Problem Set #3

advertisement

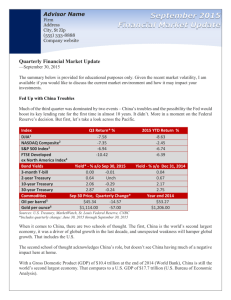

Key Problem Set #5 Interest Rate Determination in US Treasury Market Objectives • • Use the bond market diagram to analyze interest rates Understand how the liquidity preference framework explains the effect of the money supply on interest rates Question 1. Currently the Treasury is issuing a significant volume of bonds, notes, and bills to finance the ballooning government deficit. The Federal Reserve has been purchasing Treasuries in the open market in order to keep interest rates low. a. Use the Treasury Market Workspace to show and explain why the actions of the Treasury should cause interest rates to rise. The deficit is increasing either because of reductions in tax revenues or increases in government expenditures. This causes the Treasury to issue bill, notes, and bonds in order to finance the deficit. The increase in the bonds issued causes the supply of bonds to increase as shown by the shfit to the right. This in turn causes interest rates to increase as the price decreases. b. Use the Treasury Market Workspace to show and explain why the actions of the Fed should should cause interest rates to fall. If at the same time the Fed intervenes by buying significant amounts of Treasuries, then the demand for bonds increases which could cause the interest rate to go back to the previous rate. The process whereby the Treasury issues bonds and then they are purchased in the open market by the Federal Reserve is the process whereby we print money in the United States. 2. The Federal Reserve creates money by buying US Treasuries. If the Fed makes large purchases of Treasuries and thus increases the money supply, a. Use the Liquidity Preference framework to show and explain why interest rates might initially decline as the Fed increases the money supply. The liquidity effect is the initial decrease in interest rates caused when the Federal Reserve increases the money supply.The increase in the money supply causes interest rates to decrease. b. Explain why the income-effect, price-level effect, and expected-inflation effects might eventually cause interest rates to rise. The increase in the money supply and initial decrease in the interest rate would likely stimulate the eonomy. This increase in output would probably increase income. It could also lead people to expect prices to increase. The larger incomes and higher prices cause the transaction demand for money to increase. This could offset the initial decrease in the interest rates due to the liquidity effect. If the income, price-level, and expected-inflation effects were large enough, they could actually cause interest rates to rise as shown in the diagram below: