CHAPTER 8 STOCK VALUATION

advertisement

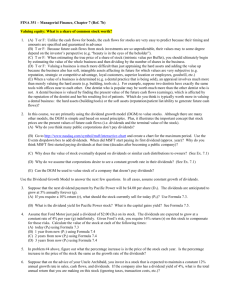

CHAPTER 8 The Valuation and Characteristics of Stock (Ch. 7 4th edition) 8- 1 Fundamental Value of stock: NOT a Keynesian Beauty Contest Keynes described the action of rational agents in a market using an analogy based on a fictional newspaper contest, in which entrants are asked to choose a set of six faces from photographs of women that are the "most beautiful". Those who picked the most popular face are then eligible for a prize. 8- 2 A naïve strategy would be to choose the six faces that, in the opinion of the entrant, are the most beautiful. A more sophisticated contest entrant, wishing to maximize his chances of winning a prize, would think about what the majority perception of beauty is, and then make a selection based on some inference from his knowledge of public perceptions. 8- 3 This can be carried one step further to take into account the fact that other entrants would each have their own opinion of what public perceptions are. Thus the strategy can be extended to the next order, and the next, and so on, at each level attempting to predict the eventual outcome of the process based on the reasoning of other rational agents. Keynes believed that similar behavior was at work within the stock market. This would have people pricing shares not based on what they think their fundamental value is, but rather on what they think everyone else thinks their value is, or what everybody else would predict the average assessment of value is. 8- 4 Market fundamentals Keynes view leads to irrationality in the stock market and speculative bubbles In this class we are looking at fundamental value The value you think the stock is worth based on the cash flow you think the stock will produce and the required rate of return adjusted for risk 8- 5 Common Stock Background Stockholders own the corporation, but in many instances the corporation is widely held • Stock ownership is spread among a large number of people Because of this, most stockholders are only interested in how much money they will receive as a stockholder • Most equity investors aren’t interested in a role as owners 8- 6 The Return on an Investment in Common Stock The future cash flows associated with stock ownership consists of – Dividends and – The eventual selling price of the shares If you buy a share of stock for price P0, hold it for one year during which time you receive a dividend of D1, then sell it for a price P1, your return, k, would be: k= D1+ P1 -P0 P0 or k= D1 P0 dividend yield + P1-P0 P0 A capital gain (loss) occurs if you sell the stock for a price greater (lower) than you paid for it. capital gains yield 8- 7 The Intrinsic (Calculated) Value and Market Price A stock’s intrinsic value is based on assumptions made by a potential investor Must estimate future expected cash flows • Need to perform a fundamental analysis of the firm and the industry Different investors with different cash flow estimates will have different intrinsic values 8- 8 Earnings trend upward over long time horizons 8- 9 Developing Growth-Based Models Realistically most people tend to forecast growth rates rather than cash flows A stock’s value today is the sum of the present values of the dividends received while the investor holds it and the price for which it is eventually sold An Infinite Stream of Dividends Many investors buy a stock, hold for awhile, then sell, as represented in the above equation • However, this is not convenient for valuation purposes D1 D2 P0 = 2 1 k 1 k Dn 1 k n Pn 1 k n 8- 10 Developing Growth-Based Models A person who buys stock at time n will hold it until period m and then sell it Their valuation will look like this: Pn = Dn + 1 Dm Pm +…+ + m-n m-n 1 + k 1 + k 1 + k Repeating this process until infinity results in: P0 i=1 Di 1 + k i Conceptually it’s possible to replace the final selling price with an infinite series of dividends 8- 11 Stock Value = PV of Dividends: D1 D2 D3 D P̂0 ... 