File

CHAPTER 7

LEARNING OBJECTIVES

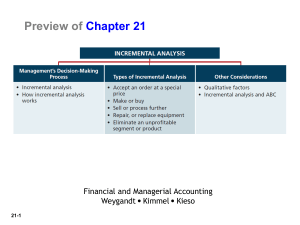

1. DESCRIBE MANAGEMENT’S DECISION-MAKING

PROCESS AND INCREMENTAL ANALYSIS.

2. ANALYZE THE RELEVANT COSTS IN ACCEPTING AN

ORDER AT A SPECIAL PRICE.

3. ANALYZE THE RELEVANT COSTS IN A MAKE-OR-BUY

DECISION.

4. ANALYZE THE RELEVANT COSTS IN DETERMINING

WHETHER TO SELL OR PROCESS MATERIALS

FURTHER.

5. ANALYZE THE RELEVANT COSTS TO BE CONSIDERED IN

REPAIRING, RETAINING, OR REPLACING EQUIPMENT.

6. ANALYZE THE RELEVANT COSTS IN DECIDING

WHETHER TO ELIMINATE AN UNPROFITABLE SEGMENT

OR PRODUCT.

CHAPTER REVIEW

Decision-Making Process and Incremental Analysis

1. (L.O. 1) Management’s decision-making process frequently involves the following steps: a. Identify the problem and assign responsibility. b. Determine and evaluate possible courses of action. c. Make a decision. d. Review the results of the decision.

Accounting’s contribution to the decision-making process occurs primarily in steps (b) and (d).

2. Business decisions involve a choice among alternative courses of action. In making such decisions, management ordinarily considers both financial and nonfinancial information. The process used to identify the financial data that change under alternative courses of action is called incremental analysis.

a. Incremental analysis involves not only identifying relevant revenues and costs, but also determining the probable effects of the decision on future earnings.

b. Data for incremental analysis involves estimates and uncertainty. c. Gathering data may involve market analysts, engineers, and accountants.

3. Three important cost concepts used in incremental analysis include: a. Relevant costs are those costs and revenues that differ across alternatives. b. Often in choosing one course of action, a company must give up the opportunity to benefit from some other course of action, this is known as opportunity cost . c. Sunk costs are costs that have already been incurred and will not be changed or avoided by any present or future decision.

4. In incremental analysis, both costs and revenues may change. However, in some cases

(1) variable costs may not change under the alternative courses of action, and (2) fixed costs may change.

Accept an Order at a Special Price

5. (L.O. 2) An order at a special price should be accepted when the incremental revenue from the order exceeds the incremental costs. a. It is assumed that sales in other markets will not be affected by the special order. b. If the units can be produced within existing plant capacity, generally only variable costs will be affected.

Make or Buy

6. (L.O. 3) In a make or buy decision, management must determine the costs which are different under the two alternatives. If there is an opportunity to use the productive capacity for another purpose, opportunity cost should be considered. Opportunity cost is the potential benefit that may be obtained by following an alternative course of action. This cost is an additional cost of making the component.

Sell or Process Further

7. (L.O. 4) The basic decision rule in a sell or process further decision is: Process further as long as the incremental revenue from such processing exceeds the incremental processing costs. Incremental revenue is the increase in sales which results from processing the product further.

8. Sell-or-process-further decisions are particularly applicable to production processes that produce multiple products simultaneously. In these types of decisions, all costs incurred prior to the point at which the joint products are separately identifiable (the split-off point) are called joint costs . Joint product costs are sunk costs.

Repair, Retain or Replace Equipment

9. (L.O. 5) In a decision to retain or replace equipment, management compares the costs which are affected by the two alternatives. Generally, these are variable manufacturing costs and the cost of the new equipment. a. b.

The book value

However, any of the old machine is a sunk cost

trade-in allowance or

Eliminate an Unprofitable Segment or Product which does not affect the decision. cash disposal value of the existing asset must be considered.

10. (L.O. 6) In deciding whether to eliminate an unprofitable segment, management should choose the alternative which results in the highest net income. Often fixed costs allocated to the unprofitable segment must be absorbed by the other segments. It is possible, therefore, for net income to decrease when what appears to be an unprofitable segment is eliminated.

11. Many of the decisions involving incremental analysis also have important qualitative features.

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 7-1

The correct order is:

1. Identify the problem and assign responsibility.

2. Determine and evaluate possible courses of action.

3. Make a decision.

4. Review results of the decision.

BRIEF EXERCISE 7-2

Alternative

A

Revenues

Costs

Net income

Alternative is better than Alternative .

Alternative

B

BRIEF EXERCISE 7-3

Reject

Order

Revenues

Costs —Variable manufacturing

Shipping

Net income

The special order …

*

**

***

BRIEF EXERCISE 7-4

Make

Variable manufacturing costs

Fixed manufacturing costs

Purchase price

Total annual cost

The decision should be to the part.

BRIEF EXERCISE 7-5

Sell

Process

Further

Sales price per unit

Cost per unit

Variable

Fixed

Total

Net income per unit

The bookcases

Accept

Order

Buy

*

**

***

BRIEF EXERCISE 7-6

The allocated joint costs are irrelevant to the sell or process further decisions. If

AB1 is processed further, the company will earn incremental revenue of $50,000

($150,000 – $100,000) and only incur incremental costs of $45,000. Therefore, the company should process AB1 further and sell AB2. If XY1 is processed further, the company will earn incremental revenue of $35,000 ($130,000 – $95,000) but will incur incremental costs of $50,000. Therefore, the company should sell XY1 rather than process it further.

BRIEF EXERCISE 7-8

Sales

Variable costs

Contribution margin

Fixed costs

Net income

Continue Eliminate