Characteristics of Money: Key Properties

advertisement

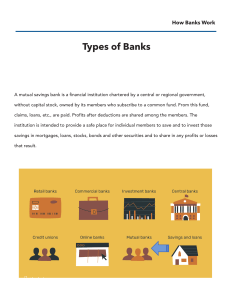

Characteristics of money 1. 2. 3. 4. 5. 6. 7. Durability Portability Divisibility Recognisability Scarcity Acceptability Uniformity Functions of money • • • • Medium of exchange Standard of value Store of value Standard of deferred payment 'Retail Banking' • A mass-market banking in which individual customers use local branches of larger commercial banks as a one-stop shop for as many financial services as possible . • Services offered include savings and checking accounts, mortgages, personal loans, debit/credit cards and certificates of deposit (CDs). • – it refers to the dealing of commercial banks with individual customers, both on liabilities and assets sides of the balance sheet. Fixed, current / savings accounts on the liabilities side; and mortgages, loans (e.g., personal, housing, auto, and educational) on the assets side, are the more important of the products offered by banks. retail banking sector is characterized by 3 basic characteristics: • Multiple products (deposits, credit cards, insurance, investments and securities) • Multiple channels of distribution (call center, branch, internet) • Multiple customer groups (consumer, small business, and corporate). 'Central Bank' • The institution responsible for overseeing the monetary system for a nation (or group of nations). Eg • National Bank of Kazakhstan • The European Central Bank. Functions of a Central Bank • Implementation of monetary policy. • Controls the nation's entire money supply. • The Government's banker and the bankers' bank ("Lender of Last Resort"). • Manages the country's foreign exchange and gold reserves and the Government's stock register; • Regulation and supervision of banks. • Setting the official interest rates- used to manage both inflation and the country's exchange rate. • The tax revenue storing bank.