ACCA and CIMA courses

advertisement

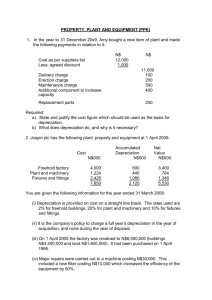

Chapter 21 Manufacturing Accounts MANUFACTURING ACCOUNT FOR THE YEAR ENDED 31 DECEMBER 20X8 $ Raw materials Opening inventory Purchases Less closing inventory $ X X X (X) X Factory wages Prime cost X X Indirect factory expenses Salaries Depreciation on plant and machinery Power Heating and lighting Indirect materials Insurance Factory cost of production Work-in-progress Opening balance Closing balance Factory cost of finished goods produced Slide 2 notes reference - page 229 X X X X X X X X X (X) X/(X) X TRADING ACCOUNT £ Sales X Opening inventory of finished goods Factory cost of finished goods transferred Closing inventory of finished goods X X X (X) X X Gross profit Slide 3 £ notes reference - page 229 Costs of production Direct costs Indirect costs Variable Slide 4 Fixed Vary with no. of goods produced & hours worked Not related to production of a unit e.g. raw materials & labour e.g. rates notes reference - page 230 Costs of production Total direct costs Prime cost Slide 5 Total direct + indirect costs Factory cost of production notes reference - page 230 Factory cost of production +/change in WIP Factory cost of finished goods produced Lecture example 1 Manufacturing account for the year ended 31 December 20X1 Raw materials Opening inventory 7,630 Purchases 18,920 26,550 (7,890) Less closing inventory 18,660 Factory wages 20,860 39,520 Prime cost Indirect factory expenses Electricity (4,620 x ½) 2,310 Rent & rates (5,000 x ½) 2,500 Supervisor’s salary 8,200 Depreciation (plant & machinery) 4,700 17,710 Factory cost of production 57,230 Opening work in progress 4,920 Closing work in progress (4,540) 380 Factory cost of finished goods produced 57,610 Slide 6 notes reference - page 232 Lecture example 1 Income Statement for the year ended 31 December 20X1 Sales Less cost of sales 181,820 Opening inventory of finished goods Factory cost of finished goods produced Less closing inventory of finished goods Gross profit Selling & distribution costs Electricity (4,620 x ¼) Rent & rates (5,000 x ¼) Depreciation (delivery vans) Sales commissions Salesmen’s salaries 6,780 57,610 64,390 (5,430) 58,960 122,860 1,155 1,250 1,600 13,680 20,000 (37,685) Slide 7 notes reference - page 233 Lecture example 1 Administration expenses Electricity (4,620 x ¼) Rent & rates (5,000 x ¼) Salaries (41,630 – 8,200) Depreciation (fixtures & fittings) 1,155 1,250 33,430 1,420 (37,255) Net Profit Slide 8 47,920 notes reference - page 234 Chapter 22 Interpretation of accounts Categories Profitability Liquidity Investors’ ratios Gearing Slide 10 notes reference - page 239 Profitability ROCE Profits earned in relation to capital employed NPM/GPM Relationship between costs and revenue Asset turnover Profitability Return on equity Return to ordinary shareholders Slide 11 notes reference - page 241 Revenue generated by assets employed Lecture example 1 Profitability 20X9 20X8 Return on capital employed (ROCE) Profit from operations % 790 = 29% 462 = 25% 3655-965 TALCL 1,801 Possible reason: New non-current assets may have improved efficiency Slide 12 notes reference - page 241 Lecture example 1 Profitability 20X9 Return on equity (ROE) PAT – preference div OSC + reserves 20X8 478 = 21.8% 266 = 19% 2,190 1,401 Possible reason: Good use of extra capital raised Slide 13 notes reference - page 241 Lecture example 1 Profitability 20X9 20X8 Asset turnover Revenue TALCL 7,180 = 2.7 2,690 5,435 = 3.02 1,801 Possible reason: New non-current assets bought in year have not had time to create the same rate of revenue Slide 14 notes reference - page 241 Lecture example 1 Profitability 20X9 20X8 Net profit margin Profit from operations % Revenue 790 = 11% 462 = 8.5% 7,180 5,435 Possible reasons: Higher selling prices Better cost control Slide 15 notes reference - page 241 Lecture example 1 Profitability 20X9 20X8 Gross profit margin 1,795 = 25% 7,180 Gross profit % Revenue 1,223 = 22.5% 5,435 Possible reasons: Higher selling prices Better cost/production control Slide 16 notes reference - page 241 Liquidity Current ratio Quick ratio Ability to meet short term commitments Stricter test of liquidity Average payment period Credit period taken by the business Inventory days Liquidity Average collection period Credit period taken by customers Slide 17 notes reference - page 241 Average period that Inventories are held Lecture example 1 Liquidity 1 20X9 20X8 2,314 = 2.4 965 1,679 = 2.4 704 Current ratio CA CL Comment A healthy unchanged ratio. Depends on the industry so comparisons are necessary. Slide 18 notes reference - page 241 Lecture example 1 Liquidity 20X9 2 20X8 Quick