Keynes and economic cycles

advertisement

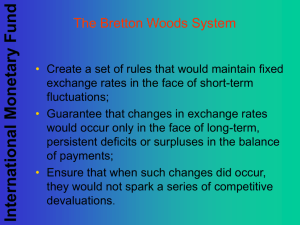

The Roaring Twenties Growth and Good Times The Dirty Thirties The Great Depression This presentation will discuss: The historical background to modern globalization Keynes’s responses and proposed solutions The Bretton Woods Conference The gold standard monetary system, The World Bank, International Monetary Fund, General Agreement on Trade and Tariffs, G7, G8, and G20. MHR, pages 226-231 Oxford, pages 209-268 “Capitalism is the extraordinary belief that the nastiest of men, for the nastiest of reasons, will somehow work for the benefit of us all." - John Maynard Keynes “…never forget that just because a man may be poorer than I am, he is no less a man, with no less a right to his dignity…” - David Weber, By Schism Rent Asunder, Tor Books, 2008. The 1920’s were a period of economic “boom” in the United States and the world. The boom was based on innovation, expanded production for personal consumption, and mechanization in the work place; for example, the development of the assembly line. The development of electrical power encouraged production of electrically powered tools and appliances. The stock market was booming, and some people became very rich. The capitalist economy was at the peak of its economic cycle. The stock market collapsed as share values dropped to record lows. This collapse triggered bank failure and the world entered the period known as the Great Depression. The 10-year economic depression ended only with the outbreak of World War II. The stock market collapse and the failure of many banks caused the loss of life savings for many people. The means to recover under capitalism was missing for all but the very rich. People had little money to invest so businesses needing capital suffered. Nations chose to restrict trade to protect their economies by imposing protective tariffs. This backfired. High unemployment occurred world wide. The world’s economic systems totally failed. The capitalist economy entered a severe downward spiral in its cycle. Was the capitalist, market system doomed to failure? Should it be replaced by a centrally planned system? What changes could or should be made to change the system? “Boom and bust” refers to the movement of an economy through economic cycles due to changes in demand. During booms, there is high demand, increased inflation, unemployment falls, and national income increases. During busts or recessions, there is low demand, inflation decreases, unemployment rises, and national income falls. Keynes argued that his system would help to stabilize world economic systems, prevent recessions, and effectively enable world monetary processes that would prevent economic problems. Keynes argued that when the capitalist economy was in a bust part of the cycle, it was up to the government to intervene. The state could get an economy out of a recession or depression by creating policies and programs that would increase the demand for goods and services. He believed that the economy needed production and consumption to aid recovery from busts. Because so many had lost their jobs (28% unemployment by 1933 in U.S.) and could not spend to increase demand, it was up to the government to stimulate the economy. During a bust, the government, even if it has to borrow to do so, should finance “big ticket” projects such as roads, dams, buildings and more. Many western governments adopted some of Keynes's ideas after World War II. In Canada the Lions Gate Bridge, the Ice Fields Parkway, and Miette Hot Springs are examples of this belief in governments taking action. A good site to research more projects is www.historicalatlas.ca. The 1933 Emergency Banking Act signaled the start of the end of classic capitalism. The government ventured into business regulation by making the banking industry meet standards to protect the average depositors from the catastrophic loss of deposits. The Tennessee Valley Authority, hydroelectric dams, schools, courthouses, town and city halls (WPA), parks and environmental cleanups (CCC) were some of the projects American governments undertook. They provided temporary jobs and new infrastructure and helped many people and communities survive the Depression. Keynes argued that government activity of this type would increase the demand for workers, which would increase spending, because the workers would have money for more than just basic necessities. This would increase the demand for goods and services and the economy would grow. Both the state and the private sector play an important role in the economy of a nation in a mixed economy. The state should institute fiscal and monetary policies to enable and sustain economic growth, according to Keynes. Fiscal refers to the income and expenditure of a nation, commonly called a budget. Fiscal policy includes: spending priorities specific projects levels of taxation Monetary policy determines a nation’s supply of money. The Federal Reserve Bank and Bank of Canada were given the task of controlling the supply of money by raising or lowering interest rates. Lower interest rates should promote growth while higher rates should slow growth. In the 1930’s, governments imposed tariffs. This caused a reduction in trade. Tariffs were an attempt to protect their economies during the Depression and post-war world. Many will argue that World War II brought the world out of the Depression, but did it solve the world’s economic problems? As the war drew to an end, new concerns surfaced. The Bretton Woods Conference attempted to create a plan to face these challenges. Took place in July 1944. Goal was to create a new framework for the global economy after the war. A stable, cooperative monetary system that was International Would prevent future monetary crises Would preserve and protect national sovereignty Keynes influenced many of the decisions made at Bretton Woods. Hayek distrusted government planning and control and opposed Keynes. Friedman was an early supporter of Keynes who changed his views to call for unfettered capitalism, featuring very little government involvement. Friedman was an advisor to Ronald Reagan and his suggestions formed the basis for the neoconservative economic movement from the 1970’s to the present. Money is a medium of exchange that does away with the barter system. A currency—including shells, paper, coins, playing cards, or anything that is deemed to be acceptable as a medium of exchange in a society—can be called money. About 8,000 years ago, precious metals, silver and gold began to be used as money. These metals were valued because they were scarce, strong and durable. First use of engraved metal coins occurred in ancient Samaria, Egypt, and Turkey. Coins were of a predetermined weight. Common forms of cheating on the value of a coin included shorting, clipping, shaving, and hollowing. The gold standard was used to try to create a common currency in the 1700’s. Runaway inflation was reduced but influxes of “prize money” disrupted the first try. National monetary policies were not possible and could not be