Capital One Financial Corporation (NYSE: COF) Analysts: Aditi Das

advertisement

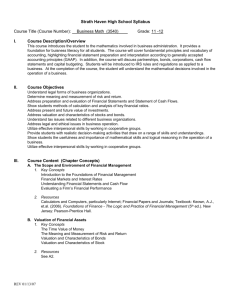

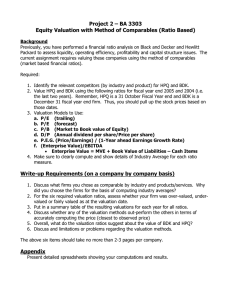

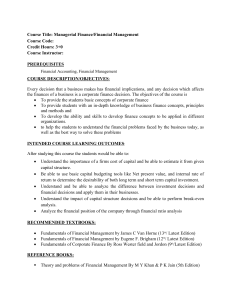

Capital One Financial Corporation (NYSE: COF) Analysts: Aditi Das, Yin-Jen Kao, Yanan Tan, Pien-Cheng Wei, Sashikanth Yenika Position: We own 100 Shares of COF at a cost of $73.13 on 12-9-2013 Recommendation: HOLD (@74.90 on 22nd October 2015) Industry and Macroeconomic Overview In 2008, the recession left the economy severely shaken. Though some of the effects have not yet worn off, the credit services industry has managed to grow and continue to provide excellent services. The industry currently faces strict government regulations, high levels of rivalry from competitors, high entries to barriers and faces threats of substitute products from private label companies issuing credit and companies such as Paypal and Venmo who allow for the transfer of money without the use of cards. Additionally, the industry’s performance hinges on household debt and salary, business sentiments, prime rates, and unemployment rate. These factors play a direct role in determining which direction the industry will go. Business Overview Established in 1994, Capital One Financial Services has created a unique niche in the credit services industry. Its business is broken into three distinct segments: credit card, consumer banking and commercial banking. Capital One strives to use its technological innovation to meet the demands and expectations of its customers. It mainly serves small institutions, consumers requiring a checking or savings accounts and consumers in need of auto loans. Capital One currently holds a 10.6% market share and has experienced growth in the past years through some major acquisitions. Financial Analysis and Valuation Capital One Finance’s Tier1 common ratio shows steady growth in company’s capital structure; while its efficiency ratios over the past four years shows improvement in operational efficiency. However, the efficiency ratios are still below 2010 levels. The relative valuation of Capital One with JPM Chase, Wells Fargo, Citi, Bank of America and Discover using Price to Earnings (both leading and trailing) ratio, Price to Sales and Price to Book Value results in a stock price of $84.00 – which is well above the current market price of $74.90. A dividend discount model is used to find the present value of future benefits of holding Capital One stock. A discount rate of 10% is obtained by adding a 1% business risk to average cost of equity calculated using CAPM, 8.2%, and average of the previous 5 years Return on Equity, 9.9%. This valuation method results in a stock price of $75.50 which is 1.0% more than current market price. 70% weight to dividend discount model and 30% to relative valuation method provides a target price of $78.16. Risks to Valuation Further decrease in business sentiment and flat wages would provide downside risks to the above mentioned valuation model while vice versa provides upside risks. Capital One’s strategy of moving towards balanced revenue mix and pursuit of any inorganic opportunities like GE’s health care loans business would provide risky to the valuation model mentioned above. Recommendation Based on the analysis described and to gain on the announced increase in dividends and share repurchase plans, we recommend a Hold, at the current market price of $74.90.