1 2 3 1 k s 1 k s 1 k s 1 k s What is a constant growth stock? One whose dividends are expected to grow forever at a constant rate, g. 8- 12 The Constant Growth Model If dividends are assumed to be growing at a constant rate forever and we know the last dividend paid, D0, then the model simplifies to: Which represents a series of fractions as follows P0 = D0 1 g 1 k D0 1 g 1 k 2 2 D0 1 g 3 1 k 3 If k>g the fractions get smaller (approach zero) as the exponents get larger If k>g growth is normal If k<g growth is supernormal • Can occur but lasts for limited time period 8- 13 Constant Normal Growth Constant growth model can be simplified to 1 D0 (1 g ) P0 k s g D1 k s g K must be greater than g. D1 = D0(1+g) The constant growth model is a simple expression for forecasting the price of a stock that’s expected to grow at a constant, normal rate 8- 14 Q: With the current market turmoil, what’s the easiest way to make a small fortune? A: Start off with a large one. Q: What’s the difference between an investment banker and a large pizza? A: A large pizza can feed a family of four. Q: What’s the definition of optimism? A: An Investment Banker ironing five shirts on a Sunday evening. 8- 15 The discount rate (ki) is the opportunity cost of capital, i.e., the rate that could be earned on alternative investments of equal risk. For Bonds: kd = k* + IP + LP + MRP + DRP. For Stocks: Ks = KRF + s (KM – KRF) 8- 16 Constant Normal Growth—Example Example Q: Atlas Motors is expected to grow at a constant rate of 6% a year into the indefinite future. It recently paid a dividends of $2.25 a share. The rate of return on stocks similar to Atlas is about 11%. What should a share of Atlas Motors sell for today? A: D1 P0 k-g $2.25 (1.06) .11 - .06 $47.70 8- 17 What happens if g > ks? •If ks< g, get negative stock price, which is nonsense. D1 P̂0 requires k s g. ks g We can’t use model unless (1) ks> g and (2) g is expected to be constant forever. 8- 18 The Zero Growth Rate Case—A Constant Dividend If a stock is expected to pay a constant, non-growing dividend, each dollar dividend is the same Gordon model simplifies to: D P0 k A zero growth stock is a perpetuity to the investor 8- 19 The Expected Return Can recast Constant Growth model to focus on the return (k) implied by the constant growth assumption D1 k g P0 g is the expected capital gains (%) The higher the expected growth in dividends the faster the price is expected to grow Would this apply to farmland? How? 8- 20 Stock jokes • The market may be bad, but I slept like a baby last night. I woke up every hour and cried. • My broker and I are working on a retirement plan. Unfortunately, it's his! • It was so cold today I saw a stockbroker with his hands in his own pockets. • A market analyst is an expert who will know tomorrow why the things he predicted yesterday didn't happen today! • Q: Why did God create stock analysts ? A: In order to make weather forecasters look good. 8- 21 Basis for dividend growth expectations Looking at past dividend growth is not very informative because it can be distorted Growth in EPS is the fundamental driver of growth in dividends (get data on EPS, calc. %, take avg.) EPS growth greater than sales growth is not sustainable over a long period (so get data on sales calc. %, take avg., use as indicator of max EPS growth) Consider industry factors, including the general economy, that affect growth and market share (so read and think) ROE times the retention rate is the fundamental driver of EPS growth (get data on ROE and retention rate, take averages, consider what is typical or reasonable) Also look for expert opinion Synthesize all the above and come up with a growth rate (there is a document with this information written out on the term project page) You will also determine Ks and if Ks< g, have to use super normal growth model. 8- 22 What’s the stock’s market value? D0 = 2.00, ks = 16%, g = 6%. Constant growth model: D1 $2.12 P0 k s g 0.16 0.06 $2.12 $21.20. 0.10 8- 23 What is the stock’s market value one ^ year from now, P1? D1 will have been paid, so expected dividends are D2, D3, D4 and so on. Then, D2 $2.247 P1 $22.47. k s g 0.16 0.06 D3 $2.382 P2 $23.82. k s g 0.16 0.06 8- 24 Constant Growth Implications Ks = 16%; g = 6%; 1/(.16-.06) = 10; D0=2.00 Year Dividend Multiple Stock Price Growth Rate 0 $2.12 10 $21.20 1 $2.247 10 $22.47 6% 2 $2.382 10 $23.82 6% 8- 25 Find the expected dividend yield, capital gains yield, and total return during the first year. D1 $2.12 Dividend yld 10%. P0 $21.20 P1 P0 D1 Cap. gains yld k s 6%. P0 P0 Total return 10% 6% 16%. 