of Portfolio Stocks

advertisement

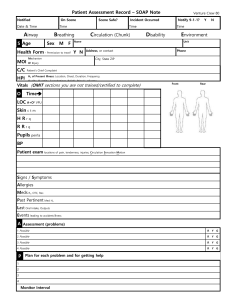

Energy Sector Stock Evaluations Brian R. Boulter Fisher College of Business 2/27/07 Comparative SIM Sector Allocation Utilities Telecommunication Services Materials 1.21% 3.35% SIM Weight 7.44% S&P 500 Weight 3.57% 1.53% 3.05% 16.38% 15.07% Information Technology 11.34% 10.82% Industrials 17.53% Health Care 12.21% 20.71% 22.18% Financials 7.73% Energy 9.69% 6.69% Consumer Staples 9.29% 7.82% Consumer Discretionary 0.00% 10.76% 5.00% 10.00% 15.00% 20.00% 25.00% $96 $57 $34 Sector Recommendation Oil Prices are likely to remain relatively flat between $45 and $60 per barrel. Recommend to decrease current SIM portfolio weighting to 7.00% Energy sector performance is still adjusting to the decline and energy companies in general are likely see flatter earnings in the future. Sell 73 basis points to reach 269 basis points below S&P 500 weighting Look to move towards equal weighting after 12-14 months Industry Fundamentals Integrated Oil & Gas - 63.76% Oil & Gas Refining & Marketing – 3.30% Oil & Gas Exploration & Production – 9.61% Revenues and earnings in these industries are very tightly correlated to oil prices Crude oil is either a major input for production of goods for sale or is itself the sole output of production. Short-term oil price volatility results in more earnings volatility in these industries. Stagnant oil prices are likely to limit growth and performance in the near future. Industry Fundamentals Oil & Gas Drilling – 4.21% Oil & Gas Equipment & Services – 13.39% Oil & Gas Storage & Transportation – 4.34% Revenues and earnings in these industries are driven by global supply and demand factors more than actual oil prices (not as highly correlated to oil prices) As long as oil is a primary source of energy, drilling, storage and transportation services will be in high demand. Revenues and earnings tend to be more stable than short-term oil prices May be an opportunity for stable growth when demand is growing yet oil prices remain stagnant Industry Fundamentals Coal & Consumable Fuels - 1.38% Recently, high oil prices have spurred the development of new coal conversion technologies. Coal can now be economically converted into natural gas, liquids and hydrogen. Quickly becoming a significant source of unconventional oil production as oil prices steadily rise with increased demand over time. Current conversion methods result in costs of about $35 per barrel of liquid hydrocarbons Recommendation Buy 125 basis points of SLB Buy 167 basis points of BTU Sell 365 basis points (ALL) of VLO Total SIM weight = 7.00% Total S&P 500 weight = 9.69% Schlumberger Ltd. (SLB) Oil & Gas Equipment & Services Industry Leading oilfield services company By market cap. and earnings (second to HAL in revenue) The Oilfield Services segment provides technology, project management and information solutions to the petroleum industry. The WesternGeco segment