Advisor Name

Firm

Address

City, St Zip

(555) 333-8888

Company website

Quarterly Financial Market Update

—September 30, 2015

The summary below is provided for educational purposes only. Given the recent market volatility, I am

available if you would like to discuss the current market environment and how it may impact your

investments.

Fed Up with China Troubles

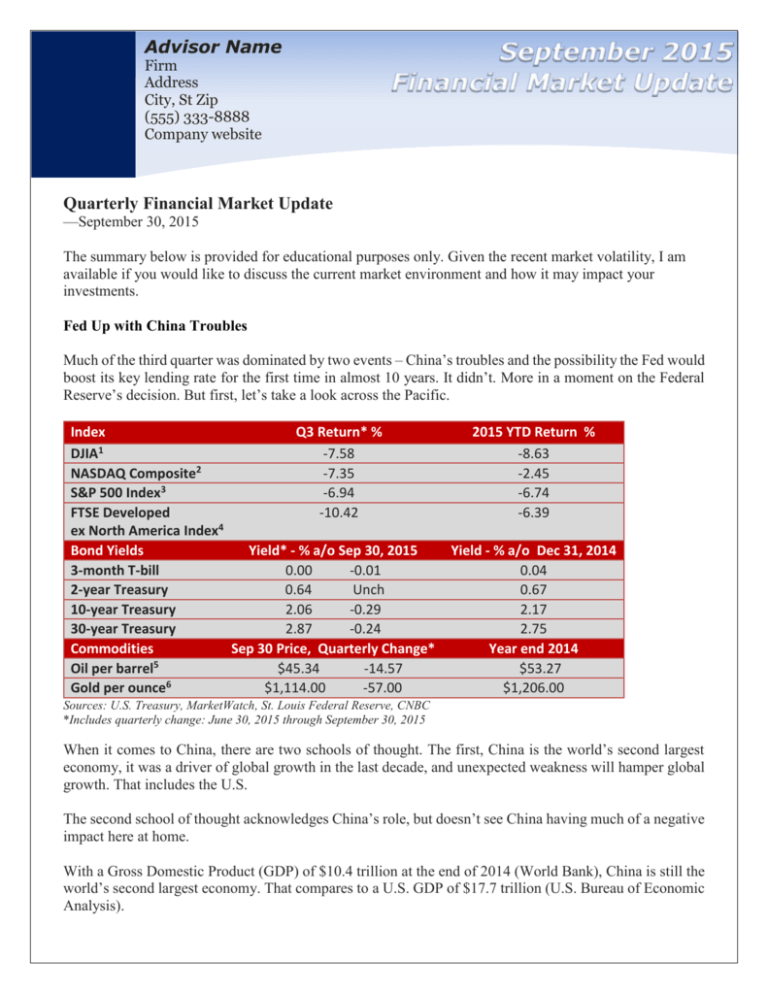

Much of the third quarter was dominated by two events – China’s troubles and the possibility the Fed would

boost its key lending rate for the first time in almost 10 years. It didn’t. More in a moment on the Federal

Reserve’s decision. But first, let’s take a look across the Pacific.

Index

Q3 Return* %

1

DJIA

-7.58

2

NASDAQ Composite

-7.35

3

S&P 500 Index

-6.94

FTSE Developed

-10.42

ex North America Index4

Bond Yields

Yield* - % a/o Sep 30, 2015

3-month T-bill

0.00

-0.01

2-year Treasury

0.64

Unch

10-year Treasury

2.06

-0.29

30-year Treasury

2.87

-0.24

Commodities

Sep 30 Price, Quarterly Change*

5

Oil per barrel

$45.34

-14.57

6

Gold per ounce

$1,114.00

-57.00

2015 YTD Return %

-8.63

-2.45

-6.74

-6.39

Yield - % a/o Dec 31, 2014

0.04

0.67

2.17

2.75

Year end 2014

$53.27

$1,206.00

Sources: U.S. Treasury, MarketWatch, St. Louis Federal Reserve, CNBC

*Includes quarterly change: June 30, 2015 through September 30, 2015

When it comes to China, there are two schools of thought. The first, China is the world’s second largest

economy, it was a driver of global growth in the last decade, and unexpected weakness will hamper global

growth. That includes the U.S.

The second school of thought acknowledges China’s role, but doesn’t see China having much of a negative

impact here at home.

With a Gross Domestic Product (GDP) of $10.4 trillion at the end of 2014 (World Bank), China is still the

world’s second largest economy. That compares to a U.S. GDP of $17.7 trillion (U.S. Bureau of Economic

Analysis).

