Unit 3 Accounts & Finance

advertisement

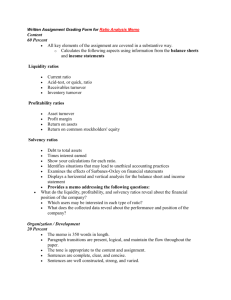

Unit 3 Accounts & Finance Ratio Analysis Learning Objectives To be able to calculate ratios To be able to use ratios to interpret and analyse financial statements from the perspective of various stakeholders HL – To evaluate the possible financial and other strategies to improve the values of ratios Five main groups of ratios • Profitability ratios – – – – Gross Profit Margin Net Profit Margin ROCE Mark-up • Liquidity ratios Accounting Ratios – Current Ratio – Acid Test Ratio • Financial efficiency ratios – Stock (inventory) Turnover Ratio – Debtor Days Ratio – Creditor Days Ratio • Shareholder or investment ratios – Dividend Yield Ratio – Earnings per share ratio • Gearing ratios – Gearing Ratio Key word – Efficiency How well a firm is using its resources Financial Efficiency Ratios • Many different ratios • Two most frequently used are – Stock turnover ratio – Debtor days ratio Financial Efficiency Ratio • • • • Cost of goods sold STR Value of stock (average) 1. Stock (Inventory) Turnover Ratio In principle, the lower the amount of capital used in holding stocks, the better Modern stock control theory focuses on minimising investment in inventories (JIT) This ratio records the number of times the stock of a business is bought in and resold in a period of time Generally, the higher the ratio, the lower the investment in stocks will be Financial Efficiency Ratio Cost of goods sold STR Value of stock (average) 1. Stock (Inventory) Turnover Ratio • This ratio uses average stock holding • The average value of inventories at the start of the year and at the end • Alternative formula is Stock turnover ratio (days) = value of stocks cost of sales / 365 Financial Efficiency Ratio • • • • Cost of goods sold STR Value of stock (average) 1. Stock (Inventory) Turnover Ratio Result is not a % but the number of times stock turns over in the time period (usually a year) The higher the number the more efficient the managers are in selling stock rapidly Very efficient stock management will give a high inventory turnover ratio Normal result for a business depends on the industry it operates in (fresh food higher ratio than car shop) Debtor Days Ratio • The debtor days ratio, also know as the debt collection period measure the number of days it takes a firm, on average, to collect money from its debtors, the shorter the time the better the management • Debtors are the customers who have purchased items on credit from the business and therefore owe money to the firm Trade debtors (accounts receivable) Sales turnover x 365 (days) Debtor Days Ratio • Can also be calculated using total credit sales, thus excluding sales for cash from the calculation – more accurate, as cash sales never lead to debtors • Results show how long a company gives its customers time to pay debts • No right o wrong result Debtor Days Ratio • For example, if a firm’s debtors totals $1M whilst its turnover is $5M, then the ratio is 73 days • This means that on average, it takes the business 73 days to collect debts from its customers who have bought items on credit • Why is the lesser the time the better? • A business who has a low figure may have to be careful they are not losing out to other businesses who may be offering better credit terms • It is common for a business to allow customers 30-60 days credit so a ratio of between 30-60 would be acceptable • The period depends on the context of the business Improving debt collection period • Impose surcharges on late payments, e.g. banks utility companies • Give debtors incentives to pay earlier, such as a discount before the due date • Direct debit • Refuse any further business with a client until payment is made • Threaten legal action Creditor Days Ratio • Measures the number of days it takes, on average, for a business to pay its creditors (suppliers) Trade Creditors Creditor purchases x 365 • E.g. if a firm has $225,000 owed to its suppliers with £1.75M worth of cost of sales, the creditor days is 47 days • This means on average it takes a business 47 days to pay its suppliers • In general the higher this figure the better for the business as it means repayment terms are prolonged • If it is too high however suppliers may impose financial penalties for late payment