used to control the supply of money. Paper money is easier and cheaper to create. It has no real value other than convention. First use was probably in China, about 3,000 years ago. By 1600, bank exchange receipts were commonly used. In 1685, colonial Canada used playing cards due to shortage of coins, but this practice didn’t last long for obvious reasons. Great Depression – the economic collapse and lack of ability to recover triggered the demand for each country to have a monetary policy to try to solve the problems of inflation and other economic woes. Each country wanted to devalue its currency to gain a trade advantage. This caused many nations to abandon the gold standard. Keynes argued for a world “reserve currency” to be administered by a World Central Bank. He lost. He argued for fixed exchange rates. The American dollar became the international base currency and the price of gold was fixed at $35.00 per ounce. Keynes envisioned an international currency which could be used to maintain a healthy world economy, but his proposals were rejected due to strong American opposition. At Bretton Woods, countries agreed to another approach. International agencies like the International Monetary Fund (IMF) would work to help standardize currency values. The IMF exists to “Facilitate the expansion and balanced growth of international trade and contribute to the promotion and maintenance of high levels of employment and real income.” The IMF is expected to oversee a system of “fixed” exchange rates to prevent devaluing of a currency to gain trade advantages. The IMF was expected to promote currency “convertibility” by making it easier to convert or exchange one currency for another when trading. The IMF was to serve as a lender of “last resort” to help countries with cash flow problems. These loans, however, come with conditions the country must follow. The IMF currently describes itself as “an organization of 187 countries (July 2010), working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty.” International Bank for Reconstruction and Development. To provide low interest loans to help rebuild after World War II. To provide low interest loans to help countries modernize. In the 1950s, the World Bank began to provide very low or no interest loans to help build infrastructure to Third World countries. This was designed to prevent poor countries from setting up a funding organization separate from the Bretton Woods Agreement. The poorest countries were unable to repay the loans and fell into default. GATT was set up to establish rules to govern global trade and to reduce national trade barriers and stop protectionist tariffs. Governed by consensus. Seven rounds of tariff reductions took place, the last in 1986 in Uruguay. The WTO replaced GATT in 1994. Introduced the General Agreement on Trade in Services, which includes telecommunications, banking, investment, transportation, education, health, and the environment. Currently the WTO has 153 member nations. Its founding and ongoing purpose is to supervise and liberalize international trade. Critics are wary of the new Dispute Settlement Body, which gives the WTO the legal tools to approve tough trade sanctions by one member against another, especially on nations which might disagree with the WTO’s interpretation of global trade rules. Any member country, acting on behalf of a business, can challenge the laws and regulations of another country on the grounds that they violate WTO rules. All nations have the right to use the Dispute Settlement Body to pursue their own economic selfinterest. The world's major trading nations are also the most powerful economic actors in the WTO. The tendency is for the strong (rich) nations to use the rulings of the WTO to dominate the weaker (poorer) countries. The 'national treatment clause' says that a country may not discriminate against products of foreign origin on any grounds. This removes the power of national governments to develop economic policy which serves the moral, ethical, or economic interests of their citizenry. Powerful nations tend to use this process to dominate weaker nations. Under the terms of the Clause, nations may not boycott goods that are: produced by children in sweatshop conditions made in a factory that fouls the air or poisons the water produced by workers paid poverty wages are poisonous or dangerous According to WTO rules, any country that refuses to import a product on the grounds that it may harm public health or damage the environment must prove the case scientifically. WTO rules on disputes over: The sale of products such as Canadian asbestos U.S. hormone fed beef American tariffs on mustard and pork Whether Canada Post unfairly subsidizes parcels and is therefore “poaching” potential customers from UPS The biggest banks, corporations and businesses argued that a deregulated, privatized, corporate-led free market will solve all of the problems of humanity. The proof for that claim is elusive. Will the biggest of banks, corporations, and businesses work for humanity or their own profit line? In the 1950’s and 1960’s, there were indications that the goals of Bretton Woods were not being achieved. In some cases, the goals being achieved were not the goals advocated by the original participants. The continuing issues included: unfair trade pricing and practices difficulty dealing with powerful transnational corporations difficulty dealing with self interested national governments stagflation runaway inflation Many problems arose in the 1970’s and 1980’s that identified inequities between countries, but they had little power to resolve them effectively. This appeared to suit the heavily industrialized nations. Many Third World nations found themselves going into heavy debt as they tried to modernize. They often found that imported product prices rose steadily, while the raw material prices for what they produced dropped. Developing countries tried to form producer cartels to drive up prices but faced stiff opposition by transnational corporations. When developing countries planned greater government involvement in the economy, this was opposed by the IMF and WTO. When developing countries planned to regulate foreign investment and impose some trade restrictions, this was opposed by the IMF and WTO. The Group of Seven (G7) was an unofficial forum which brought together the heads of the richest industrialized countries. In 1997, Russia joined the G7, creating the The Group of Eight (G8). The European Union is also represented. The Group of Twenty (G20), established in 1999, brings Finance Ministers and Central Bank Governors together to discuss key issues in the global economy. Canada is a member of the G8 and the G20. How is it to Canada’s advantage to belong to these groups? How could it be disadvantageous to Canada? Did the Bretton Woods Conference succeed? Did the institutions set up as a result of the conference achieve their intended results? If so, to what extent? If so, to whose benefit? If not, to whose detriment? Were changes to the plans needed immediately? What further changes are needed today?