Opportunity Cost

advertisement

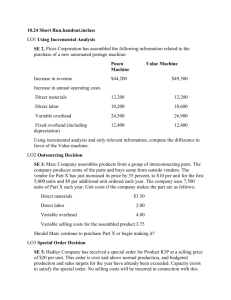

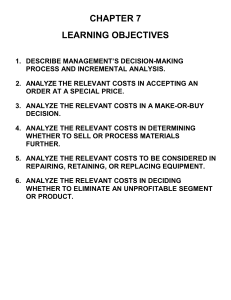

CHAPTER 7 INCREMENTAL ANALYSIS Managerial Accounting, Fourth Edition Incremental Analysis Occurs when there is more than one alternative choice of action. Alternative One Alternative Two Important Definitions Relevant Cost. Costs and revenues that do not differ between alternatives. Opportunity Cost. The benefit given up when one alternative is chosen over another. These can be ignored in incremental analysis Opportunity costs are never found in the general ledger. Sunk Cost. A cost that has already been incurred and will not be changed or avoided by any future decision. Sunk costs are not relevant costs. Types of Incremental Analysis Accept an order at a special price Make or buy components or finished products Sell products or process further Retain or replace equipment Eliminate an unprofitable business segment Allocate limited resources LO 2: Describe the concept of incremental analysis. McDermott’s Criteria When can you sell a product at less than full cost and still make a profit? When . . . You can segregate the market You can identify fixed and variable costs You have a positive contribution margin You have excess capacity or can charge for opportunity cost The minimum price you can charge under these conditions is: Variable costs of the new order plus opportunity cost Variable Cost of the New Order Variable costs of the new order include: Direct labor Direct materials Variable overhead Variable marketing and administrative costs Any other costs will be incurred to fulfill the new order (freight, special handling, and so on). Any normal costs that disappear should be subtracted from variable costs in this formula. Opportunity Cost The opportunity cost is the contribution margin of any sales given up. The formula is (contribution margin per unit ) × (units of sales to existing customers given up) Example Problem McDermott Manufacturing makes computer monitors. Revenue and cost data for the company are shown below: Price $60 Direct labor $10 Direct materials $5 Variable overhead $12 Fixed overhead $100,000 Variable marketing $6 Fixed marketing and administration $50,000 Example Problem A Japanese retailer wants to purchase 5,000 monitors. Assume that the purchase needs the criteria listed earlier by Professor McDermott. Additional Information The company has the capacity to manufacture 10,000 units per year. Currently the company is manufacturing and selling 8,000 units per year. The special order will have no marketing costs It will cost $3 to ship the monitors to the purchaser’s San Francisco warehouse. What is the minimum price for which the company would be willing to sell this special order? Calculation of Variable Costs Category Direct labor Direct materials Amount $10 $5 Variable overhead $12 Variable marketing $0 Additional shipping $3 Total variable costs $30 Remember: we delete any savings on the special order. In this case we save marketing costs (sales commissions). Calculation of Variable Costs Category Direct labor Direct materials Amount $10 $5 Variable overhead $12 Variable marketing $0 Additional shipping $3 Total variable costs $30 Also remember: We add any additional costs of this special order, in this case shipping the product to San Francisco. Calculation of Opportunity Cost The company has an excess capacity of 2,000 units (10,000 manufacturing capacity – 8,000 units presently manufactured and sold). However the customer wishes to purchase 5,000 monitors. The opportunity cost in units, therefore, is 5,000 units of demand - 2,000 units of excess capacity = 3,000 units. The opportunity cost in dollars is the contribution margin per unit times the opportunity cost in units. Calculation of Opportunity Cost The contribution margin (for existing customers) is: $60 price - $10 direct labor - $5 direct materials - $12 variable overhead - $6 variable marketing = $27. The total contribution margin lost is, therefore, $27 × 3000 units = $81,000. The opportunity cost per unit sold to the Japanese is $81,000/5000 units = $16.20 per unit Minimum Price Special Order $30 variable costs of special order + $16.20 opportunity cost = $46.20. Note: the full cost of the product including fixed costs is $48. What if the customer is willing to pay $47.50 per unit? This is less than the full (absorption) cost of the product. Should they accept the special order? Minimum Price Special Order The contribution margin is $47 - $30 variable costs of special order = $17 contribution margin. This $17 will cover the opportunity cost of $16.20 per unit, allowing $.80 per unit to flow to the bottom line. The net impact on the bottom line will be $.80 x 5000 units = $4000 Bottom line: variable revenues and costs are relevant, fixed costs are not relevant in shortterm special pricing decisions. Another example – the authors