ratio CA - inventories CL 1,308 = 1.4 965 808 = 1.1 704 Comment The company’s acid ratio has improved due to an increase in receivables and cash, not inventories Slide 19 notes reference - page 241 Lecture example 1 Liquidity 20X9 20X8 3 Inventory Days Inventories x 365 days 1,006 = 68 days 871 = 75 days 5,385 4,212 Cost of sales Comment The company holds inventories for less time. May be a reason for the improved margins. Note - Inventory turnover Cost of sales Inventories Slide 20 5,385 = 5.35 1,006 notes reference - page 241 4,212 = 4.84 871 Lecture example 1 Liquidity 20X9 20X8 4 Receivables days Trade receivables x 365 days 948 = 48 days 708 = 47 days Credit turnover 7,180 5,435 Comment No significant change. Slide 21 notes reference - page 241 Lecture example 1 Liquidity 20X9 20X8 5 Payables days Trade payables x 365 days 653 = 44 days 5,385 Credit purchases 516 = 45 days 4,212 Comment No significant change. However, payables days less than receivables days which could cause cash flow problems in the future. Slide 22 notes reference - page 241 Operating cycle Receivables Days Inventory Days Payables Days Operating cycle Cash out Slide 23 notes reference - page 241 Cash in Gearing Gearing Debt/Equity Shows how the company is financed Shows risk of shareholders not receiving dividend Slide 24 notes reference - page 242 Lecture example 1 Gearing 20X9 20X8 1 Gearing ratio Interest bearing debt Capital, reserves & debt 500 = 18.6% 400 = 22.2% 1,401+400 2,190+500 Comment Gearing has decreased due to the issue of shares. Slide 25 notes reference - page 242 Limitations of ratios • Lack of comparability of accounting policies. • Non trading income included in some ratios • Useless in isolation • Cannot compare across industries • Can be manipulated Slide 26 notes reference - page 242 Chapter 23 IAS 7: Cash Flow Statements XYZ Co – Cash Flow statement (Indirect method) $000 Cash flows from operating activities Net profit before taxation Adjustment for: Depreciation Investment income Interest expense Operating profit before working capital changes Increase in trade and other receivables Decrease in inventories Decrease in trade payables Cash generated from operations Interest paid Income taxes paid Net cash from operating activities Slide 28 notes reference - page 248 $000 3,570 450 (500) 400 3,920 (500) 1,050 (1,740) 2,730 (270) (900) 1,560 XYZ Co – Cash Flow statement (Indirect method) Cash flows from investing activities Purchase of property, plant and equipment Proceeds from sale of equipment Interest received Dividends received (900) 20 200 200 Net cash used in investing activities Cash flows from financing activities Proceeds from issuance of share capital Proceeds from long-term borrowings Dividends paid (480) 250 250 (1,290) Net cash used in financing activities (790) Net increase in cash and cash equivalents 290 Cash and cash equivalents at beginning of period (Note) Cash and cash equivalents at end of period (Note) 120 410 Slide 29 notes reference - page 248 Cash flows from operating activities • Cash flows derived from operating or trading activities • Can use: – Direct method – Indirect method (more common in exams) Slide 30 notes reference - page 249 Lecture example 1 Income Tax payable Tax paid 116 bal b/d 168 bal c/d 156 IS 104 272 Slide 31 notes reference - page 249 272 Lecture example 2 Plant and equipment b/d 200 Disposal 20 Accumulated depreciation Disposal 9 b/d 80 Addition 100 Charge c/d 300 Slide 32 280 300 c/d notes reference - page 250 111 120 40 120 Lecture example 3 Dividends paid Dividends payable b/d R Earnings Slide 33 Cash 50 c/d 45 95 notes reference - page 252 35 60 95 Lecture example 4 $000 $000 Cash flows from operating activities Net profit before taxation Adjustments for: Depreciation Interest expense Operating profit before working capital changes Increase in trade receivables (168 – 147) Increase in inventories (214 – 210) Increase in trade payables (136 – 21) Cash generated from operations Interest paid Income taxes paid (W1) Slide 34 notes reference - page 253 87 42 8 137 (21) (4) 15 127 (8) Lecture example 4 (cont’d) Working 1 Income tax payable b/d Slide 35 Cash 20 c/d 39 59 I/S notes reference - page 253 28 31 59 Lecture example 4 (cont’d) $000 $000 Cash flows from operating activities Net profit before taxation Adjustments for: Depreciation Interest expense Operating profit before working capital changes Increase in trade receivables (168 – 147) Increase in inventories (214 – 210) Increase in trade payables (136 – 21) Cash generated from operations Interest paid Income taxes paid (W1) Net cash from operating activities Slide 36 notes reference - page 254 87 42 8 137 (21) (4) 15 127 (8) (20) 99 Lecture example 4 (cont’d) Working 2 Dividends payable b/d Slide 37 Cash 22 c/d 18 40 R Earnings notes reference - page 254 16 24 40 Lecture example 4 (cont’d) Working 3 Property, plant and equipment (NBV) b/d 514 Revaluation 10 Depreciation Cash additions 146 c/d 670 Slide 38 notes reference - page 254 42 628 670 Lecture example 4 (cont’d) $000 $000 Cash flows from investing activities Purchase of property, plant and equipment (W3) Net cash used in investing activities (146) (146) Cash flows from financing activities Proceeds from issuance of share capital (320 – 260) 60 Proceeds from issuance of debentures (80 – 50) 30 Dividends paid (W2) (22) Net cash from financing activities 68 Net increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year 21 (14) 7 Slide 39 notes reference - page 254 Note to the cash flow statement Cash and cash equivalents Cash on hand Bank overdraft Cash and cash equivalents Slide 40 31.12.X8 $’000 7 7 notes reference - page 254 31.12.X7 $’000 (14) (14) Lecture example 5 Angus Ltd Cash flow statement for the year ended 31 December 20X0 $ Operating activities Cash received from customers (54,000 – 6,700) 47,300 Cash paid to suppliers (31,000 – 2,500) (28,500) Cash paid to & on behalf of employees (15,000) Interest paid (11/12 x 4,800) (4,400) Net cash inflow from operating activities Cash flow from investing activities Payments to acquire tangible fixed assets Cash flow from financing activities Proceeds from long-term loan Issue of ordinary shares Repayment of loan $ (600) (40,000) 60,000 50,000 (6,000) 104,000 Increase in cash balances Slide 41 63,400 notes reference - page 256 Lecture example 5 part (b) This cash flow statement has been prepared using the direct method Slide 42 notes reference - page 256 Chapter 24 Income and Expenditure Accounts Sources of income • Main source of income = subscriptions • Subscriptions received and receivable must be recorded in the correct period • Subscriptions income in I&E account = Number of members x membership fees Slide 44 notes reference - page 263 Lecture example 1 Subscriptions account Opening (5 x $100) receivables (subs in arrears b/d) I & E a/c (subs income) 500 4,700 Closing (10 x $200) 2,000 receivables (subs in advance c/d) Opening (2 x $200) payables (subs in advance b/d) Cash Closing payables (4 x $200) (subs in arrears c/d) 7,200 Slide 45 notes reference - page 263 400 6,000 800 7,200 Income and expenditure account for the year ended ...... INCOME $ Subscriptions Life memberships *Trading activity profit Bank interest received *Surplus on club event *Profit on sale of fixed asset $ X X X X X X X EXPENDITURE Rent Rates Electricity Depreciation *Loss on trading activity *Loss on club event *Loss on sale of fixed asset X X X X X X X (X) Surplus/(Deficit) of income over expenditure Slide 46 *=Alternatives notes reference - page 265 X/(X) Balance sheet as at NON-CURRENT ASSETS Fixtures and fittings Cost Accumulated Net book depreciation value $ $ $ X X X Investments X X CURRENT ASSETS Inventory Trade receivables Subscriptions in arrears Prepayments Cash at bank X X X X X X CURRENT LIABILITIES Trade payables Subscriptions in advance Accruals X X X X Net current assets Slide 47 X notes reference - page 265 X Proforma FUNDS Accumulated fund: Opening balance X Profit/(loss) on sale of investments X/(X) Surplus/(deficit) of income over expenditure for the year X/(X) X Life membership fund X X Slide 48 notes reference - page 265 Life membership subscription On receipt of the money Dr Cash Cr Life membership fund Two methods of accounting for life membership sub T/f to Acc Fund on death of member Dr Life membership fund Cr Accumulated fund Slide 49 Release to I&E a/c over life of member Dr Life membership fund Cr I&E account notes reference - page 266 Bar profits & social events $ Income Contribution Net income from bar trading Income from socials: receipts less expenses $ X X X (X) X X X Miscellaneous income Expenses Ground rent Rates Water etc X X X (X) X Slide 50 notes reference - page 267 Disposal of fixed assets Non current asset disposal Slide 51 Asset had been depreciated Asset had not been depreciated T/f profit/loss to I&E a/c T/f profit/loss to acc fund notes reference - page 267 Investments & special funds Investment income recorded in I&E a/c Profit/loss on sale of investment goes to acc fund Special fund e.g. to raise money for new boat house Dr Special fund cash Cr Special fund account Slide 52 notes reference - page 267 End of day 6 - what to do now… • Reinforce today’s learning • Develop question skills Course Companion 1.Course notes review Slide 53 2. Question practice 3. Study text review