Company Facts - Nimrod Sea Assets

advertisement

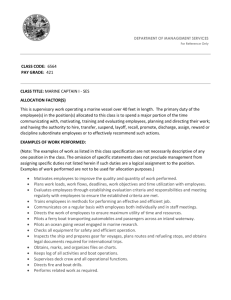

QUARTERLY FACTSHEET LSE: NSA 25 November 2015 Company Overview Nimrod Sea Assets Limited (LSE:NSA) (“NSA” or the “Company”) is a non -cellular Guernsey company limited by shares and incorporated on 8 October 2012. The ordinary shares of the Company were admitted to trading on the Specialist Fund Market (“SFM”) of the L ondon Stock Exchange (“LSE”) on 24 March 2014. The Company’s total issued share capital currently consists of 130,000,000 ordinary shares of no par value (the “Shares”) which were admitted to trading at an issue price of USD 1.00 per share. The Company's investment objective is to obtain income return and capital appreciation for its Shareholders by participating in vehicles which acquire, charter and sell Marine Assets associated with the offshore oil and gas industry. To pursue its investment objective, the Company obtains exposure to Marine Assets by acquiring interests in special purpose holding companies (“Marine Asset Companies”). The majority of the Marine Assets to which the Company will have exposure at any time are those that are needed for the inspection, repair, maintenance and operation of installed infrastructure and production equipment for use in the offshore oil and gas industry. Company Facts Listing Ticker Market Capitalisation Current/Future Anticipated Dividend Dividend Declaration Dates Currency Launch Date/Price Specialist Fund Market of London Stock Exchange NSA USD 83.2m (as at 30 September 2015 2 cents per Ordinary Share from June 2015 until March 2016. June, September, December, March USD Incorporation 24 March 2014 / USD 1.00 per Share Guernsey Consultancy Service Provider Stamford Maritime Limited Corporate and Shareholder Adviser Nimrod Capital LLP Administrator JTC (Guernsey) Limited Auditor Deloitte LLP Market Makers SEDOL, ISIN Jefferies International Limited Winterflood Securities Limited BK0SC85, GG00BK0SC854 Year End 31 March Stock and Shares ISA Eligible Website www.nimrodseaassets.com The Company aims to provide Shareholders with a total return, which will comprise distributions of income to be made throughout the life of the Company and, potentially, capital growth. Following the significant deterioration of the oil market over the last year, t he Company has previously made announcements regarding the payment of distributions ( RNS number: 7405Q, 5576R and 9410A) as well as the strategy to be adopted regarding uninvested capital (RNS number: 9410A). The Board has previously announced that it anticipates declaring a quarterly dividend of 2 cents per Ordinary Share from the end of June 2015 until March 2016. This will be funded by income received net of expenditure, and where necessary, added to from the Company's capital resources. The dividends of 30 June 2015 and 30 September 2015 have been paid. Alongside these dividend distributions the Board has conducted extensive reviews of the existing portfolio, investment policy and the investment pr ocess and future opportunities. Conditions have remained uncertain, and the Board considers that, unless market conditions improve significantly, i t is unlikely to make any further new investments. Consequently the Board anticipates returning unrequired uninvested capital after March 2016. Save for unanticipated market changes or events, the Company currently anticipates returning a further 20 cents per share at that stage. The Company will consider the best m ethod of returning this sum to S hareholders. The Company is focused on maximising the return to Shareholders from its existing assets and on ensuring it has the correct resources to do this. Executive Directors’ Market Overview Market Overview In its Interim Financial Report for the period from 1 April 2015 to 30 September 2015 (the “Period") the Company reported an overall net loss of USD 19,173,616 which included a net movement in unrealise d losses on its investment portfolio of USD 17,337,082. The overall trading loss also includes costs borne in operating DSV Alliance of USD 1,784,104. DSV Alliance AS with effect from 18 June 2015 has directly operated this vessel because the previous charterer is in administration. (For an update on this project please refer to the Investment Summary below). This is disappointing and reflects the severity of the continued downturn in the offshore oil and gas market which has seen new lows in crude prices, ongoing geopolitical tensions, and further vigorous cost reductions by Exploration and Production operators (“E&P”). This has, unsurprisingly, had further negative impact on both asset values and the ability of the Company’s counterparties to honour their commitments to the Company. The Board has prudently decided to mark asset