IMF

advertisement

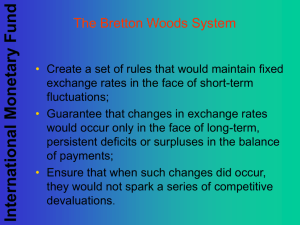

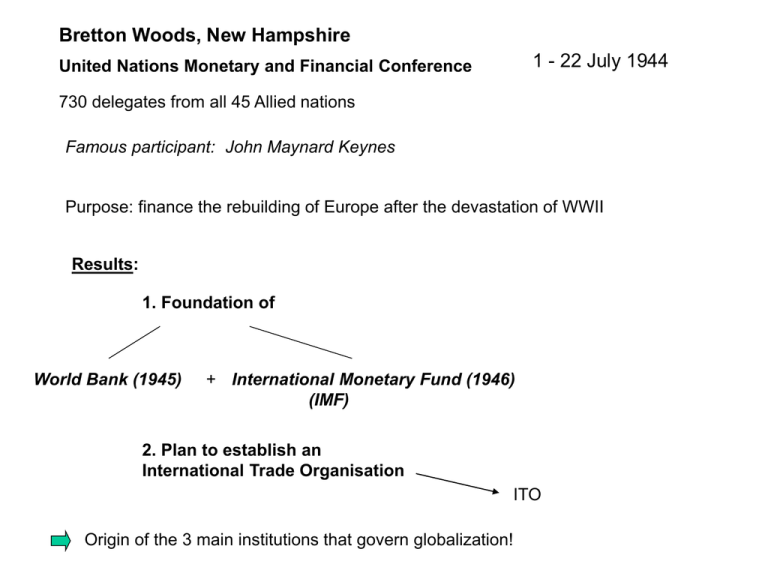

Bretton Woods, New Hampshire 1 - 22 July 1944 United Nations Monetary and Financial Conference 730 delegates from all 45 Allied nations Famous participant: John Maynard Keynes Purpose: finance the rebuilding of Europe after the devastation of WWII Results: 1. Foundation of World Bank (1945) + International Monetary Fund (1946) (IMF) 2. Plan to establish an International Trade Organisation ITO Origin of the 3 main institutions that govern globalization! 3. The Bretton Woods System of fixed exchange rates Par (equal) value system: USA defined the value of the dollar in terms of gold One ounce of gold = $ 35 Guarantee: US government will always exchange gold for dollars at that rate All other members had to define the exchange value of their money in terms of gold or in terms of the U.S. dollar, and they guaranteed the convertibility of their own currencies into dollars at a fixed exchange rate. Fixed exchange rate system (Gold exchange standard with the US dollar as key currency) Changes of the exchange rates (parity) could only be made with the consent of the IMF Member countries had to maintain their parity by buying and selling foreign currency, usually US dollars Great advantage: Currencies were kept stable and predictable Good for international traders and investors Growth of international trade The World Bank (Group) Headquarters: Washington, DC President: Robert B. Zoellick Today: Group of 5 international organizations (agencies): - the International Bank for Reconstruction and Development, established in 1945 - the International Finance Corporation, established in 1956 - the International Development Association, established in 1960 - the International Centre for Settlement of Investment Disputes, estd. in 1966 - the Multilateral Investment Guarantee Agency, established in 1988 Purpose: - economic development and poverty reduction - encouraging and safeguarding international investment provision of finance and advice to other countries Governments can choose which of these agencies they sign up to individually IBRD: 184 members Organisational structure Board of governors (1 governor and 1 alternate governor from each member country, which appoints them) Executive Board President all directors appointed by their respective governments + 23 other executive directors various departments usually the ministers of finance or governors of the central banks by tradition a US national five of them represent individual countries (USA, GB, F, G, Japan), the other 19 represent groups of countries Member governments subscribe to the basic share capital of the World Bank, with votes proportional to shareholding Result: the World Bank is controlled primarily by developed countries, while clients have almost exclusively been developing countries Total votes, as of 1 November, 2004: USA: 16.4% Japan: 7.9% Germany: 4.5% United Kingdom: 4.3% France: 4.3% Major decisions require an 85% majority! Main goals of the World Bank nowadays: - fight poverty and improve the living standards of people in the developing world Measures: Provision of long-term loans, grants and technical assistance Areas: - health and education - environmental projects - improvement of infrastructure (dams, roads etc.) - economic development Focus nowadays on support for small scale local enterprises, Rather than on measures for aggregate economic growth New attitude: Clean water, education, and sustainable development are essential to economic growth Heavy investment in such projects The International Monetary Fund Headquarters: Washington, D.C Background: Situation in the 1930s Great depression unprecedented rates of unemployment 1/4 of the US workforce was unemployed Monetary restrictions of international trade, because Many countries didn't have enough foreign currency (e.g. because of trade deficits) Some countries' central banks didn't exchange enough money into foreign currency Some countries hoarded gold and money that could be converted into gold Result: not enough foreign currency available for growing international trade Competitive devaluations Countries made their currencies cheaper in order to export more goods Other countries retaliated Original purpose of the IMF: Prevention of another global depression 1. by stimulating demand to ensure economic growth and stability Keynes: "In the long run we're all dead!" - Free markets can't always regulate themselves (Classical theory: economic disruptions are only temporary!) free markets can lead to massive long-term unemployment unemployment is the result of a lack of sufficient aggregate demand! In this case governments must stimulate demand: - by increasing public expenditures and/or - by cutting taxes Role of the IMF: Provision of money/loans for "deficit spending" + pressure on member countries to act along these lines 2. by improving restrictive monetary practices Objectives: - unrestricted conversion from one currency into another - stabilization of the value for each currency, - elimination of restrictions and practices like competitive devaluations Belief: Need for collective action at the global level for economic stability! Excursus: Keynes: The state should play an active role in the economy Expansionary economic policy: Contractionary economic policy: Government: - increase of public expenditure (state expenditures) - lower taxes - less public expenditure (cutting of deficits) - higher