Despite China’s size, the U.S. economy doesn’t depend on sales to China for its growth and neither do

many of our major trading partners (Wall Street Journal).

U.S. exports to the Asian economy make up less than 1% of U.S. GDP. “If China disappeared from the

map,” said Paul Ashworth, an economist for Capital Economics, U.S. GDP growth would fall by about 1

percentage point. “That’s not even a recession (Wall Street Journal).”

Of course, China isn’t going to fall off the map, but even if Chinese growth completely stalled, there would

likely be only a minimal impact here at home.

So what’s the big deal about China?

The Asian giant’s contribution the worldwide economy has been in basic commodities. In its quest to build

mega cities and a major industrial infrastructure, the country absorbed an enormous amount of the world's

resources. But that is about it, according to David Rosenberg, chief economist and strategist at Gluskin

Sheff.

However, smaller countries that are dependent on the sale of raw materials, and companies that are in the

mining sector are feeling the pain. According to the UN Conference on Trade and Development, 94

developing countries depended on commodities for more than 60 percent of their merchandise export

revenues in 2012/13 (Reuters).

While the bust in commodities may pose a serious challenge to economic and political stability in

developing economies across Latin America, Africa, the Middle East and Asia, U.S. manufacturers stand

to benefit from lower input prices.

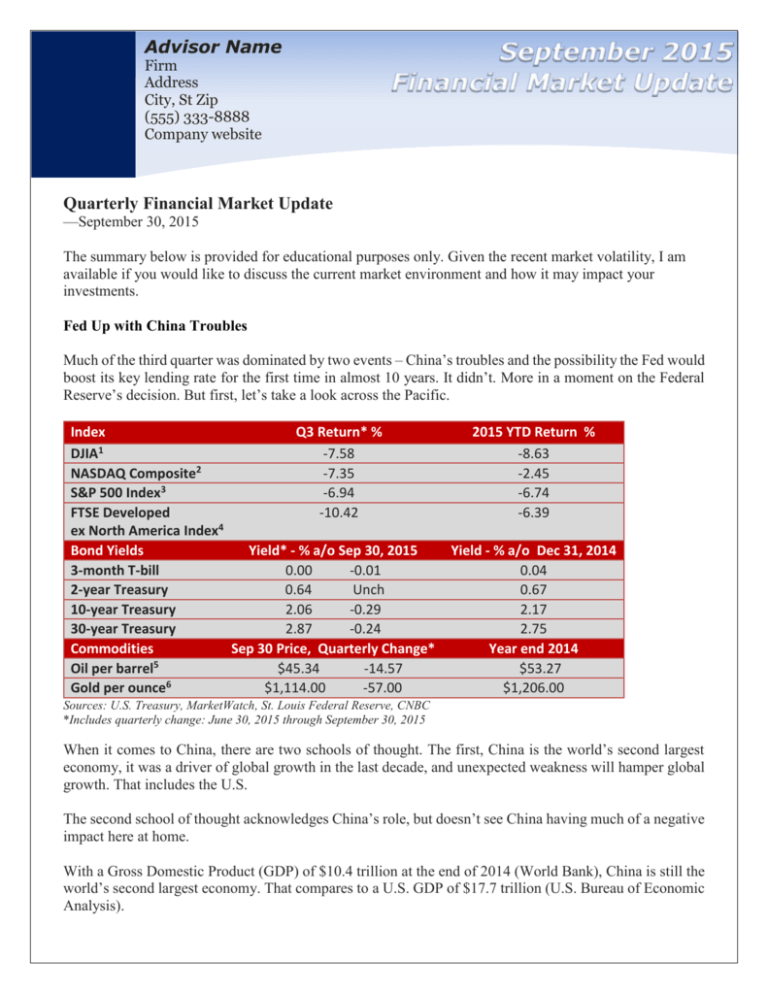

When Japan’s economy hit the skids in the 1990s, there were similar anxieties the global economy might

stumble.

China and Japan Global GDP

Percent of share of global GDP at market exchange rates

Source: Thomson Reuters Datastream/Fathom Consulting

Fig. 1

At the time, Japan was the world’s number two economy. Although Japan made up a larger share of the

global GDP at its peak than China does today – see Figure 1, the U.S. economy side-stepped Japanese

weakness.

In fact, troubles in Japan continue to this day, and they haven’t done much to depress the global economy.