values down further to reflect the change in circumstances and the uncertainty around counterparties who are experiencing an unprecedented drop in demand. The revised values imply a Net Asset Value of 68.96 cents per share. Market Update The Board has spent a great deal of time analysing the current market and therefore, as announced previously, anticipates it will return a portion of uninvested capital to Shareholders. In the current environment the Executive Directors see no realistic prospect of deploying the funds as originally intend ed and they believe the market may worsen further due to the oversupply of vessels and undersupply of work (which has been dramatically scaled back) and do not currently expect this situation to change in the foreseeable future. This downturn has been dr iven not only by the immediate cessation or postponement of works by E&P companies, but also the effect of Russian sanctions which has consequently increased the available North Sea fleet. Petrobras has started to redeliver foreign flagged vessels which wi ll result in new vessels entering other regional markets in the midst of a major cyclical downturn. Given these market conditions, the banks providing senior debt to the industry have become extremely risk averse. The Company is still unable to receive di vidends from the Bukit Timah investment, despite the charterer remaining in full compliance with their obligations, and the declining value of the Odin Viking (Norseman AS) has seen the Company inject fresh capital by way of a capital call into this invest ment. All banks involved in the Company’s various investments report consistently that they are becoming more negative on the sector and it is therefore not expected for this situation to change. A sudden rebound in commodity prices, which is not forecast in any event, will not make an immediate short -term difference to the economics for the offshore vessel owners. Tendering, planning and engineering takes time to arrange and very large numbers of engineers have been made redundant. This, in conjunction wit h the over supply of vessels in every asset class, means that a rebound in terms of vessel owners’ financial stability and performance will take time to resolve. This timing effect for a rebound in offshore activity will be, in the view of the Executive Di rectors, well outside the original Prospectus’ investment period of 18 to 24 months. Further, we do not believe asset prices have reached their lowest point, or that prospective charterers have the degree of certainty in their forward order books for them to commit realistically to offshore support vessels. The scale of this market downturn can be appreciated from the adjacent graph which highlights that E&P companies have reduced expenditure more than twice as much as in the Global Financial Crisis of 0 8/09 and of course the rebound in the oil price has not occurred in the current period as it did then. Investment Portfolio The value of the Company’s investments needs to be understood in a market context where the only sale and purchase activity relating to vessels is where the seller is normally distressed or desperate to sell. There are few representative deals that fall un der the normal shipping parlance of “willing buyer, willing seller”; but that in turn obviously reflects the poor state of the demand side of the market and the abundance on the supply side. In the view of the Executive Directors, vessel values are fund amentally too low, but it is also clear that, regrettably, they do not see a recovery for at least two years while the industry stabilises (only a major geopolitical event, as in 1990-1, could accelerate this). Traditionally more offshore maintenance work is implemented in summer as weather constraints lessen for E&P operators; 2015 has been very poor and our enquiries tell us that next year could be worse. For an industry with high fixed costs and high leverage this would likely see further bankruptcies am ongst vessel operators. Source: Pareto Securities, Bourbon Offshore Source: Bourbon Offshore During the period under review the Company concluded two restructuring events as reported below. Project Investment Summary Percentage of ownership Purchase cost (USD) Percentage of *investable funds as at Purchase Value as at 30 September 2015 (USD) Marine Asset Company Vessels Owned Bukit Timah Offshore DIS Swiber Elise-Marie Swiber Anne Christine Swiber Mary-Ann 26% 8,585,125 7.1% 6,900,836 Odin Viking 43% 9,068,500 7.2% 5,729,322 20.50% 7,261,000 6.1% 5,997,736 51% 9,639,000 8.0% 8,580,902 99.50% 10,061,689 8.3% 2,000,000 1,550,000 Norseman Offshore IS (note: an additional USD344,000 had been injected into this investment by way of a capital call) Volstad Marine DIS II Oceanic Endeavour