8- 26 Why do the dividend and capital gains returns add-up to the required rate of return? Rearrange model to rate of return form: D1 D1 P0 k s g. ks g P0 Then, ks = $2.12/$21.20+ 0.06 = 0.10 + 0.06 = 16%. Dividend yield+capital gain 8- 27 What would P0 be if g = 0? The dividend stream would be a perpetuity. 0 16% 1 2 3 2.00 2.00 2.00 PMT $2.00 P0 $12.50. k 0.16 8- 28 Two Stage Growth At times a firm’s future growth may not be expected to be constant For example, a new product may lead to temporary high growth The two-stage growth model allows us to value a stock that is expected to grow at an unusual rate for a limited time Use the Gordon model to value the constant portion Find the present value of the non-constant growth periods 8- 29 Problem 10 from lab Williamson Metals, Inc. paid a dividend last year of $3, and is expecting dividends to grow at an 18% rate in years 1 and 2 followed by constant growth of 6% per year thereafter. Similar stocks return 12%. Calculate the value of the stock today. 8- 30 ANS: A D1 = 3(1.18) = 3.54 D2 = 3.54(1.18) = 4.18 P2 = [4.18(1.06)]/.06 = 73.80 4.18 + 73.80 = 77.98 Calculator Steps: CF0 = 0, C01 = 3.54, C02 = 77.98; NPV: I = 12 NPV = $65.33 8- 31 Example Two Stage Growth—Example Q: Zylon Corporation’s stock is selling for $48 a share according to The Wall Street Journal. We’ve heard a rumor that the firm will make an exciting new product announcement next week. By studying the industry, we’ve concluded that this new product will support an overall company growth rate of 20% for about two years. After that, we feel growth will slow rapidly and level off at about 6%. The firm currently pays an annual dividend of $2.00, which can be expected to grow with the company. The rate of return on stocks like Zylon is approximately 10%. Is Zylon a good buy at $48? A: We’ll estimate what we think Zylon should be worth given our expectations about growth. 8- 32 8- 33 8- 34 8- 35 8- 36 Another example: If we have supernormal growth of 30% for 3 yrs, ^ then a long-run constant g=6%, what is P0? ks is still 16%. Have to project out the assumptions on a time line. Apply the constant growth model after 3 years. 8- 37 High growth followed by constant lower growth: 0 ks=16% 1 g = 30% D0 = 2.00 2 g = 30% 2.60 4 3 g = 30% 3.380 g = 6% 4.394 4.658 46.58 CF0=0 CF1=2.6 CF2=3.38 4.658 P3 $46.58 0.16 0.06 CF3=50.97 I=16 NPV = 37.410 = P0 8- 38 What is the expected dividend yield and capital gains yield at t = 0? At t = 4? $2.60 Div. yield0 6.95%. $37.41 Therefore the capital gain must be : Cap. gain0 16% 6.95% 9.055%. 8- 39 During nonconstant growth, dividend and cap. gains yields are not constant, and capital gains yield is less than g. After t = 3, g = constant = 6% = capital gains yield; k = 16%; so D/P = 16 - 6 = 10%. 8- 40 If g = -6%, would anyone buy the stock? If so, at what price? Firm still has earnings and still pays dividends, so P0 > 0: D01 g D1 P0 . ks g ks g ^ $2.00 0.94 $1.88 $8.55. 0.16 0.06 0.22 8- 41 What is the annual D/P and capital gains yield? Capital gains yield = g = - 6.0%, Dividend yield = 16.0% - (-6.0%) = 22%. D/P and cap. gains yield are constant, with high dividend yield (22%) offsetting negative cap. gains yield. 8- 42 super normal growth example The XYZ corporation has had annual earnings and dividends increase at the rate of 75% recently and recently paid dividends of $4/share. The outlook is for continued high growth at 50% per year for the next three years, then a more modest growth rate of 5% per year for all future years. The required return for a company of this 8- 43 risk is 15%. SUPER NORMAL GROWTH ANSWER D1=6, D2=9, D3=13.50, D4=13.5(1.05)=14.175 P3=price of the stock at time 3, when the constant growth begins P3=14.175[1/(.15-.05)]=14.175(10) =$141.75 Draw a time line. Using the CFj part of your calculator: CF0=0, CF1=6, CF2=9, CF3=13.5+141.75=155.25, I=15 NPV=P0=$114.10 8- 44 What is market equilibrium? In equilibrium, stock prices are stable. There is no general tendency for people to buy versus sell. In equilibrium, expected returns must equal required returns: k D1 P0 g k k RF k M k RF b. 8- 45 How is equilibrium established? If ^ k = (D1/ P0) + g > k, then P0 is “too low,” a bargain. Buy orders > sell orders; P0 bid up; D1/P0 falls until D1/P0 + g = ^k = k. 8- 46 Why do stock prices change? D1 P0 ki g 1. ki could