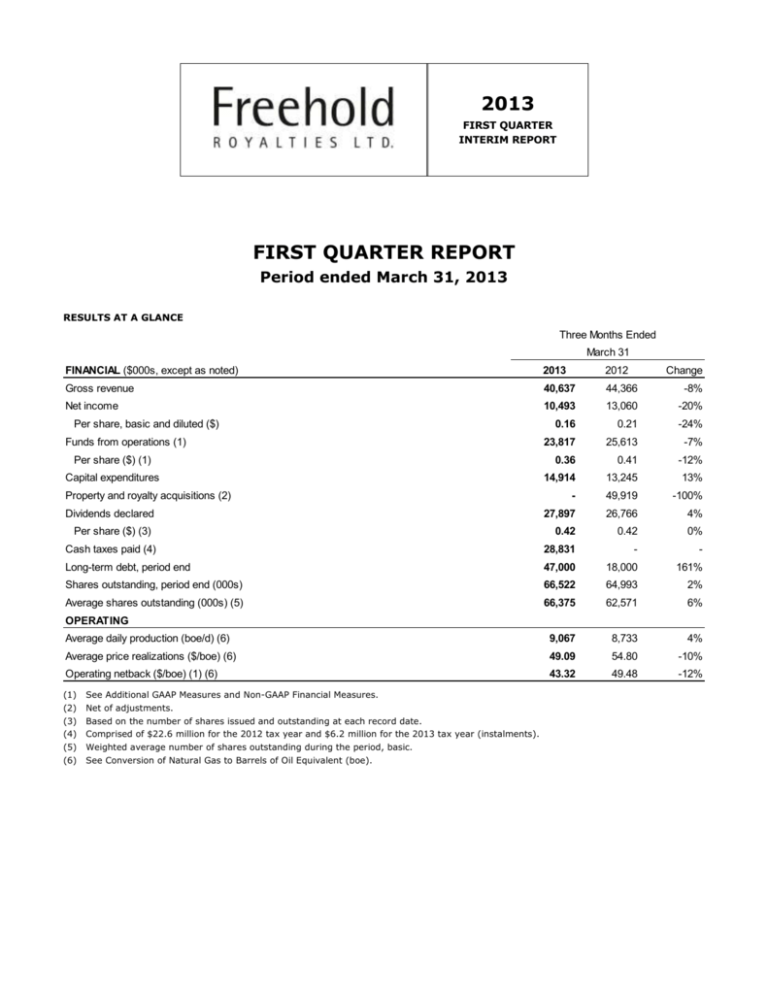

2013 first quarter interim report

advertisement