Example Mexico Co. offers to buy a special order of 2,000 blenders at $11 per unit from Sunbelt. No effect on normal sales; sufficient plant capacity Operating at 80 percent capacity = 100,000 units Current fixed manufacturing costs = $400,000 or $4 per unit Variable manufacturing cost = $8 per unit Normal selling price = $20 per unit Based strictly on total cost of $12 per unit ($8 + $4), reject offer as cost exceeds selling price of $11 LO 3: Identify the relevant costs in accepting an order at a special price. Accept an Order at a Special Price Within existing capacity, no change in fixed costs they are not relevant for this decision Total variable costs change – they are relevant Revenue increases $22,000; variable costs increase $16,000 Income increases by $6,000 Accept the Special Order LO 3: Identify the relevant costs in accepting an order at a special price. Let’s Review It costs a company $14 of variable costs and $6 of fixed costs to produce product Z200 that sells for $30. A foreign buyer offers to purchase 3,000 units at $18 each. If the special offer is accepted and produced with unused capacity, net income will: a. Decrease $6,000. b. Increase $6,000. c. Increase $12,000. d. Increase $9,000. LO 3: Identify the relevant costs in accepting an order at a special price. Make or Buy Management must decide whether to make or buy components. The decision to buy parts or services rather than making them is called outsourcing. Example: Costs to produce 25,000 switches LO 4: Identify the relevant costs in a make-or-buy decision. Make or Buy – Example Continued Switches can be purchased for $8 per switch (25,000 x $8 = $200,000) At first look, the switches should be purchased; thus saving $1 per unit Buying the switches eliminates all variable costs, but only $10,000 of fixed costs However, $50,000 of fixed costs remain even if the switches are purchased LO 4: Identify the relevant costs in a make-or-buy decision. Make or Buy – Example Continued Switches can be purchased for $8 per switch (25,000 x $8 = $200,000) At first look, the switches should be purchased; thus saving $1 per unit Buying the switches eliminates all variable costs, but only $10,000 of fixed costs However, $50,000 of fixed costs remain even if the switches are purchased!!!!! LO 4: Identify the relevant costs in a make-or-buy decision. Make or Buy – Example Continued The relevant costs for incremental analysis are: Baron Company will incur $25,000 additional cost if switches are purchased Continue to make switches LO 4: Identify the relevant costs in a make-or-buy decision. Make or Buy Opportunity Costs Definition: The potential benefits that may be obtained from following an alternative course of action. New assumption: Now assume Baron Company can use the newly available productive capacity from buying the switches to generate additional income of $28,000 by making another product. If Baron makes the switches, this possible income is lost. LO 4: Identify the relevant costs in a make-or-buy decision. Make or Buy – Opportunity Cost Example This opportunity cost, the lost income, is added to the “Make” column as an additional “cost” for comparative purposes It is now advantageous to buy the switches: Baron Company will be $3,000 better off LO 4: Identify the relevant costs in a make-or-buy decision. Let’s Review In a make-or-buy decision, relevant costs are: a. Manufacturing costs that will be saved. b. The purchase price of the units. c. Opportunity costs. d. All of the above. LO 4: Identify the relevant costs in a make-or-buy decision. Sell or Process Further Many manufacturers have the option of selling a product now or continuing to process the product hoping to sell the refined product at a higher price Decision Rule: Process further as long as the incremental revenue from such processing exceeds the incremental processing costs LO 5: Identify the relevant costs in determining whether to sell or process materials further. Sell or Process Further - Example Single-Product Case Cost to manufacture one unfinished table: Selling price of unfinished unit is $50; unused capacity can be used to finish the tables to sell for $60 Relevant unit costs of finishing tables: Direct materials increase $2; Direct labor increases $4 Variable manufacturing overhead costs increase by $2.40 (60 percent of direct labor increase) Fixed manufacturing costs will not increase LO 5: Identify the relevant costs in determining whether to sell or process materials further. Sell or Process Further Incremental revenues ($10) exceed incremental costs ($8.40); Income increases $1.60 per unit Process further LO 5: Identify the relevant costs in determining whether to sell or process materials further . Sell or Process Further Multiple-Product Case In many industries, a number of end-products are produced from a single raw material and a common production process Multiple end-products