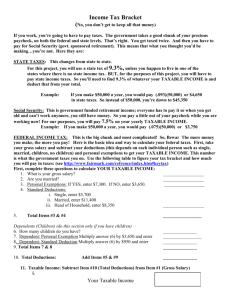

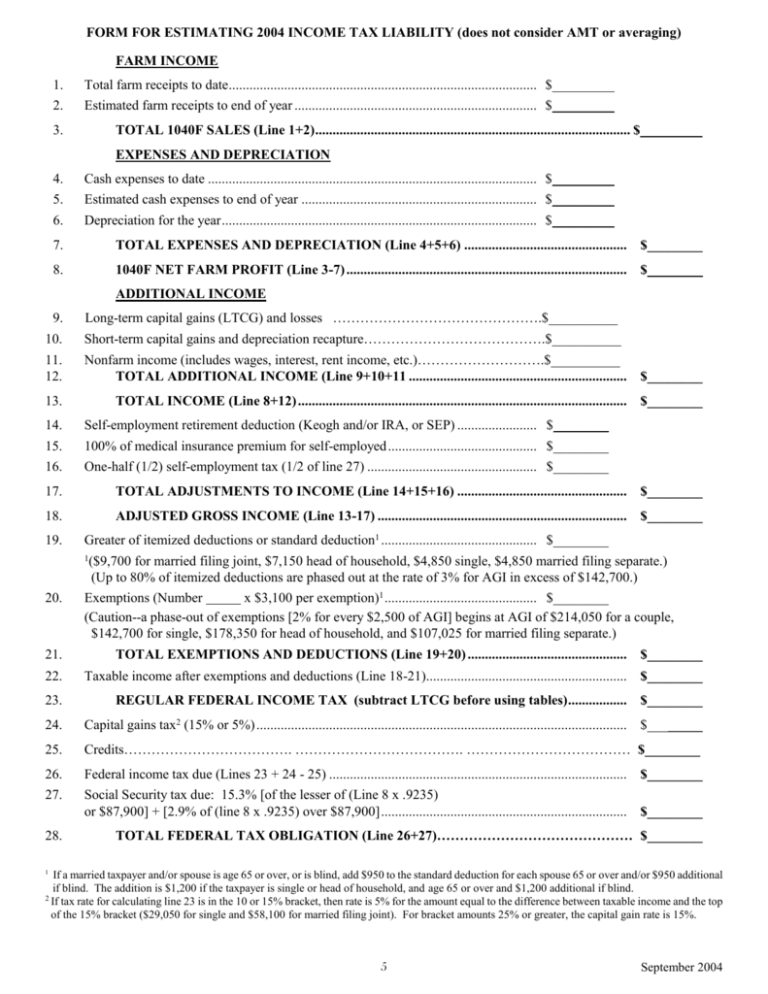

FORM FOR ESTIMATING 2004 INCOME TAX LIABILITY

advertisement

FORM FOR ESTIMATING 2004 INCOME TAX LIABILITY (does not consider AMT or averaging) FARM INCOME 1. Total farm receipts to date......................................................................................... $_________ 2. Estimated farm receipts to end of year ...................................................................... $_________ 3. TOTAL 1040F SALES (Line 1+2) ........................................................................................... $_________ EXPENSES AND DEPRECIATION 4. Cash expenses to date ............................................................................................... $_________ 5. Estimated cash expenses to end of year .................................................................... $_________ 6. Depreciation for the year ........................................................................................... $_________ 7. TOTAL EXPENSES AND DEPRECIATION (Line 4+5+6) ............................................... $________ 8. 1040F NET FARM PROFIT (Line 3-7) ................................................................................. $________ ADDITIONAL INCOME 9. Long-term capital gains (LTCG) and losses ……………………………………….$__________ 10. Short-term capital gains and depreciation recapture………………………………….$__________ 11. 12. Nonfarm income (includes wages, interest, rent income, etc.)……………………….$__________ TOTAL ADDITIONAL INCOME (Line 9+10+11 ............................................................... $________ 13. TOTAL INCOME (Line 8+12) ............................................................................................... $________ 14. Self-employment retirement deduction (Keogh and/or IRA, or SEP) ....................... $________ 15. 100% of medical insurance premium for self-employed ........................................... $________ 16. One-half (1/2) self-employment tax (1/2 of line 27) ................................................. $________ 17. TOTAL ADJUSTMENTS TO INCOME (Line 14+15+16) ................................................. $________ 18. ADJUSTED GROSS INCOME (Line 13-17) ........................................................................ $________ 19. Greater of itemized deductions or standard deduction1 ............................................. $________ 1($9,700 for married filing joint, $7,150 head of household, $4,850 single, $4,850 married filing separate.) (Up to 80% of itemized deductions are phased out at the rate of 3% for AGI in excess of $142,700.) 20. Exemptions (Number x $3,100 per exemption)1 ............................................ $________ (Caution--a phase-out of exemptions [2% for every $2,500 of AGI] begins at AGI of $214,050 for a couple, $142,700 for single, $178,350 for head of household, and $107,025 for married filing separate.) 