PowerPoint

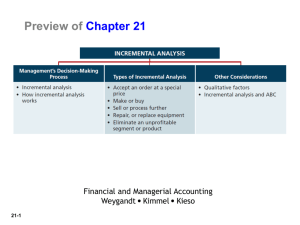

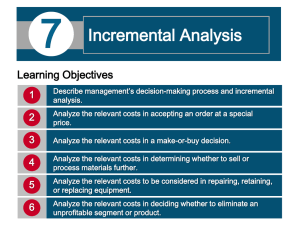

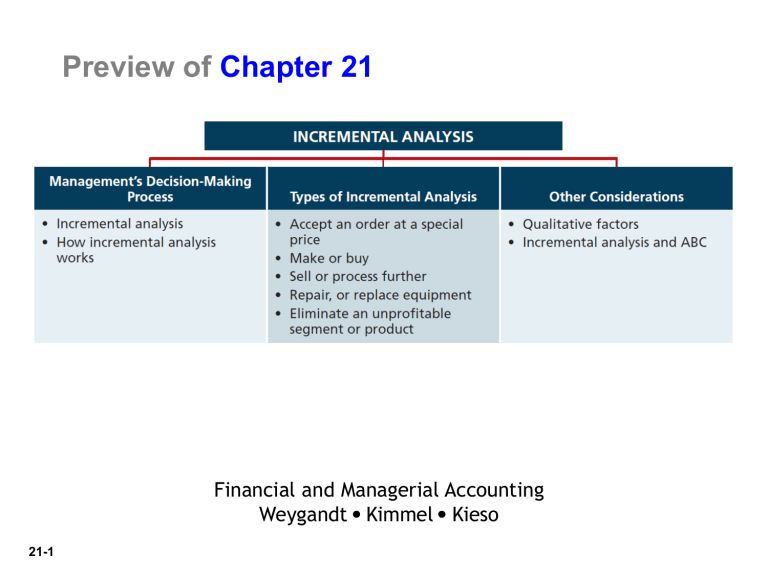

Preview of Chapter 21

21-1

Financial and Managerial Accounting

Weygandt Kimmel Kieso

21-2

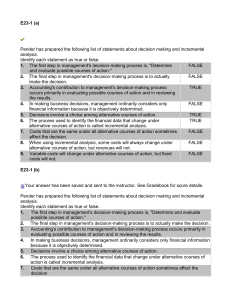

Management’s Decision-Making Process

Making decisions is an important management function.

Does not always follow a set pattern.

Decisions vary in scope, urgency, and importance.

Steps usually involved in process include:

Illustration 21-1

21-3

Management’s Decision-Making Process

21-4

Types of Decision Making

• Programmed Decisions: routine, almost automatic process.

• Managers have made decision many times before.

• There are rules or guidelines to follow.

• Example: Deciding to reorder office supplies.

• Non-programmed Decisions: unusual situations that have not been often addressed.

• No rules to follow since the decision is new.

• These decisions are made based on information, and a manger’s intuition, and judgment.

• Example: Should the firm invest in a new technology?

21-5

Decisions are broadly taken at three levels:

• Strategic decisions … big choices of identity and direction.

Who are we? Where are we heading?

These decisions are often complex and multi-dimensional. May involve large dollars and have a longterm impact … usually made by senior management.

• Tactical decisions … how to manage performance to achieve the strategy (from senior management).

What resources are needed? What is the timescale?

These decisions are distinctive but within clearer boundaries. They may involve significant resources, have medium-term implications and may be taken by senior or middle managers.

• Operational decisions … routine and follow known rules.

How many? To what specification?

These decisions involve more limited resources, have a shorter-term application and can be taken by middle or first line managers.

Management’s Decision-Making Process

21-6

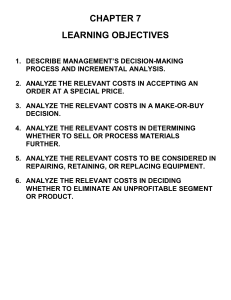

The steps are:

a. Identify the problem and assign responsibility.

b. Determine / evaluate possible courses of action.

c. Make a decision.

d. Review the results of the decision.

Accounting’s contribution to this process primarily occurs in steps (b) and (d) … evaluating possible courses of action, and reviewing results.

21-7

Management’s Decision-Making Process

Incremental Analysis Approach

Decisions involve a choice among alternative actions.

Process used to identify the financial data that change under alternative courses of action.

