The IMF-World Bank Past, Present, and Future

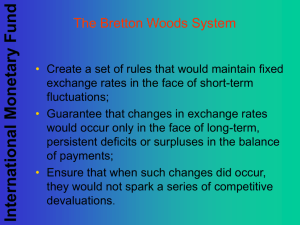

advertisement

Mandates: promote stability of the international financial system (IMF); promote economic development (WB). International monetary system: the gold standard A system under which the value of a nation’s monetary unit was backed by gold Gold standard conditions Define the monetary unit in terms of a certain quantity of gold Fixed relationship between stock of gold and the domestic currency Allow gold to be freely exported and imported Gold flows This would result in exchange rates that are fixed Domestic macro adjustments The gold standard implies changes in the domestic money supply of nations, which affects prices, real output and employment Advantages of gold standard Stable exchange rates resulting from the gold standard reduces uncertainty and risk The flow of gold between countries caused shifts in the supply and demand curves and automatically corrects balance of payments deficits or surpluses Disadvantages of gold standard Nations must accept domestic adjustments in the form of higher unemployment or inflation Countries must have sufficient reserves of gold Demise of the gold standard During the Depression years of the 1930s Bretton Woods monetary system Bretton Woods conference 1944 Adjustable peg system of exchange rate emerged A system by which members of the IMF were obligated to define their monetary units in terms of gold (or US dollars), establishing par rates of exchange between the currencies of all other members, and to keep their exchange rates within 1 per cent of these par values IMF and pegged exchange rates Stabilisation funds Suppliers of both foreign and domestic moneys and gold held with the central bank or treasury for the purpose of intervention in the foreign exchange market to maintain the par value of the exchange rate IMF credit Provided short-term loans to nations with temporary or short-term balance of payments deficits out of currencies and gold contributed by member nations Bretton Woods monetary system Fundamental imbalances: adjusting the peg Countries running persistent balance of payments deficits ran out of reserves and were unable to maintain its fixed exchange rate Demise of the Bretton Wood Dilemma: dollars and the deficits Emergence of floating rates Managed float An exchange rate system where central banks buy and sell foreign exchange to smooth out short-run or day-to-day fluctuations in rates Encourages international trade and finance, while allowing for trend or long-term exchange rate flexibility to correct fundamental payments disequilibria Liquidity and special drawing rights Special drawing rights are bookkeeping entries at the IMF, available to IMF members in proportion to their IMF quotas, that may be used to settle payments deficits or satisfy reserve needs in place of foreign exchange or gold The Bretton Woods System and the International Monetary Fund-IMF IMF In July 1944, 44 representing countries met in Bretton Woods, New Hampshire to set up a system of fixed exchange rates. All currencies had fixed exchange rates against the U.S. dollar and an unvarying dollar price of gold ($35 an ounce). It intended to provide lending to countries with current account deficits. It called for currency convertibility. Goals and Structure of the IMF The IMF agreement tried to incorporate sufficient flexibility to allow countries to attain external balance without sacrificing internal objectives or fixed exchange rates. Two major features of the IMF Articles of Agreement helped promote this flexibility in external adjustment: IMF lending facilities IMF conditionality is the name for the surveillance over the policies of member counties who are heavy borrowers of Fund resources. Adjustable parities Convertibility Convertible currency A currency that may be freely exchanged for foreign currencies. Example: The U.S. and Canadian dollars became convertible in 1945. A Canadian resident who acquired U.S. dollars could use them to make purchases in the U.S. or could sell them to the Bank of Canada. The IMF articles called for convertibility on current account transactions only. IMF: 3 main functions Surveillance: (economic analysis/advice): appraise each member’s exchange rate policies within overall analysis of general economic situation. Multilateral: World/Regional Economic Outlooks; Global Financial Stability Report; Bilateral: Annual assessment (Article IV consultation); financial sector (FSAP); standards and codes. Financial assistance: loans to support countries with BoP problems and low income countries (concessional loans, Policy Support Instrument, external shocks facility (ESF)). Technical assistance: advice/support on technical issues related to macroeconomic policy. Why the Bretton Woods System Was Created Avoid Past Mistakes -Disastrous economic policies that contributed to Great Depression of the 1930s and WW II - Protectionism - Tariff wars - Competitive Devaluations Rebuild confidence in international cooperation and international financial system Such "beggar-thy-neighbor" policies devastated the international economy; world trade declined sharply, as did employment and living standards in many countries. Roles of IMF and World Bank IMF Promote global financial stability Exchange rate stability (balanced growth of trade) Forum for international monetary cooperation Temporary financial assistance to members