The Fed blinks

The Federal Reserve has held its key lending rate, the fed funds rate, at near zero for almost 10 years. It

really does want to start raising interest rates amid concerns that low rates may eventually create financial

bubbles. Reason – consumers and businesses may increasingly base buying, lending and investment

decisions on artificially low interest rates.

Some argue that this is already happening in junk bonds, as super low rates in safe investments encouraged

investors to seek out higher yields in riskier bonds.

In addition, we will eventually slip into a recession. Free market economies always do. And when that

happens, the Fed would like to have the ability to administer traditional monetary medicine (cutting the fed

funds rate) to combat a slumping economy. If rates are still near zero, it loses a key weapon in its arsenal

that it has used for decades to combat recessions.

Figure 2 highlights what happened at the September meeting – no change in interest rates. China and

emerging market worries appeared to dominate the agenda, and Fed officials kept the fed funds rate at a

target of 0 – 0.25%.

Fed Funds Target Rate

Percent

Jobless rate: 5.6%

Inflation rate: 2.0%

7.0

6.0

0.1

4.0

0.08

3.0

1.0

0.14

0.12

5.0

2.0

Fig. 2

Jobless rate: 6.6%

Inflation rate: 2.3%

Jobless rate: 5.1% 0.06

Inflation rate: 1.3%

0.04

0.02

0.0

0

1/3/1992

1/3/1998

1/3/2004

1/3/2010

Data Source: St. Louis Federal Reserve, NBER

Last date of target fed funds rate = September 2015; Last date of jobless rate = August 2015

Last date of inflation rate (core PCE Price Index) = August 2015; core inflation excludes food and energy

Note: the PCE Price Index is the Fed-favored gauge for measuring inflation

Shaded areas mark recessions

Investors with a very short-term time horizon interpreted the outcome as a vote of ‘no confidence’ by the

Fed in the global economy, creating additional short-term volatility. While an ultra-accommodative

monetary policy in the form of low interest rates is normally viewed as favorable for stocks, it loses its

punch when investors sour on the economic outlook.

In a late September speech, Yellen did say she believes “it will likely be appropriate” to raise the fed funds

rate this year and “continue boosting short-term rates at a gradual pace (Federal Reserve).”

Maybe “liftoff” will occur at the end-of-October meeting or at the December meeting. But international

woes in China and emerging markets aren’t going away anytime soon.

Taking a broader view, will it really matter to long-term investors whether the Fed hiked in September,

October or December five years or ten years from now? Probably not.

Warmest Regards,

Advisors Name/Signature

Share!

It’s OK with us if you would like to share the Market Update with your friends,

family and neighbors. We love meeting new folks!

It is important that you do not use this e-mail to request or authorize the purchase or sale of any security or commodity, or to

request any other transactions. Any such request, orders or instructions will not be accepted and will not be processed.

All items discussed in this report are for informational purposes only, are not advice of any kind, and are not intended as a

solicitation to buy, hold, or sell any securities. Nothing contained herein constitutes tax, legal, insurance, or investment advice.

Stocks and bonds and commodities are not FDIC insured and can fall in value, and any investment information, securities

and commodities mentioned in this report may not be suitable for everyone.

U.S. Treasury bonds and Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of

return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of

principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year)

obligations of the U.S. government.

Past performance is not a guarantee of future performance. Different investments involve different degrees of risk, and

there can be no assurance that the future performance of any investment, security, commodity or investment strategy that is

referenced will be profitable or be suitable for your portfolio.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material

is accurate or complete. The information contained in this report does not purport to be a complete description of the

securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of

all available data necessary for making an investment decision and does not constitute a recommendation.

Before making any investments or making any type of investment decision, please consult with your financial advisor and

determine how a security may fit into your investment portfolio, how a decision may affect your financial position and how it

may impact your financial goals.

All opinions are subject to change without notice in response to changing market and/or economic conditions.

1 The Dow

Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance

does not guarantee future results.

2 The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee

future results.

3 The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not

guarantee future results.

4 The FTSE Developed ex North America Index is an unmanaged index of large and mid-cap stocks providing coverage of developed markets,

excluding the US and Canada. It cannot be invested into directly. Past performance does not guarantee future results.

5

New York Mercantile Exchange front-month contract; Prices can and do vary; past performance does not guarantee future results.

London Bullion Market Association; gold fixing pricing at 3 p.m. London time; Prices can and do vary; past performance does not guarantee

future results.

Copyright © 2015 Financial Jumble, LLC All rights reserved.

6