File

advertisement

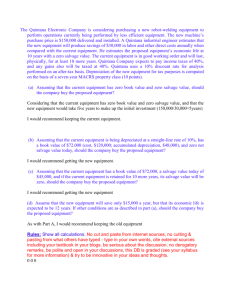

Prof. Rajeev Nair 1 IET 310: 301 Engineering Economic Analysis: Fall 2011 Homework # 10 (Based on Chapter 13) (50 points) Due date - December 7’Th (Wednesday), 2011, before 11.55 PM EST Prof. Rajeev Nair 1. A drill press was purchased 2 years ago for $40,000. The press can be sold for $15,000 today, or for $12,000, $10,000, $8,000, $6,000, $4,000, or $2,000 at the ends of each of the next 6 years. The annual operating and maintenance cost for the next 6 years will be $2,700, $2,900, $3,300, $3,700, $4,200 and $4,700. Determine the marginal cost to extend service for each of the next 6 years if the MARR is 12%. If a new drill press has an EAC of $7,000, when should the drill press be replaced (10 points)? Year 0 1 2 3 4 5 6 Market Value $15,000 $12,000 $10,000 $8,000 $6,000 $4,000 $2,000 Loss in Market Value in Year n $3,000 $2,000 $2,000 $2,000 $2,000 $2,000 Interest in Year n Operating Cost in Year n Marginal Cost in Year n $1,440 $1,200 $960 $720 $480 $240 $2,700 $2,900 $3,300 $3,700 $4,200 $4,700 $7,140 $6,100 $6,260 $6,420 $6,680 $6,940 Although the marginal cost is above the $7000 mark in the first year, it decreases in subsequent years, therefore I would recommend not replacing the unit until the end of the 6th year. 2. A five year-old defender has a current market value of $4,000 and expected O & M costs of $3,000 this year, and increasing by $1,500 per year. Future market values are expected to decline by $1,000 per year. The machine can be used for another three years. The challenger costs $6,000 and has O & M costs of $2,000 per year, increasing by $1,000 per year. The machine will be needed for only three years, and the salvage value at the end of that time is expected to be $2,000. The MARR is 15%. (10 points). (a) Determine the annual cash flows for retaining the old machine for three years. Defender Current Market Year Value O&M Cost cash flow IRR 0 $4,000 $3,000 $1,000 1 $3,000 $4,500 $1,500 2 $2,000 $6,000 $4,000 3 $1,000 $7,500 $6,500 -230.52% (b) Determine whether the time to replace the old machine is now. First show the annual cash flows for the challenger. Challenger Salvage Year Cost O&M Cost Value Cash Flow 0 $6,000 $6,000 1 $2,000 $4,667 $4,000 2 $3,000 $3,333 $1,667 3 $4,000 $2,000 $667 IRR= 103.19% I would replace the old machine now. 3. Mary O’Leary’s company, ships fine wool garments from County Cork, Ireland. Five years ago she purchased some new automated packing equipment having a first cost of $125,000 and a MACRS class life of 7 years. The annual costs for operating, maintenance, and insurance, as well as market value data for each year of the equipment’s 10-year useful life are as follows (10 points). Year n Operating ($) 1 2 3 4 5 6 7 8 9 10 16,000 20,000 24,000 28,000 32,000 36,000 40,000 44,000 48,000 52,000 Annual costs in Year n Market Value for, in Year n Maintenance ($) Insurance ($) 5,000 17,000 80,000 10,000 16,000 78,000 15,000 15,000 76,000 20,000 14,000 74,000 25,000 12,000 72,000 30,000 11,000 70,000 35,000 10,000 68,000 40,000 10,000 66,000 45,000 10,000 64,000 50,000 10,000 62,000 Now Mary is looking at the remaining 5 years of her investment in this equipment, which she had initially evaluated on the basis of an after-tax MARR of 25% and a tax rate of 35%. Assume that the replacement repeatability assumptions are valid. (a) What is the before-tax marginal cost for the remaining 5 years? (b) When, if at all, should Mary replace this packing equipment if a new challenger, with a minimum EUAC of $110,000, has been identified? 4. Five years ago, a conveyor system was installed in a manufacturing plant at a cost of $35,000. It was estimated that the system, which is still in operating condition, would have a useful life of eight years with a salvage value of $3,000. It was also estimated that if the firm continues to operate the system, its market values and operating costs for the next three years would be as follows (10 points). Year End 0 1 2 3 Market Value ($) 11,500 5,200 3,500 1,200 Book Value ($) 15,000 11,000 7,000 3,000 Operating Cost ($) 4,500 5,300 6,100 A new system can be installed for $43,500; it would have an estimated economic value of 10 years with a salvage value of $3,500. Operating costs are expected to be $1,500 per year throughout the service life of the system. The firm’s MARR is 18%. The system belongs to the seven-year MACRS property class. The firm’s marginal tax rate is 35%. (a) Decide whether to replace the existing system now. (b) If the decision is to replace the existing system, when should replacement occur? 5. A professor of engineering economics owns a 1996 car. In the past 12 months, he has paid $2,000 to replace the transmission, bought two new tires for $160, and installed a CD player for $110. He wants to keep the car for 2 more years because he invested money three years ago in a five-year certificate of deposit, which is earmarked to pay for his dream machine, a red European sports car. Today the old car’s engine failed. The professor has two alternatives. He can have the engine overhauled at a cost of $1,800 and then most likely have to pay another $800 per year for the next two years for maintenance. The car will have no salvage value at that time. Alternatively, a colleague offered to make the professor a $5,000 loan to buy another used car. He must pay the loan back in two equal installments of $2,500 due at the end of Year 1 and Year 2, and at the second year he must give the colleague the car. The “new” used car has an expected annual maintenance cost of $300. If the professor selects this alternative, he can sell his current vehicle to a junkyard for $1,500. Interest is 5%. Using present worth analysis, which alternative should he select and why (10 points)? Defender year 0 1 2 Challenger year 0 1 2 paid out $2,270 $1,800 maint $800 $800 paid out maint/payback $5,000 $2,800 $2,800 total pay out $3,070 $2,600 $5,670 Salvage total $1,500 $4,100 plus car I would advise that he repair the old car with the possibility of it lasting longer than the expected two years. Simply because at the end of the two years if he borrows the money from his colleague, he will end up paying $4100 and no car, unless he can afford his dream car by that time. Note – Units are important. If units are not present, 10% per problem will be deducted.