► Both costs and revenues may vary or

► Only revenues may vary or

► Only costs may vary

21-8

Management’s Decision-Making Process

Important concepts in incremental analysis:

Relevant cost.

Revenues

or

Costs that DIFFER between options

Option 1: Buy a Honda Civic with a GPS … $20,500

Option 2: Buy Honda Civic without GPS … $ 21,000

Management’s Decision-Making Process

21-9

Important concepts in incremental analysis:

Opportunity cost.

Potential benefit lost when you choose one thing over another … the “next best choice”.

Opportunity costs of going away to college – full-time - include:

* wages that could have been earned,

* the value of any activities missed to study,

* value of items that you could have bought with tuition money.

21-10

Management’s Decision-Making Process

Important concepts in incremental analysis:

Sunk Costs.

Cost that cannot be changed or avoided by any present or future choice.

Money spent on a “non-refundable deposit”.

Concert tickets already bought for this weekend.

21-11

Management’s Decision-Making Process

How Incremental Analysis Works

May involve changes that seem contrary to intuition.

Variable costs may not change under alternatives.

Fixed costs sometimes change between alternatives.

Incremental analysis not the same as CVP analysis.

21-12

Types of Incremental Analysis

1. Accept an order at a special price.

2. Make or buy component parts or finished products.

3. Sell or process further them further

4. Repair, retain, or replace equipment.

5. Eliminate an unprofitable business segment or product.

21-13

Accept an Order at a Special Price

Obtain additional business by making a major price concession to a specific customer.

Assumes that sales of products in other markets are not affected by special order.

Assumes that company is not operating at full capacity.

21-14

Accept an Order at a Special Price

Illustration: Sunbelt Company produces 100,000 Smoothie blenders per month, which is 80% of plant capacity.

Variable manufacturing costs are $8 per unit.

Fixed manufacturing costs are $400,000, or $4 per unit.

The blenders are normally sold to retailers at $20 each.

Sunbelt has an offer to purchase an additional 2,000 blenders at $11 per unit. Acceptance of the offer would not affect normal sales of the product. The units can be manufactured without increasing plant capacity. What should management do?

Accept an Order at a Special Price

21-15

Fixed costs do not change since within existing capacity – thus fixed costs are not relevant .

Variable manufacturing costs and expected revenues change – thus both are relevant to the decision.

21-16

Cobb incurs costs of $28 per unit ($18 var., $10 fxd) to make a product that sells for $42. Foreign company offers to buy

5,000 units at $25 ea. Cobb will incur additional shipping costs of $1 per unit.

Compute the increase or decrease in net income from accepting the special order, assuming Cobb has excess operating capacity.

Should Cobb Company accept the special order?

Make or Buy

Illustration: Baron Company incurs the following annual costs in producing 25,000 ignition switches.

21-17

Instead of making its own switches company can purchase the switches at a price of $8 each .

“What should management do?”

Make or Buy

21-18

Total manufacturing cost is $1 higher per unit than purchase price.

Must absorb at least $50,000 of fixed costs under either option.

21-19

Make or Buy –

Opportunity Cost

Illustration: Assume that through buying the switches, Baron

Company can use the released productive capacity to generate additional income of $38,000 from producing a different product.

This lost income is an additional cost of continuing to make the switches in the make-or-buy decision.

21-20

Review Question

In a make-or-buy decision, relevant costs are: a.

Manufacturing costs that will be saved.

b. The purchase price of the units. c. Opportunity costs.

d. All of the above.

J Company must decide whether to make or buy some of its components for appliances it makes. Costs of making 166,000 electrical cords for its appliances are as follows.

Direct materials … $90,000 Variable overhead … $32,000

Direct labor ……… 20,000 Fixed overhead …….24,000

Instead of making the electrical cords at an average cost per unit of $1.00 ($166,000 ÷ 166,000), company has an opportunity to buy the cords at $0.90 each. If company purchases the cords, all variable costs and 1/4 of the fixed costs will be eliminated.

21-21

(a) Prepare an analysis of whether company should make or buy the cords.

(b) What if the released productive (manufacturing) capacity will generate additional income of $5,000?

(a) Prepare an incremental analysis showing whether the company should make or buy the electrical cords.

21-22

Juanita Company will incur $1,400 of additional costs if it buys the electrical cords rather than making them.

(b) Will your answer be different if the released productive capacity will generate additional income of $5,000?

21-23

Yes, net income will be increased by $3,600 if Juanita Company purchases the electrical cords rather than making them.