provides reservoir imaging, monitoring and development services. Established 1926 and currently operates in 80 countries worldwide SLB Comparative Financial Strength Net Prof Marg Adj 5yr Avg -1.24 7.2 -6.2 3 3.5 3.5 3.5 3.5 3.5 Net Prof Marg Adj T4Q 10.23 14.41 -4.33 11.11 9.87 12.85 11.44 18.55 9.92 19.7 9.88 17.78 6.94 7.31 6.12 12.32 4.99 12.68 6.47 7.49 Current Ratio 0.98 2.54 1.65 2.2 2.53 3.16 3.37 1.54 2.1 1.48 1.77 2.86 SCHLUMBERGER LIMITED SEACOR HOLDINGS INCORPORATED TIDEWATER INCORPORATED DAWSON GEOPHYSICAL COMPANY GLOBAL INDUSTRIES LIMITED GULFMARK OFFSHORE INCORPORATED KEY ENERGY SERVICES INC MITCHAM INDUSTRIES INC NEWPARK RESOURCES INCORPORATED PRIDE INTERNATIONAL INCORPORATED TETRA TECHNOLOGIES INCORPORATED MATRIX SERVICE COMPANY Median Mean 3.5 19.64 11.42 1.42 1.12 48.61 30.92 39.6 3.5 3.5 4 4 4 4 4 4 4 4 4.5 4 3.8 13.94 28.77 10.11 13.25 26.9 1.69 19.11 4.29 10.74 12.39 3.18 12.39 12.73 8.3 15.24 3.57 -0.75 12.01 -0.01 -8.59 2.37 4 6.61 1.75 6.47 5.22 3.38 4.57 2.7 1.98 2.02 1.99 4.15 2.47 1.45 1.85 1.53 2.1 2.32 2.98 4.18 2.6 1.31 1.91 1.78 3.46 1.3 1.01 1.12 0.91 1.31 1.69 -5.39 39.2 -37.81 -162.82 33.23 47.57 19.83 -22.81 51.16 -68.74 84.35 7.13 -14.75 41.68 15.31 0 12.85 43.62 44.81 5.95 34.91 34.21 35.63 25.05 32.72 27.58 34.55 13.75 0 21.45 45.99 Mean Mkt-Cap Wtd 3.5 16.11 8.84 1.76 1.36 29.05 29.73 35.4 Stock Name ACERGY SA ADR CORE LABORATORIES NV HORIZON OFFSHORE INCORPORATED NATURAL GAS SERVICES GROUP INC OIL STATES INTERNATIONAL INC W-H ENERGY SERVICES INC LUFKIN INDUSTRIES INCORPORATED BJ SERVICES COMPANY HALLIBURTON COMPANY HELIX ENERGY SOLUTIONS GROUP INC OCEANEERING INTERNATIONAL RPC INCORPORATED Financl Strength Rating LT Debt LT Debt Quick Free CF/ /Total /Tot Cap Ratio Total CF Capital% 5Yr Avg% 0.82 70.03 1.77 32.44 1.87 79.71 80.37 41.38 0.76 NEG 36.17 43.89 0.84 -367.35 32.72 39.14 1.1 -149.69 38.81 25.97 2.19 -22.4 32.74 37.69 1.89 33.26 0 0.06 1.08 44.74 18.88 14.21 1.62 7.13 30.15 36.15 1.14 -49.11 41.19 1.21 -2.27 24.26 27.95 2.41 -9.71 0 1.54 6.81 36.59 46.66 22.02 31.03 32.44 27.22 SLB Comparative Profitability Stock Name GULFMARK OFFSHORE INCORPORATED TIDEWATER INCORPORATED HELIX ENERGY SOLUTIONS GROUP INC SCHLUMBERGER LIMITED MITCHAM INDUSTRIES INC BJ SERVICES COMPANY RPC INCORPORATED CORE LABORATORIES NV SEACOR HOLDINGS INCORPORATED GLOBAL INDUSTRIES LIMITED W-H ENERGY SERVICES INC TETRA TECHNOLOGIES INCORPORATED LUFKIN INDUSTRIES INCORPORATED NATURAL GAS SERVICES GROUP INC PRIDE INTERNATIONAL INCORPORATED ACERGY SA ADR DAWSON GEOPHYSICAL COMPANY HALLIBURTON COMPANY OCEANEERING INTERNATIONAL OIL STATES INTERNATIONAL INC NEWPARK RESOURCES INCORPORATED MATRIX SERVICE COMPANY KEY ENERGY SERVICES INC HORIZON OFFSHORE INCORPORATED Median Mean Mean Mkt-Cap Wtd Net Prof Net Prof Pre-Tax Pre-Tax Marg Adj Marg Adj Margin Margin T4Q 5yr Avg T4Q 5yr Avg 32.46 12.64 37.03 13.42 28.77 15.24 39.46 22.39 19.7 12.68 28.96 18.62 Gross Margin 5yr Avg 47.91 42.02 27.5 Gross Margin LFY 53.02 