Word

advertisement

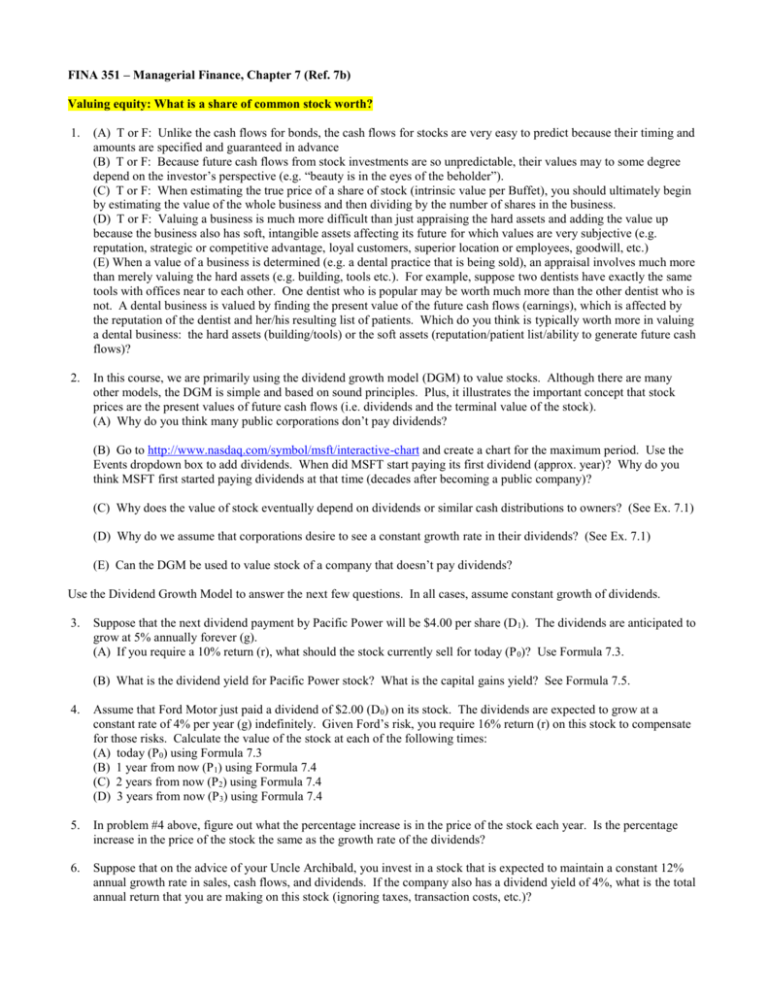

FINA 351 – Managerial Finance, Chapter 7 (Ref. 7b) Valuing equity: What is a share of common stock worth? 1. (A) T or F: Unlike the cash flows for bonds, the cash flows for stocks are very easy to predict because their timing and amounts are specified and guaranteed in advance (B) T or F: Because future cash flows from stock investments are so unpredictable, their values may to some degree depend on the investor’s perspective (e.g. “beauty is in the eyes of the beholder”). (C) T or F: When estimating the true price of a share of stock (intrinsic value per Buffet), you should ultimately begin by estimating the value of the whole business and then dividing by the number of shares in the business. (D) T or F: Valuing a business is much more difficult than just appraising the hard assets and adding the value up because the business also has soft, intangible assets affecting its future for which values are very subjective (e.g. reputation, strategic or competitive advantage, loyal customers, superior location or employees, goodwill, etc.) (E) When a value of a business is determined (e.g. a dental practice that is being sold), an appraisal involves much more than merely valuing the hard assets (e.g. building, tools etc.). For example, suppose two dentists have exactly the same tools with offices near to each other. One dentist who is popular may be worth much more than the other dentist who is not. A dental business is valued by finding the present value of the future cash flows (earnings), which is affected by the reputation of the dentist and her/his resulting list of patients. Which do you think is typically worth more in valuing a dental business: the hard assets (building/tools) or the soft assets (reputation/patient list/ability to generate future cash flows)? 2. In this course, we are primarily using the dividend growth model (DGM) to value stocks. Although there are many other models, the DGM is simple and based on sound principles. Plus, it illustrates the important concept that stock prices are the present values of future cash flows (i.e. dividends and the terminal value of the stock). (A) Why do you think many public corporations don’t pay dividends? (B) Go to http://www.nasdaq.com/symbol/msft/interactive-chart and create a chart for the maximum period. Use the Events dropdown box to add dividends. When did MSFT start paying its first dividend (approx. year)? Why do you think MSFT first started paying dividends at that time (decades after becoming a public company)? (C) Why does the value of stock eventually depend on dividends or similar cash distributions to owners? (See Ex. 7.1) (D) Why do we assume that corporations desire to see a constant growth rate in their dividends? (See Ex. 7.1) (E) Can the DGM be used to value stock of a company that doesn’t pay dividends? Use the Dividend Growth Model to answer the next few questions. In all cases, assume constant growth of dividends. 3. Suppose that the next dividend payment by Pacific Power will be $4.00 per share (D 1). The dividends are anticipated to grow at 5% annually forever (g). (A) If you require a 10% return (r), what should the stock currently sell for today (P 0)? Use Formula 7.3. (B) What is the dividend yield for Pacific Power stock? What is the capital gains yield? See Formula 7.5. 4. Assume that Ford Motor just paid a dividend of $2.00 (D0) on its stock. The dividends are expected to grow at a constant rate of 4% per year (g) indefinitely. Given Ford’s risk, you require 16% return (r) on this stock to compensate for those risks. Calculate the value of the stock at each of the following times: (A) today (P0) using Formula 7.3 (B) 1 year from now (P1) using Formula 7.4 (C) 2 years from now (P2) using Formula 7.4 (D) 3 years from now (P3) using Formula 7.4 5. In problem #4 above, figure out what the percentage increase is in the price of the stock each year. Is the percentage increase in the price of the stock the same as the growth rate of the dividends? 6. Suppose that on the advice of your Uncle Archibald, you invest in a stock that is expected to maintain a constant 12% annual growth rate in sales, cash flows, and dividends. If the company also has a dividend yield of 4%, what is the total annual return that you are making on this stock (ignoring taxes, transaction costs, etc.)? 7. T or F: In a bull market, the capital gains yield is more important to investors, but in a bear market, the dividend yield takes on new importance. 8. Go to http://www.dogsofthedow.com/ddogytd.htm. (A) Of the 30 stocks on the Dow, which one currently has the highest dividend yield? The lowest dividend yield? (Note: you can sort by clicking on “Yield.”) (B) Why do you think certain corporations pay higher dividend yields than the others? 9. Most retirement plans require employees to select certain investments (usually mutual funds) among a spectrum of options, ranging from the risky to the risk-adverse. Choices on the investment menu usually include: (A) income stock funds (B) growth stock funds (C) short-term Treasury bond funds (D) long-term Treasury bond funds (E) corporate bond funds rated AAA Based on what we’ve covered so far in this course, rank these choices from the most risky to the least risky. 10. Go to http://istockresearch.com/model/ and click on Step 2, Calculate. This is a complex stock evaluation model that takes into account a number of variables, other than just dividend growth. According to this model, is Google under or over-valued? See valuation results in pink font. (Note: the Intrinsic Value per Share is how much the model calculates the stock is really worth. If the actual market price were lower, this would indicate a positive margin of safety and an upside potential. And vice versa.).