21-24

Sell or Process Further

May have option to sell product at a given point in production or to process further and sell at a higher price.

Decision Rule :

Process further as long as the incremental revenue from processing exceeds the incremental processing costs.

Sell or Process Further Single-Product Case

Illustration: “W” makes tables. Cost to make an unfinished table is

$35. The selling price per unfinished unit is $50.

21-25

“W” has unused capacity that can be used to finish the tables and sell them at $60 per unit.

• Direct materials will increase $2

• Direct labor costs will increase $4.

• Variable overhead costs will increase by $2.40 (60% of direct labor) .

• No increase is anticipated in fixed overhead.

Sell or Process Further Single-Product Case

The incremental analysis on a per unit basis is as follows.

21-26

Should Woodmasters sell or process further .

Sell or Process Further Multiple-Product Case

Joint product situation for Marais Creamery. Cream and skim milk are products that result from the processing of raw milk.

21-27

Joint product costs are sunk costs and thus not relevant to the sell-or-process further decision.

Sell or Process Further Multiple-Product Case

Cost and revenue data per day for cream.

21-28

Determine whether the company should simply sell the cream or process it further into cottage cheese.

Sell or Process Further Multiple-Product Case

Analysis of whether to sell cream or process into cottage cheese.

21-29

Marais should or should not process the cream further?

Sell or Process Further Multiple-Product Case

Cost and revenue data per day for skim milk.

21-30

Determine whether the company should sell the skim milk or process it further into condensed milk.

Sell or Process Further Multiple-Product Case

Analysis of whether to sell skim milk or process into condensed milk.

21-31

Marais should or should not process the milk further?

21-32

Review Question

The decision rule is a sell-or-process-further decision:

Process further as long as the incremental revenue from processing exceeds: a.

Incremental processing costs.

b. Variable processing costs. c. Fixed processing costs.

d. No correct answer is given.

21-33

Repair, Retain, or Replace Equipment

Decision: Replace old machine with new. Old machine originally cost $110,000. Book value is $40,000. It has a remaining useful life of four years (

@ depreciation rate of $70,000 per year).

New machine costs $120,000.

Expected salvage value after 4-year useful life is zero.

New machine will decrease variable mfg costs from

$640,000 to $500,000

The old machine can be sold for $5,000.

21-34

Repair, Retain, or Replace Equipment

Additional Considerations

The book value of old machine does not affect the decision.

► Book value is a sunk cost.

► Costs which cannot be changed by future decisions

(sunk cost) are not relevant in incremental analysis.

However, any trade-in allowance or cash disposal value of the existing asset is relevant.

21-35

Repair, Retain, or Replace Equipment

Prepare the incremental analysis for the four-year period .

KEEP

Machine

REPLACE

Machine

Retain or

Replace

?

21-36

Eliminate an Unprofitable Segment

Key: Focus on Relevant Costs.

Consider effect on related product lines.

Fixed costs allocated to the unprofitable segment must be absorbed by the other segments.

Net income may decrease when an unprofitable segment is eliminated.

Decision Rule : Retain the segment unless fixed costs eliminated exceed contribution margin lost.

21-37

Eliminate an Unprofitable Segment

Illustration: Company makes 3 models of tennis rackets:

Profitable lines: Pro and Master

Unprofitable line: Champ Should Champ be eliminated?

Eliminate an Unprofitable Segment

Prepare income data after eliminating Champ product line.

Assume fixed costs are allocated 2/3 to Pro and 1/3 to Master.

21-38

Total income is changed by $10,000.

21-39

Eliminate an Unprofitable Segment

Incremental analysis of Champ provided the same results:

Do Not Eliminate Champ

21-40

Review Question

If an unprofitable segment is eliminated: a.

Net income will always increase.

b. Variable expenses of the eliminated segment will have to be absorbed by other segments. c. Fixed expenses allocated to the eliminated segment will have to be absorbed by other segments.

d. Net income will always decrease.

21-41

LambCo makes accessories including hats and scarves. Sales of hats & scarves = $400,000, variable expenses = $310,000, and fixed expenses = $120,000 for a net loss of $30,000. If LambCo eliminates hats and scarves, $20,000 of fixed costs will remain.

Should LambCo eliminate the hats and scarves.

21-42

Other Considerations in Decision-Making

Qualitative Factors

Potential effects of decision on existing employees and the community.

Cost savings that may be obtained from outsourcing or from eliminating a plant should be weighed against these qualitative attributes.

Cost of lost morale that might result.