48.12 35.41 EBITDA Margin 5yr Avg 39.37 35.22 35.12 EBITDA Margin LFY 35.74 50.14 43.26 ROE T4Q 19.6 18.66 27.99 19.64 11.42 25.73 12.63 22.39 31.29 27.48 35.07 40.55 19.11 18.55 17.78 14.41 13.94 13.25 12.85 12.39 11.44 11.11 10.74 10.23 10.11 9.92 9.88 9.87 4.29 3.18 1.69 -4.33 12.39 12.96 -8.59 12.32 7.49 7.2 8.3 -0.75 7.31 6.61 6.12 -14 18.71 13.02 8.92 14.12 -0.91 11.58 9.95 9.63 70.66 26.41 39.95 22.79 77.05 33.7 46.8 29.28 4 -1.24 3.57 4.99 6.47 6.94 2.37 1.75 -0.01 -6.2 6.47 5.24 18.58 27.07 29.99 20.47 27.03 20.82 20.79 18.82 17.31 17.67 18.32 14.07 16.28 15.26 14.91 15.68 4.11 4.53 2.7 8.42 18.58 19.33 7.42 -4.35 5.11 5.83 9.49 10.01 3.79 0.78 0.15 -13.76 9.49 7.07 11.45 44.32 23.63 21.03 46.97 34.29 11.35 17.22 7.63 18.43 20.64 9.88 9.31 10.88 22.79 26.67 16.97 43.6 24.48 23.03 36.45 31.72 16.08 25.33 13.57 17.95 21.25 10.8 9.53 31.44 17.46 29.28 30.19 45.52 24.01 22.52 16.26 31.93 12.5 23.04 18.53 12.75 34.63 29.73 2.64 14.04 9.09 18.99 13.6 13.7 2.97 -0.11 18.99 21.02 49.3 30.99 23.66 24.47 38.09 18.74 16.47 21.66 13.35 26.94 29.21 8.56 22.88 14.17 14.38 12.64 13.7 5.07 20.1 6.53 22.88 23.96 17.16 35.82 36.05 50.63 12.84 25.81 26.23 26.45 22.89 8.08 10.66 35.45 16.15 31.31 20.02 24.53 7.74 20.91 2.19 -10.77 22.89 21.96 16.12 8.83 22.42 10.58 20.3 27.31 22.19 28.24 34.06 SLB DCF Assumptions CAPM produced 9.4% terminal discount rate (Beta = 1.35) Terminal Growth Rate of 5.75% Increasing demand for oil and oil drilling/production services Current high operating margins declining to industry average of 18% Cap Ex. and Depreciation approaching 5% of sales SLB DCF Output NPV of free cash flows NPV of terminal value Projected Equity Value Free Cash Flow Yield Shares Outstanding 28% 72% 100% $27,862.4 $72,692.0 100,554.4 1.34% 1,242.2 Current Price 62.80 Implied equity value/share 80.95 Upside/(Downside) to DCF 28.9% SLB Multiple Valuations Absolute Valuation A. P/Forward E P/S P/EBITDA P/CF AVERAGE DCF Market High Low B. Mean C. 51.1 5.73 99.9 23.5 Current D. 14.7 2.11 3.9 7.6 24.4 3.61 14.2 15.7 #Your Target *Your Target Your Target Multiple E, S, B, Price (F x G) etc/Share E. F. G. H. 67.1 16 24.4 2.75 69.8535 4.17 3.61 19.35 78.384 12 14.2 5.52 17.113 15 15.7 1.09 71.78 80.95 64.58 Peabody Energy (BTU) The world’s largest coal producer founded in 1883. (IPO May, 2001) owns interests in 36 coal operations in the United States and Australia. Produces about 240 million tons of coal annually Has approximately 9.8 billion tons of proven and probable coal reserves Markets, brokerages and trades coal US customers, primarily power companies, currently account for more than 90% of sales Participates in BTU conversion technologies that convert coal into natural gas, liquids and hydrogen. BTU Comparative Financial Strength Stock Name ALLIANCE RESOURCE PARTNERS LP CONSOL ENERGY INCORPORATED PEABODY ENERGY CORPORATION PENN VIRGINIA RESOURCE PTNR LP YANZHOU COAL MINING CO LTD MASSEY ENERGY COMPANY ARCH COAL INCORPORATED