F301 Quiz 2

advertisement

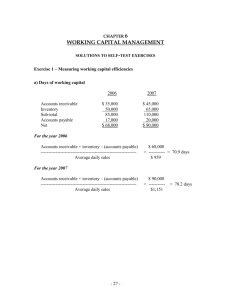

F301 Quiz 2 – Practice Problems Part 2 – Solutions are in bold. 1. To calculate the change in net working capital, which of the following would be considered a cash outflow? a. b. c. d. e. An increase in sales A decrease in sales A decrease in accounts receivable due to a decrease in sales A decrease in accounts payable An increase in accounts payable 2. If the marginal tax rate goes up, what happens to the value of the depreciation tax shield in the future? The value of the tax shield goes up. 3. If a project’s first cash flow is a cash outflow, and if all the rest of the forecast cash flows are positive, then the cash flows are: a. b. c. d. e. independent mutually exclusive conventional negative taxable 4. You discover that the successful diesel engine oil additive your scientists developed three years ago also makes a great cooking oil, when a suitably strong fragrance is added to it. You must prepare a capital budgeting analysis to help decide whether to go into production on the proposed new cooking oil product. In your analysis of this proposal, how should you treat the $30,000 spent by your R&D department to develop the original diesel additive? (Assume the research has no value to any other firm.) Ignore the $30,000. It is a sunk cost. F301 JCS 5. Consider a project with the following expected cash flows: Year Cash Flow 0 –22,000 1 6,000 2 7,000 3 8,000 4 9,000 5 10,000 a. What is the IRR? 21.59% b. What is the NPV at a discount rate of 10%? $7,606.52 6. You find the following numbers on a firm’s balance sheet: Accounts receivable=75. Inventory=350. Property & equipment=1,000. Accounts payable=60. Long-term debt=510. What is the value of net working capital? $365 7. Shown below are selected numbers from a firm’s balance sheet for 2003 and for 2004. For each account, these balance sheet items present the amount in place as of the end of each year. What was the cash flow in 2004 for net working capital? Accounts receivable Inventory Accounts payable 2003 650 1800 430 2004 620 1980 445 Solution: ($135), that is, a cash outflow F301 JCS Accounts receivable Inventory Accounts payable 2003 650 1,800 430 2004 620 1,980 445 NWC in place 2,020 2,155 Cash flow = Change Inflow/(Outflow) 30 (180) 15 (135) 8. Your company just bought some new equipment for its manufacturing plant. The equipment cost $1,000,000. Industrial equipment like this has a MACRS classification of 7 years. If the equipment will be sold in four years for $224,900, what is the after-tax cash flow from the asset sale, assuming a tax rate of 34%? Year 1 2 3 4 5 6 7 8 7-Year MACRS Depreciation factor 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% CF = Sell price – [(Sell price – Book Value) x tax rate] = 224,900 – [(224,900 – 312,400) x .34] = $254,650 9. Which of the following projects would increase net working capital the most, all else equal? a. b. c. d. Financing a land purchase for a new manufacturing plant via a sale of new stock. Decreasing the amount of sales your firm makes on credit. Decreasing the number of product lines your firm carries. Changing your production schedule so that you produce goods only after a customer order. e. Using long-term bank credit to reduce payables. F301 JCS