Altus Subsea IS Altus Invictus DSV Alliance AS DSV Alliance (previously Red7 Alliance) Aberdeen Offshore DIS FS Cygnus 75% 12,750,000 10.6% Jane Offshore Ltd EDT Jane 50% 8,022,500 6.6% 6,648,300 65,387,814 53.9% 37,407,096 Totals *investable funds as at the launch of the company The valuations stated above and below are as per the latest information available to the Board as at 17 November 2015, being the latest practicable date prior to publication of this Factsheet.. Investment Summary Marine Asset Company ("MAC") Purchase Cost (USD) Value as at 30 September 2015 Percentage of *investable funds as at Purchase Asset type Build Date Counterparty/Charterer Length of Charter Timing of dividends from MAC to NSA Investment Update Bukit Timah Offshore DIS 8,585,125 6,900,836 7.1% Marine Asset Company ("MAC") Purchase Cost (USD) Value as at 30 September 2015 Percentage of *investable funds as at Purchase Asset type Build Date Counterparty/Charterer Length of Charter Timing of dividends from MAC to NSA Investment Update Norseman Offshore IS 9,068,500 (note: an additional $344,000 had been injected into this MAC by way of a capital call) 5,729,322 7.2% Marine Asset Company ("MAC") Purchase Cost (USD) Value as at 30 September 2015 Percentage of *investable funds as at Purchase Asset type Build Date Counterparty/Charterer Length of Charter Timing of dividends from MAC to NSA Investment Update Volstad Marine DIS II 7,261,000 5,997,736 6.1% *investable funds as at the launch of the company Anchor Handling Tug Supply Vessels 2009 - 2010 Newcruze Offshore Marine Pte Ltd, guaranteed by Swiber Holdings Ltd (“Swiber”) 10 years to 2019/20 Bi-annual from December 2016 subject to Lender approval. This investment has underperformed due to the banking consortium preventing dividend payments from being distributed despite Swiber continuing to maintain an immaculate payment record and recent stable vessel valuations. Such a stance by the banks unfortunately reflects market sentiment and we are not confident of this position changing in the short-term. High Specification North Sea Anchor Handler Tug Supply Vessel 2003 Viking Supply Ships A/S (“Viking Supply”) 8 years to 2020 Bi-annual from July 2016 subject to meeting Lender covenants. The vessel is a high specification unit that has been dramatically affected by the drop in work following the Russian sanctions, and the asset has suffered a large drop in independent shipbroker valuations (from USD 45,000,000 at investment to USD 28,900,00 in August 2015). We have injected USD 344,000 of equity by way of a capital call. Viking Supply continues to honour all its obligations to the Company, but we are unlikely to receive a dividend for the foreseeable future. Seismic Vessel 2008 CGG Eidesvik Ship Management AS (“CGG Eidesvik”) 8 years to 2018 with 2 x 5 year extension options Bi-annual This seismic investment continues to perform as forecast. The seismic market is extremely weak but we believe we have an excellent counterparty, who is proactively restructuring their business to cope with the new reality of cost conditions. The vessel is one of the most capable in its class with up to date technology installed. Marine Asset Company ("MAC") Purchase Cost (USD) Value as at 30 September 2015 Percentage of *investable funds as at Purchase Asset type Build Date Counterparty/Charterer Length of Charter Timing of dividends from MAC to NSA Investment Update Altus Subsea IS 9,639,000 8,580,902 8.0% Marine Asset Company ("MAC") Purchase Cost (USD) Value as at 30 September 2015 Percentage of *investable funds as at Purchase Asset type Build Date Timing of dividends from MAC to NSA Investment Update DSV Alliance DIS 10,061,689 2,000,000 8.3% Marine Asset Company ("MAC") Purchase Cost (USD) Value as at 30 September 2015 Percentage of *investable funds as at Purchase Asset type Build Date Counterparty/Charterer Length of Charter Timing of dividends from MAC to NSA Investment Update Aberdeen Offshore DIS 12,750,000 1,550,000 10.6% Remote Operated Support Vessel 2011 Marine Engineering Diving Services FZC (“MEDS”) 7 years to 2021 Bi-annual The Altus Invictus had been working at the start of the year on the South Stream project in the Black Sea. Due to political tensions this project was cancelled, at short notice and at huge cost to all involved, and MEDS suffered from delayed payment from the overall contractor that has led to severe cash flow issues. As already announced we are working with MEDS to bring payments up-todate. As a maintenance focused vessel which has recently secured work (although at a day rate lower than we would have liked) we believe long term this will remain a good investment if MEDS can trade through this downturn. Dive Support Vessel 1984 Not applicable In September the Company