WESTMORELAND COAL COMPANY Median Mean Mean Mkt-Cap Wtd Financl Strength Rating EPS Net Prof Net Prof Stabilty Marg Adj Marg Adj 5-Yrs T4Q 5yr Avg 10.73 11.53 8.95 115.01 11.13 3.86 37.45 11.02 3 4 4 4 3.7 14.01 14.68 538.17 481.62 112.52 112.52 165.52 3.7 143.85 Current Ratio 1.58 1.24 LT Debt LT Debt Quick Free CF/ /Total /Tot Cap Ratio Total CF Capital% 5Yr Avg% 1.34 42.92 48.04 92.5 0.71 0.9 29.08 48.05 5.26 1.29 0.71 28.47 38.8 45.78 7.81 21.96 1.14 10.54 2.48 11.02 9.7 22.57 0.72 1.33 2.09 3.86 6.4 1.1 3.19 2.79 1.42 1.09 1.42 1.71 0.98 2.75 1.26 0.86 0.4 0.98 1.13 86.41 66.61 -28.29 -40.27 36.21 36.21 24.12 46.5 0.18 56.73 45.07 63.73 46.5 41.02 37.96 3.13 42.64 51.8 74.04 48.05 49.49 11.85 6.89 1.68 1.1 17.61 33.82 42.27 BTU Comparative Profitability Stock Name YANZHOU COAL MINING CO LTD ALLIANCE RESOURCE PARTNERS LP CONSOL ENERGY INCORPORATED PEABODY ENERGY CORPORATION ARCH COAL INCORPORATED PENN VIRGINIA RESOURCE PTNR LP WESTMORELAND COAL COMPANY MASSEY ENERGY COMPANY Median Mean Mean Mkt-Cap Wtd Net Prof Net Prof Pre-Tax Pre-Tax Gross Marg Adj Marg Adj Margin Margin Margin T4Q 5yr Avg T4Q 5yr Avg 5yr Avg 21.96 22.57 32.17 33.51 49.28 11.53 8.95 18.1 11.94 11.13 3.86 14.83 5.44 31.47 Gross EBITDA Margin Margin LFY 5yr Avg 54.08 46.48 21.76 37.11 17.14 11.02 5.26 9.91 4.63 18.39 19.99 16.17 10.54 7.81 2.48 1.14 11.02 9.7 1.33 2.47 11.46 13.34 2.09 0.72 3.86 6.4 10.74 14.41 1.89 2.03 14.41 13.01 0.94 -2.06 4.63 8.12 26.13 17.36 26.13 25.68 22.6 22.79 22.79 28.32 15.02 69.58 8.51 12.63 17.14 25.91 11.96 7.07 14.52 9.08 25.54 28.85 22.81 EBITDA Margin LFY 46.97 24.14 23.48 ROE T4Q 15.14 50.97 35.66 16.08 25.15 11.52 20.13 18.51 15.24 7.02 NMN 10.19 3.5 18.51 20.13 19.74 23.68 21.85 24.37 BTU DCF Assumptions CAPM produced 12% terminal discount rate (Beta = 2.01) Terminal Growth Rate of 5.00% Current moderate operating margins increasing slightly to industry average of 14% Cap Ex. and Depreciation approaching 5.5% of sales BTU DCF Output NPV of free cash flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 47% 53% 100% $6,897.5 $7,841.4 14,738.9 1.78% Shares Outstanding 268.0 Current Price 40.42 Implied equity value/share 54.99 Upside/(Downside) to DCF 36.1% Valero Energy (VLO) Oil & Gas Refining & Marketing Founded 1955 Operates 18 refineries in the United States, Canada and Aruba Markets transportation fuels and home heating oils to residential consumers Operates 1,008 company owned gas stations and 5,000 retail and wholesale outlets VLO Comparative Financial Strength Stock Name BUCKEYE PARTNERS LP ENBRIDGE ENERGY PARTNERS LP GENESIS ENERGY LP KINDER MORGAN ENERGY PARTNERS LP KINDER MORGAN MANAGEMENT LLC MAGELLAN MIDSTREAM PARTNERS LP MARKWEST ENERGY PARTNERS LP ONEOK PARTNERS LP PLAINS ALL AMERICAN PIPELINES LP TC PIPELINES LP TEPPCO PARTNERS LP VALERO LP ENBRIDGE INCORPORATED TRANSCANADA CORPORATION Financl Strength Rating 2 3 EPS Net Prof Net Prof Stabilty Marg Adj Marg Adj 5-Yrs T4Q 5yr Avg 2.13 22.61 26.48 