are commonly called joint products Petroleum – gasoline, lubricating oil, kerosene Meat Packing – meat, hides, bones LO 5: Identify the relevant costs in determining whether to sell or process materials further. Sell or Process Further Multiple-Product Case All costs incurred prior to the point at which the products are separately identifiable (the split-off point) are called joint costs Joint costs are (for purposes of determining product cost) allocated to individual products on the basis of relative sales value Joint costs are not relevant for any sell-or-process-further decisions Joint product costs are sunk costs. They have already been incurred and cannot be changed LO 5: Identify the relevant costs in determining whether to sell or process materials further. Sell or Process Further - Example Multiple-Product Case Marais Creamery must decide whether to: Sell cream and skim milk now or Process each further before selling LO 5: Identify the relevant costs in determining whether to sell or process materials further. Sell or Process Further – Example Continued The daily cost and revenue data for Marais Creamery are: LO 5: Identify the relevant costs in determining whether to sell or process materials further. Sell or Process Further – Example Continued Sell cream or process further into cottage cheese? Do not process cream further: To do so will incur an incremental loss of $2,000 LO 5: Identify the relevant costs in determining whether to sell or process materials further. Sell or Process Further Sell skim milk or process further into condensed milk? Marais should process the skim milk: To do so will increase net income by $7,000 LO 5: Identify the relevant costs in determining whether to sell or process materials further. Let’s Review The decision rule in a sell-or-process-further decision is: process further as long as the incremental revenue from processing exceeds: a. Incremental processing costs. b. Variable processing costs. c. Fixed processing costs. d. No correct answer is given. LO 5: Identify the relevant costs in determining whether to sell or process materials further. Retain or Replace Equipment Management must decide whether a company should continue to use an asset or replace it Example: Assessment of replacement of a factory machine: Book value Cost Remaining useful life Scrap value Old Machine $40,000 four years -0- New Machine $120,000 four years -0- Variable costs: Decrease from $160,000 to $125,000 annually LO 6: Identify the relevant costs to be considered in retaining or replacing equipment. Retain or Replace Equipment - Example Replace the equipment - Lower variable manufacturing costs more than offset cost of new equipment. The book value of the old machine does not affect the decision – it is a sunk cost. However, any trade-in allowance or cash disposal value of the old asset is relevant LO 6: Identify the relevant costs to be considered in retaining or replacing equipment. Let’s Review In a decision to retain or replace equipment, the book value of the old equipment is a(an): a. Opportunity cost. b. Sunk cost. c. Incremental cost. d. Marginal cost. LO 6: Identify the relevant costs to be considered in retaining or replacing equipment. Eliminate an Unprofitable Segment Should the company eliminate an unprofitable segment? Key: Focus on relevant costs Consider effect on related product lines Fixed costs allocated to the unprofitable segment must be absorbed by the other segments Net income may decrease when an unprofitable segment is eliminated Decision Rule: Retain the segment unless fixed costs eliminated exceed the contribution margin lost LO 7: Identify the relevant costs in deciding whether to eliminate an unprofitable segment. Eliminate an Unprofitable Segment - Example Martina Company manufactures three models of tennis racquets: Profitable lines: Pro and Master Unprofitable line: Champ Condensed Income Statement data: Should the Champ line be eliminated? LO 7: Identify the relevant costs in deciding whether to eliminate an unprofitable segment. Eliminate an Unprofitable Segment - Example If Champ is eliminated, must allocate its $30,000 share of fixed costs: 2/3 to Pro and 1/3 to Master Revised Income Statement data: Total income has decreased by $10,000 ($220,000 $210,000) LO 7: Identify the relevant costs in deciding whether to eliminate an unprofitable segment. Eliminate an Unprofitable Segment - Example Incremental analysis of Champ provides the same results: Decision: Do not eliminate Champ LO 7: Identify the relevant costs in deciding whether to eliminate an unprofitable segment. Let’s Review If an unprofitable segment is eliminated: a. Net income will always increase. b. Variable expenses of the eliminated segment will have to be absorbed by other segments. c. Fixed expenses allocated to the eliminated segment will have to be absorbed by other segments. d. Net income will always decrease. LO 