File

advertisement

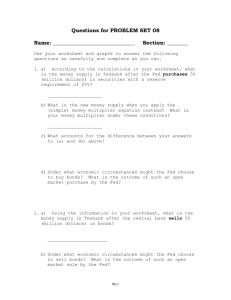

APEcon 12-13 Name:_______________________ Monetary Policy Review Questions- Answers 1) Assume that there is an increase in the demand for money at every interest rate. Using a diagram, show the effects this will have on the equilibrium interest rate for a given money supply. Demand Curve moves right increasing the interest rate. 2) Now assume that the Fed is following a policy of targeting the federal funds rate. What will the Fed do in this situation described in question 1 to keep the federal funds rate unchanged? Illustrate with a diagram. The Fed would BUY BONDS to increase the money supply and lower the interest rate back to the targeted level. 3) Suppose the economy is currently suffering from a recessionary gap and the Federal Reserve uses an expansionary monetary policy to close that gap. Describe the short-run effect of this policy on the following. a. b. c. d. e. The money supply curve- shifts right The equilibrium interest rate- Decrease Investment spending- Increase Consumer spending- Increase Aggregate output- Increase 4) Suppose that inflation in an economy is 2 percent, the federal funds rate is 4 percent, and the Real GDP falls 2 percent below the potential GDP. In what direction do you think the Fed should change the federal funds rate? How would an economist expect this change in the federal funds rate to impact the economy? Lower Fed Funds Rate to stimulate Investment Spending 5) How does the size of the money multiplier impact the Fed’s ability to implement monetary policy? Can the Federal Reserve change the money multiplier by using open market operations? Larger Multiplier means the more impact Fed Policy will have on aggregate output. No… Banks willingness to loan and Businesses willingness to borrow. APEcon 12-13 6) Name:_______________________ List the 3 tools the Federal Reserve can use to change the size of the money supply. Which of these tools is used most often and why? Reserve Requirement Discount Rate OMO’s