October 2013 Update - Goodwin Securities, Inc.

advertisement

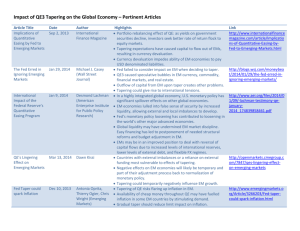

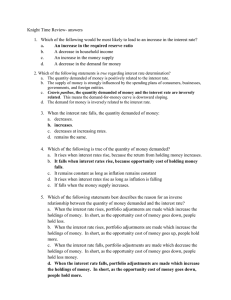

October 2013 Update Economic Update: Our economy continues to plod along, way below the speed we would like, but ever upward. Low interest rates have helped everyone, especially banks and consumers, to improve their cash positions or debt levels since 2008. People still need to replace old cars and upgrade housing that gives the economy some momentum. There are no apparent bubbles out there that I can see, since these are usually accompanied by investors throwing money at some illogical investment. You could argue that bonds at these prices and yields are illogical, but only if you believe that we have inflation over 3% coming, and that is not the case so far. The Fed would love to get inflation to that level. Market Update: Stocks are telling you the life looks pretty darn good! As we trade around 15,000 on the Dow all the distractions like Syria, govt shut down, ACA state exchanges, or no tapering seem to be meaningless. Interest rates have backed off their highest levels and are looking less threatening since the Fed postponed tapering.