The Quintana Electronic Company is considering purchasing a new

advertisement

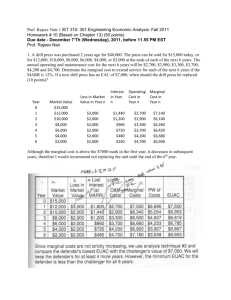

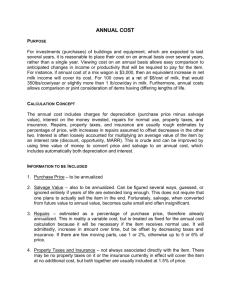

The Quintana Electronic Company is considering purchasing a new robot-welding equipment to perform operations currently being performed by less efficient equipment. The new machine’s purchase price is $150,000 delivered and installed. A Quintana industrial engineer estimates that the new equipment will produce savings of $30,000 in labor and other direct costs annually when compared with the current equipment. He estimates the proposed equipment’s economic life at 10 years with a zero salvage value. The current equipment is in good working order and will last, physically, for at least 10 more years. Quintana Company expects to pay income taxes of 40%, and any gains also will be taxed at 40%. Quintana uses a 10% discount rate for analysis performed on an after-tax basis. Depreciation of the new equipment for tax purposes is computed on the basis of a seven-year MACRS property class (10 points). (a) Assuming that the current equipment has zero book value and zero salvage value, should the company buy the proposed equipment? Considering that the current equipment has zero book value and zero salvage value, and that the new equipment would take five years to make up the initial investment (150,000/30,000=5years) I would recommend keeping the current equipment. (b) Assuming that the current equipment is being depreciated at a straight-line rate of 10%, has a book value of $72,000 (cost, $120,000; accumulated depreciation, $48,000), and zero net salvage value today, should the company buy the proposed equipment? I would recommend getting the new equipment. (c) Assuming that the current equipment has a book value of $72,000, a salvage value today of $45,000, and if the current equipment is retained for 10 more years, its salvage value will be zero, should the company buy the proposed equipment? I would recommend getting the new equipment (d) Assume that the new equipment will save only $15,000 a year, but that its economic life is expected to be 12 years. If other conditions are as described in part (a), should the company buy the proposed equipment? As with Part A, I would recommend keeping the old equipment Rules: Show all calculations. No cut and paste from internet sources, no cutting & pasting from what others have typed - type in your own words, cite external sources including your textbook in your blogs, be serious about the discussion, no derogatory remarks, be polite and open in your discussions, this DB is graded (see your syllabus for more information) & try to be innovative in your ideas and thoughts. 000

![Quiz chpt 10 11 Fall 2009[1]](http://s3.studylib.net/store/data/005849483_1-1498b7684848d5ceeaf2be2a433c27bf-300x300.png)