21. TOTAL EXEMPTIONS AND DEDUCTIONS (Line 19+20) .............................................. $________ 22. Taxable income after exemptions and deductions (Line 18-21).......................................................... $________ 23. REGULAR FEDERAL INCOME TAX (subtract LTCG before using tables)................. $________ 24. Capital gains tax2 (15% or 5%) ........................................................................................................... $________ 25. Credits………………………………. ………………………………. ……………………………… $________ 26. Federal income tax due (Lines 23 + 24 - 25) ...................................................................................... $________ 27. Social Security tax due: 15.3% [of the lesser of (Line 8 x .9235) or $87,900] + [2.9% of (line 8 x .9235) over $87,900] ....................................................................... $________ 28. TOTAL FEDERAL TAX OBLIGATION (Line 26+27)……………………………………. $________ 1 If a married taxpayer and/or spouse is age 65 or over, or is blind, add $950 to the standard deduction for each spouse 65 or over and/or $950 additional if blind. The addition is $1,200 if the taxpayer is single or head of household, and age 65 or over and $1,200 additional if blind. 2 If tax rate for calculating line 23 is in the 10 or 15% bracket, then rate is 5% for the amount equal to the difference between taxable income and the top of the 15% bracket ($29,050 for single and $58,100 for married filing joint). For bracket amounts 25% or greater, the capital gain rate is 15%. 5 September 2004 2004 Tax Rates, Single Individual Taxable Income Tax Payable $ 0 7,150 $ 7,150 - 29,050 $ 29,050 - 70,350 $ 70,350 - 146,750 $ 146,750 - 319,100 Over $319,100 $ 715.00 $ 4,000.00 $ 14,325.00 $ 35,717.00 $ 92,592.50 10% of TI + 15.0% + 25.0% + 28.0% + 33.0% + 35.0% of of of of of (TI - 7,150) (TI - 29,050) (TI - 70,350) (TI - 146,750) (TI - 319,100) 2004 Tax Rates, Married Filing Jointly Taxable Income $ $ $ $ $ Tax Payable 0 - 14,300 14,300 - 58,100 58,100 - 117,250 117,250 - 178,650 178,650 - 319,100 Over $319,100 $ 1,430.00 $ 8,000.00 $ 22,787.50 $ 39,979.50 $ 86,328.00 10% of TI + 15.0% + 25.0% + 28.0% + 33.0% + 35.0% of of of of of (TI - 14,300) (TI - 58,100) (TI - 117,250) (TI - 178,650) (TI - 319,100) 2004 Tax Rates, Heads of Households Taxable Income Tax Payable $ 0 - 10,200 $ 10,200 - 38,900 $ 38,900 - 100,500 $ 100,500 - 162,700 $ 162,700 - 319,100 Over $319,100 $ 1,020.00 $ 5,325.00 $ 20,725.00 $ 38,141.00 $ 89,753.00 10% of TI + 15.0% + 25.0% + 28.0% + 33.0% + 35.0% of of of of of (TI - 10,200) (TI - 38,900) (TI - 100,500) (TI - 162,700) (TI - 319,100) 2004 Married Filing Separately Taxable Income Tax Payable $ 0 7,150 $ 7,150 - 29,050 $ 29,050 - 58,625 $ 58,625 - 89,325 $ 89,325 - 159,550 Over $159,550 $ 715.00 $ 4,000.00 $ 11,393.75 $ 19,989.75 $ 43,164.00 10% of TI + 15.0% + 25.0% + 28.0% + 33.0% + 35.0% of of of of of (TI - 7,150) (TI - 29,050) (TI - 58,625) (TI - 89,325) (TI - 159,550) 2004 Estates and Trusts Taxable Income $ $ $ $ 0 1,950 4,600 7,000 Over $9,550 Tax Payable 1,950 4,600 7,000 9,550 $ 292.50 $ 955.00 $ 1,627.00 $ 2,486.50 15% of TI + 25.0% + 28.0% + 33.0% + 35.0% of of of of (TI (TI (TI (TI - 1,950) 4,600) 7,000) 9,550) Corporations with a Tax Year that Begins on or After January 1, 1994 (Unofficial Table) Taxable Income Tax Payable $ 050,000 $ 50,000 75,000 $ 75,000 100,000 $ 100,000 335,000 $ 335,000 10,000,000 $ 10,000,000 15,000,000 $ 15,000,000 18,333,333 Over $18,333,333 $ 7,500 $ 13,750 $ 22,250 $ 113,900 $ 3,400,000 $ 5,150,000 6 15% of TI + 25% of + 34% of + 39% of + 34% of + 35% of + 38% of 35% of (TI - 50,000) (TI - 75,000) (TI - 100,000) (TI - 335,000) (TI - 10,000,000) (TI - 15,000,000) (TI - 0) September 2004