change: ki = kRF + (kM - kRF )bi kRF = k* + IP 2. g could change due to economic or firm situation 3. D could change – usually due to earnings 4. Super-normal growth expectations could 8- 47 be formed or change. Feb. 4, 1994: Fed announced increase in interest rates at 11 a.m. Result: Dow Jones fell 95 points. ki = kRF + (kM - kRF )bi kRF = k* + IP D1 P0 ki g 8- 48 Securities Analysis Securities analysis is the art and science of selecting investments Fundamental analysis looks at a company and its business to forecast value Technical analysis bases value on the pattern of past prices and volumes The Efficient Market Hypothesis says information moves so rapidly in financial markets that price changes occur immediately, so it is impossible to consistently beat the market to bargains 8- 49 Give a man a beer and he wastes an hour. Teach a man to brew and he wastes a lifetime. 8- 50 What’s the Efficient Market Hypothesis? EMH: Securities are normally in equilibrium and are “fairly priced,” given the information currently known. One cannot “beat the market” except through good luck or inside info. Implications: 1. Resources spent trying to beat the market are wasted 2. You can’t tell the difference between good luck and skill by looking at the result 3. Try to get the average return with the lowest 8- 51 cost method. From a newsletter by Oaktree Capital Management’s Howard Marks describing the concept of market efficiency: …thousands of intelligent, computer-literate, objective, unconditional, highly motivated and hard-working investors spend a great deal of time searching for information about assets and analyzing what it means for their value. For this reason, all available information is incorporated instantaneously in market prices. This causes the market price of every asset to accurately reflect its intrinsic value, such that an investor in the asset will enjoy a risk-adjusted return that is fair relative to the return on all other assets; no more and no less. 8- 52 1. Weak-form EMH: Can’t profit by looking at past trends. A recent decline is no reason to think stocks will go up (or down) in the future. Seems empirically true, but “technical analysis” is still used. 8- 53 2. Semi-strong form EMH: All publicly available info. is reflected in stock prices, so doesn’t pay to pore over annual reports looking for undervalued stocks. Largely true, but superior analysts can still profit by finding and using new information. It is VERY hard to tell good luck from superior stock picking/timing ability. 8- 54 8- 55 Technical analysis has a large amount of specific language making it sound really impressive and the language tends to be used with a high degree of confidence. However, the scientific evidence supporting these concepts is almost completely absent. 8- 56 3. Strong-form EMH: All information, even inside info, is embedded in stock prices. Not true--insiders can gain by trading on the basis of insider information, but that’s illegal. 8- 57 Standard & Poor's released its latest Indices Versus Active Funds Scorecard today, and the headline result is the same one delivered by almost every study of mutual fund performance since the 1960s: Most actively managed mutual funds underperform the market. To be precise, 66.21% of actively managed domestic stock funds underperformed the S&P Composite 1500 Index in the five years from 2004 through 2008. During the previous five-year period, a smaller majority—50.76%—had underperformed. 8- 58 For the period of December 31, 1992 to December 31, 2007, only 41.6% of activelymanaged U.S. large company funds that beat the S&P 500 in a particular year were able to beat the S&P 500 in the next year. After three years, only 9.7% of the original group was still beating the index. The numbers are similar for actively-managed small cap funds and emerging market funds. 8- 60 Advisor Average and Market Benchmark for Corn, 1995 – 2001 Crop Years Avg. Dif. = 0¢ 8- 61 Advisor Average and Market Benchmark for Soybeans, 1995 – 2001 Crop Years Avg. Dif. = +11¢ 8- 62 Markets are efficient because: 1. 2. 3. 4. 15,000 or so trained analysts; MBAs, CFAs, Technical PhDs. Work for firms like Merrill, Morgan, Prudential, which have much money. Have similar access to data. Thus, news is reflected in P0 almost instantaneously. 8- 63