7: Identify the relevant costs in deciding whether to eliminate an unprofitable segment . Other Considerations in Decision Making Many decisions involving incremental analysis have important qualitative features that must be considered in addition to the quantitative factors. Example – cost of lost morale due to outsourcing or eliminating a plant Incremental analysis is completely consistent with activity-based costing (ABC) ABC often results in better identification of relevant costs and, thus, better incremental analysis All About You What is a Degree Worth? Over a life time of work, college graduates earn an average of $500,000 more than associate degree holders and $900,000 more than high-school graduates. Tuition costs about $8,655 a year to attend a public four-year college and about $1,359 for a public two year institution. About 600,000 students drop out of four-year colleges each year. All About You What is a Degree Worth? You are working two jobs, your grades are suffering, you feel depressed: Should you drop out of school? Is it better to stay in school even if you only take one class each semester? Chapter Review - Exercise 7-1 Identify each of the following statements as true or false. 1. The first step in management’s decision-making process is “Determine and evaluate possible courses of action.” False 2. The final step in management’s decision-making process is to actually make the decision. False 3. Accounting’s contribution to management’s decisionmaking process occurs primarily in evaluating possible courses of action and in reviewing the results. True 4. In making business decisions, management ordinarily considers only financial information because it is objectively determined. False Chapter Review - Exercise 7-1 Continued Identify each of the following statements as true or false. 5. Decisions involve a choice among alternative courses of action. True 6. The process used to identify the financial data that change under alternative courses of action is called incremental analysis. True 7. Costs that are the same under all alternative courses of action sometimes affect the decision. False 8. When using incremental analysis, some costs will always change under alternative courses of action, but revenues will not. False 9. Variable costs will change under alternative courses of action, but fixed costs will not. False Problems Come Next! Brief Exercise One The steps in management decision-making process are listed in random order below. Indicate the order in which the step should be executed. Identify the problem and assign responsibility. Determine and evaluate possible courses of action. Make a decision. Review results of the decision. Exercise One Given the following list of statements about decision making and incremental analysis, determine which are true and which are false. If false, correct the statement. Statements The first step in management ‘s decision-making process is: Determine and evaluate possible courses of action. False. The first step in management decision making process is identified the problem and assign responsibility The final step in management’s decision-making process is to actually make the decision. False. The final step in management’s decisionmaking process is to review the results of the decision. Statements Accounting’s contribution to management’s decision-making process occurs primarily in evaluating possible courses of action and in reviewing the results. True In making business decisions, management ordinarily considers only financial information because it is objectively determined. False. In making business decisions, management ordinarily considers both financial and nonfinancial information. Statements Decisions involve a choice among alternative courses of action. The process used to identify the financial data that changes under alternative courses of action is called incremental analysis. True True Costs that are the same under all alternative courses of action sometimes affect the decision. False. Costs that are the same are not relevant. Statements When using incremental analysis, some costs will always change under alternative courses of actions, but revenues will not. False. When using incremental analysis, either costs or revenues or both will change under alternative courses of action. Variable costs will change under variable courses of action, but fixed costs will not. False. Sometimes variable costs will not change under alternative courses of action, but fixed costs will. Exercise 7-2 A company produces golf discs which normally sellto retailers for seven dollars each. The cost of manufacturing 20,000 golf discs is. Materials $10,000 Labor $30,000 Variable overhead $20,000 Fixed overhead $40,000 Total cost $100,000 The company incurs a 5% sales commission ($0.35) on each disc sold. Exercise 7-2 An outside firm offers $4.75 per disc for 5,000 discs. This