PPE Revision questions

advertisement

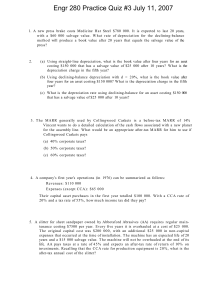

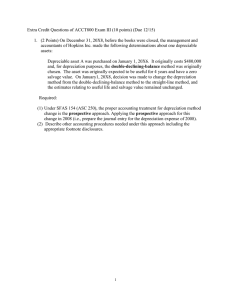

PROPERTY, PLANT AND EQUIPMENT (PPE) 1. In the year to 31 December 20x9, Amy bought a new item of plant and made the following payments in relation to it: N$ 12,000 1,000 Cost as per suppliers list Less: agreed discount N$ 11,000 100 200 300 400 Delivery charge Erection charge Maintenance charge Additional component to increase capacity Replacement parts 250 Required: a) State and justify the cost figure which should be used as the basis for depreciation. b) What does depreciation do, and why is it necessary? 2 .Jospin plc has the following plant, property and equipment at 1 April 2005: Cost N$000 Freehold factory Plant and machinery Fixtures and fittings 4,000 1,224 2,426 7,650 Accumulated Depreciation N$000 600 440 1,080 2.120 Net Book Value N$000 3,400 784 1,346 5,530 You are given the following information for the year ended 31 March 2006: (i) Depreciation is provided on cost on a straight line basis. The rates used are 2% for freehold buildings, 20% for plant and machinery and 10% for fixtures and fittings. (ii) It is the company’s policy to charge a full year’s depreciation in the year of acquisition, and none during the year of disposal. (iii) On 1 April 2005 the factory was revalued to N$6,000,000 (buildings N$4,400,000 and land N$1,600,000). It had been purchased on 1 April 1995. (iv) Major repairs were carried out to a machine costing N$30,000. This included a new filter costing N$10,000 which increased the efficiency of the equipment by 50%. (v) Fixtures and fittings costing N$480,000 on 1 June 2000 were sold for N$440,000. (vi) A new machine was purchased for N$140,000 plus installation costs of N$10,000 (vii) Fixture and fittings were purchase for N$50,000 plus delivery costs of N$4,000 and a N$2,000 warranty against mechanical defects for three years. (viii) On 1 April 2005, when reviewing the expected lives of its PPE, the directors decided that due to changes in technology it was desirable to reduce the remaining life of a machine purchased on 1 April 2004 to two years. It would then be scrapped with an expected nil residual value. The original cost of the machine was N$764,000. REQUIRED: (a) Prepare a schedule of PPE movements and balances (i.e. reconciling opening balances with closing balances) suitable for inclusion in the company’s published accounts for the year ended 31 March 2006. (b) A company has the following accounting policy: ‘Freehold and long leasehold properties are maintained to a standard that preserves likely residual values at a level at least equal to total book values. Accordingly no provision has been made for depreciation as the amount involved would not be material.’ Evaluate this policy against the requirements of IAS 16 and IAS 36. 11 11 3. Herring plc has the following non-current assets at 1 April 20x8. Cost N$000 Freehold factory 1,440 Plant & equipment 1,968 Motor vehicles 449 Office equipment & fixtures 888 4,745 Depreciation N$000 144 257 194 583 1,178 Net book Value N$000 1,296 1,711 255 305 3,567 You are given the following information for the year ended 31 March 20x9: (i) The factory was acquired in June 20x4 and is being depreciated over 50 years. (ii) Depreciation is provided on cost on a straight line basis. The rates used are 20% for fixtures and fittings, 25% for motor vehicles and 10% for plant and equipment. (iii) During the year the factory was revalued to an open market value of N$2.2 million and an extension was built costing N$500,000. Plant and fixtures for the factory extension cost N$75,000 and N$22,000 respectively. (iv) The directors decided to change the method of depreciating motor vehicles to 30% reducing balance to give a fairer presentation of the results and of the financial position. (v) Two cars costing N$17,500 each were bought in May. (vi) When reviewing the expected lives of its non-current assets the directors felt that it was necessary to reduce the remaining life of a two year old grinding machine to four years when it will be sold for N$8,000 as scrap. The machine originally cost N$298,000 and at 1 April 20x8 had related accumulated depreciation of N$58,000. (vii) It is the company’s policy to charge a full year’s depreciation in the year of acquisition. REQUIRED Prepare the disclosure notes for PPE for the year ended 20x8 in a form suitable for publication in a set of company accounts. 13 13