and the Bank of London and the Middle East (“BLME”), the mortgage provider, reached agreement regarding the immediate future of the vessel. The Company will provide some further working capital which is now first priority recoverable when the vessel is sold. We are hoping for some short-term charters while market conditions are so poor to allow us to recover some value in a managed fashion. The vessel has been laid up in the UK at a very competitive cost, but has the ability to mobilise quickly for available, or even emergency, works. Platform Supply Vessel 2014 Fletcher Supply Ships Limited (“Fletcher”) 6 years to 2021 No dividends expected until market conditions improve. The FS Cygnus was changed to a new pay-as-you-earn charter model as part of a wider restructuring of Fletcher Shipping Limited. The vessel is now on charter to Enquest but the rate is well below that required to earn an economic profit for shareholders and there is no expectation of a dividend in the future without a dramatic change in the day rates for this class of vessel. No segment of the entire offshore vessels market has been harder hit than Platform Supply Vessels (“PSV’s”) with day rates in the North Sea well below Operating expenditure. While this situation cannot last forever, it can clearly last significantly longer as there are 79 North Sea PSVs in lay-up at the time of writing. As new PSVs come off long-term charters owners are reluctant to contract at current rates for long periods and therefore the pool continues to grow. E&P companies are using this to drive their costs down in the short-term despite widespread industry acknowledgement that current North Sea PSV rates are unsustainable. *investable funds as at the launch of the company Marine Asset Company ("MAC") Purchase Cost (USD) Value as at 30 September 2015 Percentage of *investable funds as at Purchase Asset type Build Date Counterparty/Charterer Length of Charter Timing of dividends from MAC to NSA Investment Update Jane Offshore Ltd 8,022,500 6,648,300 6.6% Multi Purpose Support Vessel 2013 EDT Offshore Ltd (“EDT”) 10 years to 2025 Bi-annual The EDT Jane had poor utilisation over the Summer in what is normally the busiest time of the year which is placing severe financial strain on EDT. EDT remains in full compliance with the charter agreement despite the vessel having had very low utilisation. This is a maintenance focused asset which has recently secured work, although at day rates lower than we would have liked, and we believe long term it will remain a good investment if it can trade through this downturn. *investable funds as at the launch of the company Summary The charterers of the vessels are regrettably all suffering from a market that is as weak as anyone can remember it, and unfortunately there is still some residual tonnage being delivered next year which will further increase capacity. Despite current market conditions, the Company owns substantive assets and we remain hopeful that most of these companies can trade through this down turn and asset values and day rates will revert to a more normalised environment. The support of the shareholders in these challenging times is greatly appreciated. Contact Details Company Nimrod Sea Assets Limited Dorey Court, PO Box 156 Admiral Park, St Peter Port Guernsey GY1 4EU Corporate and Shareholder Advisor Nimrod Capital LLP St Helen’s Place London EC3A 6AB Tel: +44 1481 702 400 www.nimrodseaassets.com Tel: +44 207 382 4565 www.nimrodcapital.com Disclaimer This document is issued by Nimrod Sea Assets Limited (the "Company") to, and for the information of, its existing shareholders and does not in any jurisdiction constitute investment advice or an invitation to invest in the shares of the Company. The Company has used reasonable care to ensure that the information included in this document is accurate at the date of its issue but does not undertake to update or revise the information, including any information provided by Stamford Maritime Limited or the Executive Directors, or guarantee the accuracy of such information. Neither Stamford Maritime Limited nor the Executive Directors have made and do not make any express or implied representation or warranty as to the accuracy or completeness of the information provided by it and, to the extent permitted by law neither the Company, Stamford Maritime Limited nor the Executive Directors nor their directors or officers shall be liable for any loss or damage that anyone may suffer in reliance on such information. The information in this document may be changed by the Company at any time. Past performance cannot be relied on as a guide to future performance. The value of an investment may go down as well as up and some or all of the total amount invested may be lost.