company would sell the discs under its own brand in foreign markets yet not served. If the manufacturer accepts the offer, it’s fixed overhead will increase from $40,000 to $45,000 due to the purchase of a new printing machine. No sales commissions will result from the special order. Exercise 7-2 Prepare an incremental analysis for the special order. (a) Reject Order Accept Order $23,750 (2,500) (7,500) Net Income Effect $23,750 (2,500) (7,500) -0-0- (5,000) (5,000) -0- (5,000) (5,000) -0- $ -0- $ 3,750 $ 3,750 Revenues Materials ($0.50) Labor ($1.50) Variable overhead ($1.00) Fixed overhead Sales commissions $ -0-0-0-0- Net income Note that fixed costs sometimes are relevant. However only the portion that varies one alternative to the next ($5,000) is relevant. The other $47,000 is not relevant Exercise 7-2 Should the company except the special order? Why or why not? As shown in the incremental analysis, Innova should accept the special order because incremental revenue exceeds incremental expenses by $3,750. Exercise 7-2 What assumptions underlie the decision made in part b? It is assumed that sales of the golf discs in other markets would not be affected by this special order. If other sales were affected. Innova would have to consider the lost sales in making the decision. Second, if Innova is operating at full capacity, it is likely that the special order would be rejected. Exercise 7-5 XYZ Company has been manufacturing his own shades for table lamps. The company is currently operating at 100% capacity, and variable overhead is charged production at the rate of 70% of direct labor costs. The direct materials and direct labor cost per unit to make lampshades are five and six dollars respectively. Exercise 7-5 Normal production is 30,000 tables per year. A supplier offers to make the lampshades at a price of $15.50 per unit. If XYZ accepts the suppliers offer, all variable costs will be eliminated, but the $45,000 of fixed manufacturing overhead currently charge to lampshades will have to be absorbed by other products. Exercise 7-5 Prepare the incremental analysis for the decision to make her by the lampshades. Make Direct materials (30,000 X $5.00) Direct labor (30,000 X $6.00) Variable manufacturing costs ($180,000 X 70%) Fixed manufacturing costs Purchase price (30,000 X $15.50) Total annual cost $150,000 180,000 126,000 45,000 0 $501,000 Buy $ 0 0 0 45,000 465,000 $510,000 Net Income Increase (Decrease) $ 150,000 180,000 126,000 0 ( (465,000) ($ (9,000) In this case the fixed cost is not relevant since it is not change one alternative to the next. Exercise 7-5 Prepare the incremental analysis for the decision to make her by the lampshades. Make Direct materials (30,000 X $5.00) Direct labor (30,000 X $6.00) Variable manufacturing costs ($180,000 X 70%) Fixed manufacturing costs Purchase price (30,000 X $15.50) Total annual cost $150,000 180,000 126,000 45,000 0 $501,000 Buy $ 0 0 0 45,000 465,000 $510,000 Net Income Increase (Decrease) $ 150,000 180,000 126,000 0 ( (465,000) ($ (9,000) They should not purchase the lampshades Since doing so will decrease net income by $9,000. Exercise 7-5 Prepare the incremental analysis for the decision to make her by the lampshades. Make Direct materials (30,000 X $5.00) Direct labor (30,000 X $6.00) Variable manufacturing costs ($180,000 X 70%) Fixed manufacturing costs Purchase price (30,000 X $15.50) Total annual cost $150,000 180,000 126,000 45,000 0 $501,000 Buy $ 0 0 0 45,000 465,000 $510,000 Net Income Increase (Decrease) $ 150,000 180,000 126,000 0 ( (465,000) ($ (9,000) Would your answer be different if the productive capacity released by not making the lampshades could be used to produce income of $35,000? Of course, by purchasing the lampshades they would then save $26,000. Exercise 7-6 XYZ has recently started to manufacture a product. The cost structure to manufacture 20,000 units is as follows. Direct materials ($40 per unit) $80,000 Direct labor ($30) $600,000 Variable labor ($6) hundred and $20,000 Allocated fixed overhead ($25) $500,000 Total costs $2,020,000 XYZ is approached by ABC which offers to make the product for $90 per unit or $1,800,000. Exercise 7-6 Using incremental analysis, determine rather XYZ should accept the offer under each of the following independent assumptions. Exercise 7-6 Assume that $300,000 of the fixed overhead costs can be reduced or avoided. Direct materials Make $ 800,000 -0- Net Income Increase (Decrease) $ 800,000 Buy $ Direct labor 600,000 -0- 600,000 Variable overhead 120,000 -0- 120,000 Fixed overhead 500,000 200,000 300,000 Purchase price 0 1,800,000 (1,800,000) $2,020,000 $2,000,000 Total annual cost Accept the order! $ 20,000 Exercise 7-6 Assume that none of the fixed overhead can be avoided. However, if the products are purchased from ABC, XYZ can use the release productive resources to generate additional income of $300,000. (2) Direct