 $36,250 $87,850 $4,991.25 plus 25% of the amount over $36,250 $87,850 $183,250 $17,891.25 plus 28% of the amount over $87,850 $183,250 $398,350 $44,603.25 plus 33% of the amount over $183,250 $398,350 $400,000 $115,586.25 plus 35% of the amount over $398,350 $400,000 no limit $116,163.75 plus 39.6% of the amount over $400,000 Example: You are single and earn $89,000 as a plumber. You get the standard deduction amount of $6,100 and a child tax credit of $1,000. What is your AGI and how much money do you owe in taxes? AGI = $89,000 - $6,100 AGI = $82,900 Income = $89,000 Deductions? $6,100 Amount of tax owed? AGI = $82,900 - $36,250 $46,650 X .25 $11,662.50 $4,991.25 plus 25% of the amount over $36,250 $4,991.25 + $11,662.50 $16,653.75 Tax credits? $16,653.75 - $1,000.00 Tax owed = $15,653.75