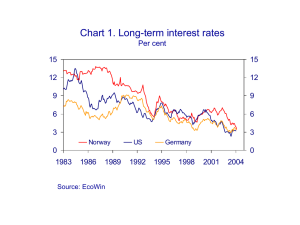

Chart 1 - Norges Bank

advertisement

Chart 1: Share of households with recurrent payment problems and number of forced sales. 1989-2013 35000 14 Number of forced sales (l.h.s.) 30000 12 Recurrent payment problems (r.h.s.) 25000 10 20000 8 15000 6 10000 4 5000 2 0 1989 1993 Sources: Grindaker (2013) and SIFO 1997 2001 2005 2009 0 2013 Chart 2: Estimated average loss ratio1) for consumption-sensitive2) and other industries. All banks except branches and subsidiaries of foreign banks in Norway. 1997-2013 0.6 0.6 Consumption-sensitive industries 0.5 Others 0.5 0.4 0.4 0.3 0.3 0.2 0.2 0.1 0.1 0 0 1) Loss as a percentage of lending to each industry. 2) Consumption-sensitive industries comprise the following: consumer goods, the furniture industry, retail trade, other transport, construction excl. building project development and hotels and restaurants. Source: Norges Bank Chart 3: Estimated share of lending to industries. All banks except branches and subsidiaries of foreign banks in Norway. 1997-2013 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 1997 1999 2001 2003 2005 Consumption-sensitive industries Extraction of crude oil and natural gas Power and water supply Services 1) Adjusted for consumer goods and the furniture industry. 2) Incl. building project development. Source: Norges Bank 2007 2009 2011 Primary industries Manufacturing and mining¹ Foreign shipping Commercial property² 2013 Chart 4: Estimated share of lending to industries. All banks and mortgage companies in Norway except branches of foreign banks in Norway. 1997-2013 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 1997 1999 2001 2003 2005 Consumption-sensitive industries Extraction of crude oil and natural gas Power and water supply Services 1) Adjusted for consumer goods and the furniture industry. 2) Incl. building project development. Source: Norges Bank 2007 2009 2011 Primary industries Manufacturing and mining¹ Foreign shipping Commercial property² 2013 Chart 5: Risk-weighted lending to non-financial enterprises. All banks except branches and subsidiaries of foreign banks in Norway. 1997–2013 60 60 Consumption-sensitive industries Others 50 50 40 40 30 30 20 20 10 10 0 0 1997 Source: Norges Bank 1999 2001 2003 2005 2007 2009 2011 2013 Chart 6: Risk-weighted lending to non-financial enterprises. All banks and mortgage companies in Norway except branches of foreign banks in Norway. 1997–2013 60 60 Consumption-sensitive industries Others 50 50 40 40 30 30 20 20 10 10 0 0 1997 Source: Norges Bank 1999 2001 2003 2005 2007 2009 2011 2013 Chart 7: Risk-weighted lending to non-financial enterprises. Based on DNB’s risk weights. Lending for all banks and mortgage companies in Norway except branches of foreign banks in Norway. 1997–2013 60 60 Consumption-sensitive industries Others 50 50 40 40 30 30 20 20 10 10 0 0 1997 1999 2001 2003 Sources: DNB Pillar 3 report 2012 and Norges Bank 2005 2007 2009 2011 2013 Chart 8: Banks’ annual loss ratios by industry. All banks except branches and subsidiaries of foreign banks in Norway. 1997–2013 1.6 1.6 Consumption-sensitive industries Others 1.4 1.2 1.4 1.2 1 0.8 1 0.6 0.8 0.4 0.6 0.2 0.4 0 -0.2 0.2 -0.4 0 1997 Source: Norges Bank 1999 2001 2003 2005 2007 2009 2011 2013 Chart 9: Annual percentage rise in house prices and commercial property prices. 2000-2013 60 60 50 50 40 40 30 30 20 20 10 10 0 0 -10 -20 -30 Jan-00 -10 Return on capital, IPD, all buildings OPAK commercial property selling prices House prices Jan-02 Jan-04 Jan-06 Jan-08 -20 -30 Jan-10 Sources: Statistics Norway, Norwegian Association of Real Estate Agents (NEF), Eiendom Norge, Eiendomsmeglerforetakenes forening (EFF), Finn.no, Eiendomsverdi, IPD and Norges Bank Jan-12 Chart 10: Correlation between house and commercial property prices (IPD), annual percentage change. For negative values, house prices lead commercial property prices. Annual lags. 2000-2013 1 1 0.8 0.8 0.6 0.6 0.4 0.4 0.2 0.2 0 0 -0.2 -0.4 -0.6 -0.2 Correlation between house prices and different lags for the IPD series P-value P-value = 0.05 -0.8 -0.4 -0.6 -0.8 -3 -2 -1 0 1 2 Sources: Statistics Norway, Norwegian Association of Real Estate Agents (NEF), Eiendom Norge, Eiendomsmeglerforetakenes forening (EFF), Finn.no, Eiendomsverdi, IPD and Norges Bank 3 Chart 11: Correlation between between house and commercial property prices (OPAK), annual percentage change. For negative values, house prices lead commercial property prices. Annual lags. 2000-2013 1 0.8 Correlation between house prices and different lags for the OPAK series P-value P-value = 0.05 1 0.8 0.6 0.6 0.4 0.4 0.2 0.2 0 0 -0.2 -0.2 -0.4 -0.4 -0.6 -0.6 -0.8 -0.8 -3 -2 -1 0 1 2 Sources: Statistics Norway, Norwegian Association of Real Estate Agents (NEF), Eiendom Norge, Eiendomsmeglerforetakenes forening (EFF), Finn.no, Eiendomsverdi, IPD and Norges Bank 3 Chart 12: Percentage change in consumption and housing investment during episodes of declining house prices1). Median values Housing market crash All house price declines Other house price declines Housing investment Consumption -14 -12 -10 -8 -6 -4 -2 0 2 4 1) Total of 114 episodes of declining house prices and 28 housing market crashes. Percentage change in housing investment and consumption is measured from peak to trough of house price cycle. Sources: Claessens, Kose and Terrones (2008 and 2009) 6