materials Direct labor Variable overhead Fixed overhead Opportunity cost Purchase price Totals Make $ 800,000 600,000 120,000 500,000 300,000 0 $2,320,000 Buy $ 0 0 0 500,000 0 1,800,000 $2,300,000 Net Income Increase (Decrease) $ 800,000 600,000 120,000 0 300,000 (1,800,000) $ 20,000 Here the author shows the revenue as a negative (opportunity) cost which is the same as a revenue. Exercise 7-6 Describes the qualitative factors that might affect the decision to purchase the product from an outside supplier. Qualitative factors include the possibility of laying off those employees that produced the robot and the resulting poor morale of the remaining employees, maintaining quality standards, and controlling the purchase price in the future. Exercise 7-11 XYZ Enterprises uses a computer to handle its sales invoices. Lately, businesses has been so good that it takes an extra three hours per night, plus every third Saturday, to keep up with the volume of sales invoices. Management is considering updating its computer with a faster model that would eliminate all of the overtime processing. Exercise 7-11 Current Machine New Machine $15,000 $25,000 $6,000 $0 $24,000 $18,000 Five years Five years Original purchase cost Accumulated depreciation Estimated annual operating costs Useful life If sold now, the current machine would have a salvage value of $5,000. If operated for the remainder of its useful life, the current machine would have a zero salvage value. The new machine is expected to have zero salvage value after five years. Should the current machine be replaced? Exercise 7-11 Retain Machine Operating costs New machine cost Salvage value (old) Total $120,000 0 0 $120,000 Net Income Increase (Decrease) Replace Machine (1) ($ 90,000) ( 25,000) ( (5,000) ($110,000) (2) ( $ 30,000 ( (25,000) ( 5,000) ($ 10,000) (1) $24,000 X 5. (2) $18,000 X 5. There are a number of formats one could use in doing this analysis, here the author chooses to make the far right column show the impact the change would have on operating income. He arbitrarily decides to make a positive impact a positive number and a negative impact a negative number. Exercise 7-11 Retain Machine Operating costs New machine cost Salvage value (old) Total $120,000 0 0 $120,000 Net Income Increase (Decrease) Replace Machine (1) ($ 90,000) ( 25,000) ( (5,000) ($110,000) (2) ( $ 30,000 ( (25,000) ( 5,000) ($ 10,000) (1) $24,000 X 5. (2) $18,000 X 5. The current machine should be replaced. The incremental analysis shows the net income for the five-year period will be $10,000 higher by replacing the current machine. Problem 5 Lewis Manufacturing Company has four operating divisions. During the first quarter of 2008, the company reported aggregate income from operations of $176,000 and the following divisional results. Problem 5 Divisions One Two Sales $250,000 $200,000 $500,000 $400,000 COGS 200,000 189,000 300,000 250,000 65,000 60,000 60,000 50,000 -$15,000 -$49,000 $140,000 $100,000 S&A Expense Income (loss) Three Four Analysis reveals the following percentages of variable costs in each division. Divisions One Two Three Four COGS 70% 90% 80% 75% S&A Exp. 40% 70% 50% 60% Problem 5 Discontinuance of any division would save 50% of the fixed costs and expenses for that division. Top management is very concerned about the unprofitable divisions (one and two). Consensus is that one or both of the division should be discontinued. Problem 5 Compute the contribution margin for divisions one and two. Sales Variable costs Cost of goods sold Selling and administrative Total variable expenses Contribution margin Division I Division II $250,000 140,000 26,000 166,000 ($ 84,000) $200,000 170,100 42,000 212,100 $ (12,100) Contribution margin is what is available to pay fixed costs. Eliminating Division II gives us a negative contribution margin. However, if we can decrease fixed cost below $12,100, the elimination would still be a good idea. Problem 5 Prepare an incremental analysis concerning the possible discontinuance of Division I and Division II. (1) Division I Contribution margin (above) Fixed costs Cost of goods sold Selling and administrative Total fixed expenses Income (loss) from operations Continue Eliminate Net Income Increase (Decrease) $(84,000) (60,000) (39,000) (99,000) $(15,000) $( 0) (30,000) (19,500) (49,500) $(49,500) $(84,000) 30,000 19,500 49,500 $(34,500) Eliminating Division One would reduce income by $34,500 – not a good idea! Problem 5 Division II Contribution margin (above) Fixed costs Cost of goods sold Selling and administrative Total fixed expenses Income (loss) from operations Continue Eliminate Net Income Increase (Decrease) $(12,100) (18,900 ( 18,000 ( 36,900 $(49,000) $( 0) ( 9,450) ( 9,000) (18,450) $(18,450) $12,100 ( 9,450 ( 9,000 18,450 $30,550 Division II should be eliminated as income from operations would increase by $30,500 by so doing. The End