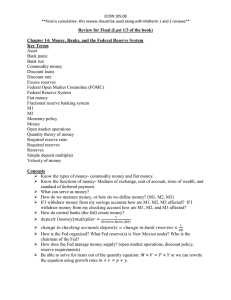

Notes

advertisement

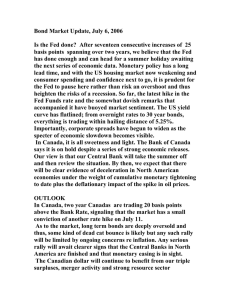

Advantage and Specialization • Absolute Advantage – better at production of given good or service • Comparative Advantage – Produces good or service at lower opp. cost – Should specialize in production At the base of the pyramid on the $1 bill you will find “****” in Roman Numerals On the $100 bill, the clock tower of Independence Hall in Philadelphia is shown with the time set at 4:10. According to the US Bureau of Engraving and Printing, “there are no records explaining why that particular time was chosen” The elm tree on back of the $20 bill near the White House represents a real tree in this same location. However, the tree is no longer on the White House grounds because it succumbed to rain-softened ground in 2006 Most people save $2 bills, thinking they are rare and therefore valuable; they're actually worth... $2 97% of all paper money contains traces of cocaine • • • • • • • • • • Top Yahoo News Searches of 2013 10- Food Host Fired 9- World Leader Death 8- New Pope (1st From Which Continent) 7- This Country Threatens Nuclear War 6- Syria- which chemical 5- Trial (name the man) 4- Baby- name the baby 3- Boston 2- This Law 1- Boyfriend murderer What is Money? • Anything generally accepted as payment Types of Money Commodity money- money itself serves a purpose (i.e. tulip bulbs, salt, tobacco) Backed-money- money’s value is backed by a commodity (i.e. gold, silver) Fiat money- value based solely on acceptance of value and government backing Federal Reserve Act of 1913 • Created Federal Reserve System 12 District Banks Where’s My Money From? • Boston New York Philadelphia Cleveland Richmond Atlanta Chicago St. Louis Minneapolis Kansas City Dallas San Francisco 1 2 3 4 5 6 7 8 9 10 11 12 A B C D E F G H I J K L Ben Bernanke- FED Chairman Janet Yellen- FED Chairman The FED Bank Panic- 1907 F.D.I.C. • • • • • • • • 1934 – $2,500 1935 – $5,000 1950 – $10,000 1966 – $15,000 1969 – $20,000 1974 – $40,000 1980 – $100,000 2008 – $250,000 F.D.I.C. • Federal Deposit Insurance Corporation • Insures bank deposits up to $5,000 (then) $100,000 (recent) $250,000(now) Monetary Policy • Fiscal Policy – Taxes and spending – Controlled by politicians • Monetary Policy – Control of the money supply – NOT controlled by politicians Roles of the FED • Government’s Bank • Bank for Banks • Monetary Policy- control money supply to stabilize inflation and maximize employment (keep prices from rising too quickly) (stimulate economic growth) Monetary Policy • During Recession- Increase Money Supply • During Inflation- Decrease Money Supply Tools of the FED • Reserve Requirement • Discount Rate • Open Market Operations