taxes Central Bank: - lower interest rates - higher interest rates Stimulation of demand Economic growth (expansion) Dangers: - inflation - governments don't repay their debts in better times Less demand Less economic growth (contraction) Organisational structure Board of governors (1 governor and 1 alternate governor from each member country, which appoints them) Executive Board Chairperson Dominique Strauss-Kahn + 23 other members usually the ministers of finance or governors of the central banks by tradition a non-US national five of them represent individual countries (USA, GB, F, G, Japan), the other 19 represent groups of countries various departments http://www.imf.org/external/np/sec/memdir/eds.htm Quotas and voting Members in May 1946: 39 Members today: 184 Each member country contributes a certain sum of money (quota subscription) Purposes: - pool of money (2001: $269 bn) from which members can borrow when they are in financial difficulties determined by the IMF itself on the basis of the country's wealth and economic performance (reviewed every five years) - basis for how much a member country can borrow - determine the voting power of a country USA 17,1% Japan 6,1% Germany 6% G8 states Major decisions require an 85% majority! France 5% GB 5% Italy 3,3% Canada 3% Russia 2,8% 80 poorest countries together 10% The collapse of the Bretton Woods System Growing world trade Growing demand for money for transaction purposes not enough gold and dollars available! 1971: USA stopped guarantee to convert dollars into gold 1973: free exchange rates (floating) Exchange rates (prices of currencies) are now a result of market forces on capital markets for most countries IMF lost a great part of its purpose New field of activities, e.g. - The IMF now tries to influence the market forces (economic policies) that determine the exchange rate - evaluate member countries' economic performances Three main functions of the IMF today: 1. Surveillance (supervision): - Examination of all aspects of any member's economy that are relevant for that member's exchange rate - Evaluation of member countries' overall economic performance more influence on members' economic policies periodic consultations in the member country Belief: strong and consistent domestic economic policies will lead to stable exchange rates and a growing and prosperous world economy 2. Financial assistance: - The IMF lends money to member countries with payment problems Potential borrower must present a plan of reforms, which usually includes: - reduction of public expenditure - tight monetary policy - privatization of industries 3. Technical assistance: for members who need expertise in central banking and public finance etc. e.g. developing countries, Russia A critical view on IMF policies: Funds are only provided if countries engage in contractory and neo-liberal policies Neo-liberal policy: - less state intervention: free markets can regulate things better - privatization of nationalized industries - austerity: reduction of debts by reducing public spending - market liberalization: free trade and free flow of capital Attraction of foreign investment Advantages: - MNCs bring expertise and access to foreign markets - MNCs have better access to sources of finance - new employment possibilities Negative results: - Industries in poor countries often can't compete with imported goods, which are sometimes even subsidised. local industries go bankrupt, foreign MNCs take over - high interest rates and other contractory measures lead to slow economic growth - free capital markets: local banks go bankrupt, small businesses and farmers can't get any more loans - not enough money for health, education and a social safety net The IMF's most important macroeconomic goal: low inflation (due to its focus on monetary problems) Less important: unemployment, distribution of income and wealth, education, health Newest tendency: More attention on help for the poor, health and education and "good governance" Suggestions for a better policy: Take it slowly! A functioning market system requires: - clear property rights and the courts to enforce them - competition and information can't be established overnight Successful East Asian countries: - dropped protective barriers slowly and carefully - state investments for enterprises - joint-venture companies China has only just started to dismantle trade barriers after 20 successful years Development also requires a transformation of society, e.g. - Education: All countries which have invested in universal primary education (including girls) have done better - Help for the poor (safety net) important to avoid riots and upheaval - Land reform: In many developing countries a few rich people own most of the land - Fight against corruption What the h… is the difference? World Bank - assists developing countries through long-term financing of development projects and programs IMF - oversees the international monetary system - evaluation of member countries' economic performance - acquires most of its financial resources by borrowing on the international bond market - promotes exchange stability and orderly exchange relations among its member countries - staff of 7,000 drawn from 184 member countries - assists all members - both industrial and developing countries by providing short- to medium-term credits - draws its financial resources principally from the quota subscriptions of its member countries - staff of 2,300 drawn from 184 member countries