experiencing balance of payments difficulties World Bank Reconstruction and economic development after WWII Long-term economic development Project financing, including infrastructure, energy, education, health Both IMF and WB share the common objective of raising living standards of their member countries with distinct mandates: WB promotes long-term economic development while IMF promotes international financial stability (stable exchange rates) and facilitates the growth of trade. Internal and External Balance Under the Bretton Woods System The Changing Meaning of External Balance The “Dollar shortage” period (first decade of the Bretton Woods system) The main external problem was to acquire enough dollars to finance necessary purchases from the U.S. Marshall Plan (1948) A program of dollar grants from the U.S. to European countries. It helped limit the severity of dollar shortage. Speculative Capital Flows and Crises Current account deficits and surpluses took on added significance under the new conditions of increased private capital mobility. Countries with a large current account deficit might be suspected of being in “fundamental disequilibrium”under the IMF Articles of Agreement. Countries with large current account surpluses might be viewed by the market as candidates for revaluation. The External Balance Problem of the United States The U.S. was responsible to hold the dollar price of gold at $35 an ounce and guarantee that foreign central banks could convert their dollar holdings into gold at that price. Foreign central banks were willing to hold on to the dollars they accumulated, since these paid interest and represented an international money par excellence. The Confidence problem The foreign holdings of dollars increased until they exceeded U.S. gold reserves and the U.S. could not redeem them. Special Drawing Right (SDR) An artificial reserve asset SDRs are used in transactions between central banks but had little impact on the functioning of the international monetary system. Worldwide Inflation and the Transition to Floating Rates The acceleration of American inflation in the late 1960’s was a worldwide phenomenon. It had also speeded up in European economies. When the reserve currency country speeds up its monetary growth, one effect is an automatic increase in monetary growth rates and inflation abroad. U.S. macroeconomic policies in the late 1960s helped cause the breakdown of the Bretton Woods system by early 1973. Who Governs the IMF? IMF governed by member countries, through Board of Governors(1 governor per country). Meets annually. Subset of governors--International Monetary and Financial Committee (IMFC)--advises Board of Governors. Meets 2 x year. Funding, Quotas, Voting Power IMF capital base consists of membership quotas: the financial contributions made by member countries. Total quotas nearly $300 billion. Quotas broadly determined by their economic position relative to other countries, and reviewed regularly. A country’s quota determines its voting power and access to financing. When you become a member you must pay in a certain sum of money; we call it a quota. The bigger your economy, the bigger your quota. The United States is the biggest economy in the world and its quota is the largest in the Fund; it represents about 17% of total quotas or about $40 billion. Think of IMF as a credit union. All members put money in the bank, and when a member needs money, the other members lend it money under certain conditions. The quotas members pay in are the main source of funding of IMF. Note that just like when you put money in a bank the money still belongs to you, the money countries put in the Fund is still theirs; they merely transfer some of their monetary assets to the Fund, but it is still part of their reserves. Reforms to increase share of developing countries Quotas raised for China, Turkey, Korea, Mexico in 2006. April 2008 approved: further increase in quota/votes for mainly developing countries (including China) formula more closely based on GDP regular 5-yearly reviews Distribution of quotas US %17 Europe % 41 Americas %10 Asia and Pacific % 20 Africa % 5 Middle East % 7 Global financial crisis Financial turmoil: loose monetary policy and regulation led to excessive leverage and risk. “Sub-prime”problem sparked off financial turmoil, leading to world recession. World economy slowing sharply Role of Fund Early warning signs risks in sub-prime Financial assistance Policy advice Multilateral assessments, distillinginternational experience Actions and issues Moving quickly to help affected emerging countries. Stand ready to lend over $200 billion. Offering policy advice. New short-term liquidity facility: help countries with sound fundamentals that face acute liquidity pressures. Fast/flexible, no conditionality. Questions of resources and new roles in global financial architecture. Summary In an open economy, policymakers try to maintain internal and external balance. The architects of the IMF hoped to design a fixed exchange rate system that would encourage growth in international trade. To reach internal and external balance at the same time, expenditure-switching as well as expenditure-changing policies were needed. The United States faced a unique external balance problem, the confidence problem. U.S. macroeconomic policies in the late 1960s helped cause the breakdown of the Bretton Woods system by early 1973.