27.13 4.05 3.52 376.97 1.08 0.2 4.72 4.97 6.19 19.76 59.57 8.02 12.2 15.13 59.47 6.48 6.02 10.32 19.68 8.42 0.97 0.68 4.87 66.92 88.81 6.34 1.29 1.83 6.53 11.71 31.47 8.64 5.79 7.88 5.28 13.82 14.63 VALERO ENERGY CORPORATION Median Mean 3 3 2.7 32.07 8.02 38.42 6.02 2.86 6.48 12.02 Mean Mkt-Cap Wtd 2.8 17.71 7.95 Current Ratio 1.58 1.01 0.98 0.67 1 1 1.09 1.25 1.01 0.96 1.44 0.95 0.5 LT Debt LT Debt Quick Free CF/ /Total /Tot Cap Ratio Total CF Capital% 5Yr Avg% 1.03 45.41 53.61 53.37 0.86 -29.09 57.36 54.75 0.92 35.66 0 16 0.57 33.07 59.27 52.69 0.87 0 0 0.46 58.72 49.2 48.11 1.01 -68.09 66.19 45.83 1.12 77.6 56.53 54 0.44 -580.91 41.7 45.24 99.99 0 4.14 0.86 -30.76 55.94 57.56 0.71 63.48 38.09 32.69 0.63 24.67 61.42 61.15 0.32 61.36 55.37 58.41 14.63 19.92 1.13 1.01 1.04 0.55 0.86 0.74 63.22 45.41 -10.4 25.52 53.61 41.35 39.23 48.11 41.54 10.22 0.96 0.6 19.51 43.05 47.13 VLO Comparative Profitability Stock Name TC PIPELINES LP BUCKEYE PARTNERS LP TRANSCANADA CORPORATION MAGELLAN MIDSTREAM PARTNERS LP VALERO LP ONEOK PARTNERS LP MARKWEST ENERGY PARTNERS LP Net Prof Net Prof Pre-Tax Pre-Tax Gross Marg Adj Marg Adj Margin Margin Margin T4Q 5yr Avg T4Q 5yr Avg 5yr Avg 66.92 88.81 71.52 93.14 22.61 26.48 23.89 23.3 53.84 13.82 14.63 21.34 26.21 82.15* 12.2 15.13 16 18.23 41.52 11.71 31.47 13.72 33.48 10.32 19.68 13.57 14.16 6.48 8.8 Gross Margin LFY 16.88 EBITDA Margin 5yr Avg 96.73 41.26 58.73 31.02 56.13 45.09 12.52 EBITDA Margin LFY 81.92 39 50.35 21.93 19.61 48.1 10.82 ROE T4Q 13.82 12.97 13.83 16.48 7.12 17.49 12.12 52.97 80.93 29.61 VALERO ENERGY CORPORATION ENBRIDGE INCORPORATED KINDER MORGAN ENERGY PARTNERS LP ENBRIDGE ENERGY PARTNERS LP TEPPCO PARTNERS LP GENESIS ENERGY LP PLAINS ALL AMERICAN PIPELINES LP KINDER MORGAN MANAGEMENT LLC Median Mean 6.02 2.86 8.92 4.26 8.13 9.2 6.18 7.15 34.5 5.79 4.97 3.94 1.29 1.08 0.97 7.7 11.07 4.38 1.98 0.87 1.27 99.99 11.07 20.33 10.94 11.72 4.25 2.65 -0.18 0.72 99.9 14.16 24.48 38.49 21.92 16.92 32.23 17.26 13.62 1.94 1.8 2.3 1.48 28.17 19.7 10 6.36 0.8 1.29 17.65 16.31 8.31 3.46 1.31 1.62 6.48 12.01 7.88 6.19 3.51 1.83 0.2 0.68 59.57 14.63 19.92 21.92 29.63 17.26 25.65 28.17 29.57 17.65 23.4 14.06 12.14 15.02 10.55 11.34 11.66 3.59 12.97 13.78 Mean Mkt-Cap Wtd 7.87 10.1 14.01 14.38 29.2 27.33 23.75 19.81 20.28 Comparative Dupont Analysis % Change from 2003 to 2005 Asset Margin Turnover Leverage ROE SLB BTU VLO 180% 65% -28% 105% 236% 31% -29% 199% 102% 25% -25% 147% Recommendation Buy 125 basis points of SLB Increasing demand for oil and oil will result in stable growth despite stagnant oil prices. Buy 167 basis points of BTU Coal becoming a viable unconventional source of oil and gas Sell 365 basis points (ALL) of VLO Stagnant industry oil prices will limit short-term growth in this Final Energy Sector Portfolio Stocks % of Portfolio XOM 2.24% (224bp) HAL 1.84% (184bp) SLB 1.25% (125bp) BTU 1.67% (167bp) Final Sector Weight 7.00% S&P 500 Weight 9.69% Underweight (2.69%)