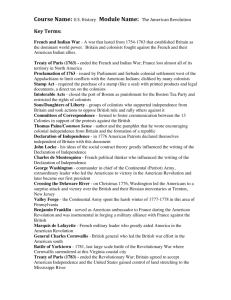

The Spirit of Independence

advertisement

No Taxation Without Representation Objectives Explain the Proclamation of 1763. Analyze why Britain began to enact harsher trade laws and taxes. Understand cause and effect relationships as they relate to the reactions of the colonists. Indentify those individuals and groups that began to rebel against British policy. Vocabulary Revenue – incoming money from taxes or other sources Writ of assistance – court document allowing customs officers to enter any location to search for smuggled goods Resolution – an official expression of opinion by a group Effigy – a mocking figure representing an unpopular individual Boycott – to refuse to buy items in order to show disapproval or force acceptance of one’s terms Repeal – to cancel an act or law Directions Follow along with the PowerPoint to fill in information about British laws placed on American colonists. Proclamation of 1763 Prohibited, or barred, colonists from living west of the Appalachian Mountains. Proclamation of 1763 Proclamation of 1763 This was set up for the following reasons: a. Keep peace between Native Americans and settlers b. Kept colonists near the Atlantic coast, where British authority was stronger c. Allowed Britain to control westward expansion and the fur trade Proclamation of 1763 King George III sent 10,000 troops to enforce the proclamation and keep peace with Native Americans. New Taxes Great Britain needed revenue, or income, to pay for the troops, and to pay off large debts from the French and Indian War. New Taxes They issued new taxes and enforced old taxes more strictly. Some colonists resorted to smuggling, and this led to a loss of revenue. Smuggling Parliament then passed a law to have accused smugglers tried royally, and empowered customs officers to obtain writs of assistance. These documents allowed the officers to search almost anywhere for smuggled goods. Smuggling Poster Sugar Act This lowered the tax on the molasses the colonists imported. Britain hoped that this would lead to colonists paying the tax instead of smuggling. It also allowed officers to seize goods from accused smugglers without going to court. Sugar Act Colonists believed they had a right to a trial by jury, and to be viewed as innocent until proved guilty. They also did not want their homes randomly searched for smuggled goods. Stamp Act In 1765, Parliament passed the Stamp Act. This law taxed almost all printed materials. Newspapers, wills, and even playing cards needed a stamp to show that the tax had been paid. Stamp Act Patrick Henry: passed a resolution – a formal expression of opinion – declaring that only the burgesses could tax its citizens. Stamp Act Samuel Adams: helped start the Sons of Liberty. They burned effigies, or stuffed figures, made to look like tax collectors. Stamp Act People urged merchants to boycott, or refuse to buy – British goods in protest. Businesses in Britain lost so much money that they demanded Parliament repeal, or cancel, the Stamp Act. Stamp Act Townshend Acts 1767: Parliament taxed imported goods, such as glass, tea, and paper, before they were brought inside the colonies. Remember Import means to go in to a country. Townshend Acts Women protested by supporting another boycott of British goods. They also urged colonists to wear homemade fabrics. Some women’s groups called themselves the Daughters of Liberty. Wrap Up 1. Explain the Proclamation of 1763. 2. How are the Stamp Act and Sugar Act similar? How are they different? 3. Why do you think Samuel Adams and others formed the “Sons of Liberty” instead of just acting alone to express their anger at the British policies? 4. How was the Townshend Act different from the Stamp Act and Sugar Act?