Winter 2008 – Quiz 1

advertisement

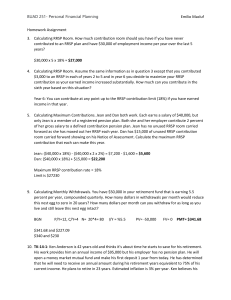

Quiz 1 Question 1 Use the following numbers to calculate the net worth: Bank Account $1,500 Canada Savings Bonds $5,000 Monthly income $6,000 House $125,000 Car $10,000 Mortgage $95,000 Car Loan $5,000 Monthly mortgage payments $1,200 1 / 1 point a) $40,300 b) $41,500 c) $46,300 d) $47,500 e) $141,500 1 / 1 point Question 2 Don has prepared a budget for himself. His expenses are greater than his income. Which of the following expenses would you suggest would be easiest for him to reduce his spending on? a) Utilities b) Rent c) Entertainment d) Car operation expenses Question 3 Pam and John have the following assets and liabilities: Assets: Bank account $4,000 House $150,000 Canada Savings Bonds $5,000 Liabilities Credit Cards $6,000 One year loan $7,000 Mortgage $85,000 1 / 1 point Which statement about their current ratio is correct? Downloaded for free at www.uofgexamnetwork.com 1 a) The ratio is good because their assets are greater than their debts. b) The ratio is not good because they do not have enough liquid assets to cover their short-term debts. c) The ratio is good because they have enough liquid assets for emergencies. d) The ratio is not good because their long-term debts are higher than their shortterm debts. 1 / 1 point Question 4 The federal government wishes to introduce a new item that will reduce taxes to the income tax system. If they want it to be of equal benefit to all tax payers the benefit should be a) a deduction from income b) a tax credit c) part of the GST rebate d) a provincial credit Question 5 The final step in the financial planning process is to 1 / 1 point create a financial plan of action. develop financial goals. evaluate and revise your actions. implement your financial plan. Question 6 Financial strategies refer to 1 / 1 point the process of predicting your future financial situation. courses of action to achieve financial goals. resources an individual has available for investing. ideas or principles that are considered correct, desirable, or important. Question 7 A(n)_______ is a specific plan for spending. 1 / 1 point budget Downloaded for free at www.uofgexamnetwork.com 2 balance sheet income statement bank statement Question 8 An example of a liquid asset would be 1 / 1 point a home. an automobile. a chequing account a retirement account. Question 9 _______________ represent amounts owed to others. 1 / 1 point Current assets Expenses Mutual funds Liabilities Question 10 A personal cash flow statement presents 1 / 1 point amounts earned from savings. income and payments. assets and liabilities. amounts owed to others. RRSP tax savings 1 / 1 point Question 11 Patrice contributed $3,000 to her RRSP this year. If her Marginal Tax Rate is 23% and her Average Tax Rate is 15% how much did Patrice save in income taxes? a) $450.00 b) $690.00 Downloaded for free at www.uofgexamnetwork.com 3 c) $1,140.00 Question 12 Connie contributed $3,000 to her RRSP. This is an example of 1 / 1 point a) income deferment b) income splitting c) a transfer of tax credits d) tax evasion Question 13 Use the following numbers to calculate the taxable income: 0 / 1 point Employment income $52,000 Interest income $1,500 RRSP contribution $7,000 Professional dues $300 Tuition $1,000 CPP premium $1,673 a) $43,527 b) $44,527 c) $46,200 d) $46,500 Question 14 An example of a tax deferral technique is 1 / 1 point an RESP. child care expenses. an RRSP. commission and bonuses. Question 15 An example of a tax exemption is 1 / 1 point taxable income. deductible expenses. Downloaded for free at www.uofgexamnetwork.com 4 capital gains. amounts not subject to a CCRA audit. Future Value lump sum 1 / 1 point Question 16 Shirley purchased a 2 year GIC. The face value of the GIC is $5,000.00. The GIC has an interest rate of 10% compounded annually. How much will the GIC be worth when it matures? a) $4,132.23 b) $5,500.00 c) $6,050.00 d) $6,000.00 Present Value lump sum 1 / 1 point Question 17 Roger wishes to have $400,000.00 in a retirement fund 25 years from now. If he can earn 7%, compounded annually on his investments, how much must Roger deposit today in order to create the retirement fund? a) $73,699.67 b) $373,831.80 c) $1,100,000.00 d) $2,170,973.00 Present Value - lump sum s.a. 1 / 1 point Question 18 Janine purchased a $5,000.00 compound interest bond. The interest rate is 8%, compounded semi-annually. How much will the bond be worth in 2 years when it matures? a) $5,408.00 b) $5,849.29 c) $5,832.00 d) $6,802.44 Annual deposits - FV Question 19 Downloaded for free at www.uofgexamnetwork.com 1 / 1 point 5 Peter is saving for his post-secondary education. How much will he have if he can save $1,200.00 per year at 5%, compounded annually for 4 years? a) $1,458.61 b) $4,255.14 c) $5,040.00 d) $5,172.15 Annual withdrawals PV 1 / 1 point Question 20 How much does Constance need to have on deposit at retirement if she plans to withdraw $15,000.00 annually for 20 years assuming that the retirement fund earns 6%, compounded annually? a) $48,107.03 b) $172,048.82 c) $300,000.00 d) $318,000.00 Downloaded for free at www.uofgexamnetwork.com 6