FINAN303Principles of FinanceSpring 2016 Interest Rates Why do

advertisement

FINAN303

Principles of Finance

Spring 2016

Interest Rates

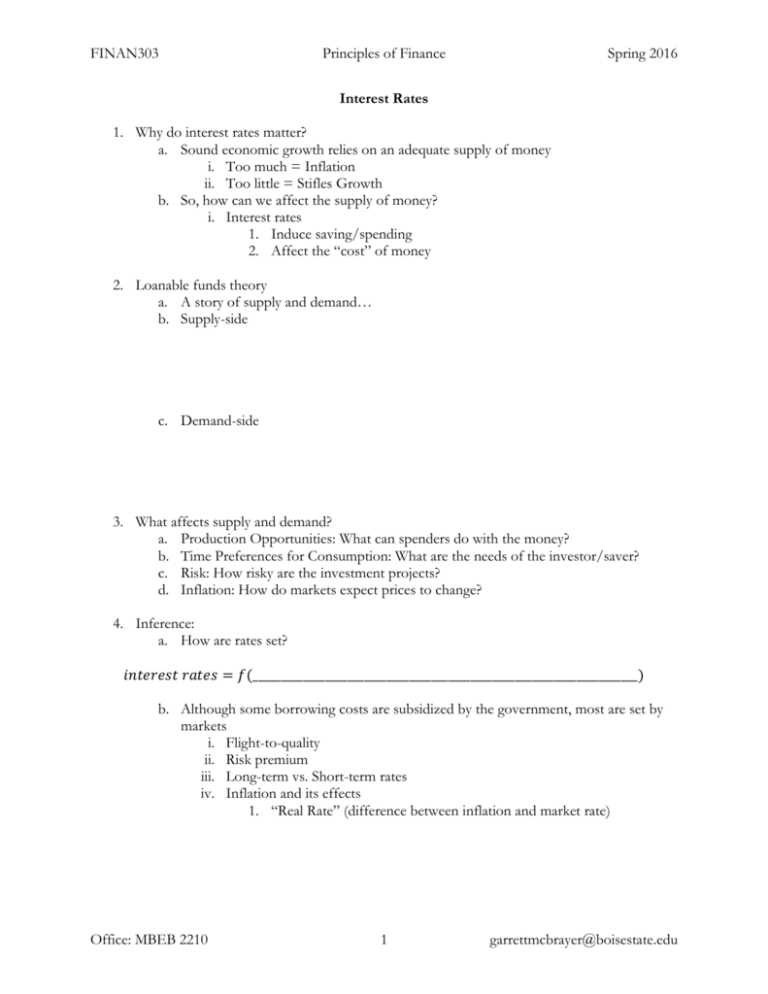

1. Why do interest rates matter?

a. Sound economic growth relies on an adequate supply of money

i. Too much = Inflation

ii. Too little = Stifles Growth

b. So, how can we affect the supply of money?

i. Interest rates

1. Induce saving/spending

2. Affect the “cost” of money

2. Loanable funds theory

a. A story of supply and demand…

b. Supply-side

c. Demand-side

3. What affects supply and demand?

a. Production Opportunities: What can spenders do with the money?

b. Time Preferences for Consumption: What are the needs of the investor/saver?

c. Risk: How risky are the investment projects?

d. Inflation: How do markets expect prices to change?

4. Inference:

a. How are rates set?

𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑟𝑎𝑡𝑒𝑠 = 𝑓(_____________________________________________________________________)

b. Although some borrowing costs are subsidized by the government, most are set by

markets

i. Flight-to-quality

ii. Risk premium

iii. Long-term vs. Short-term rates

iv. Inflation and its effects

1. “Real Rate” (difference between inflation and market rate)

Office: MBEB 2210

1

garrettmcbrayer@boisestate.edu

FINAN303

Principles of Finance

Spring 2016

5. Measuring Rates…Or, the determinants of rates

a. We know:

𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑟𝑎𝑡𝑒𝑠 = 𝑓(𝑜𝑝𝑝𝑜𝑟𝑡𝑢𝑛𝑖𝑡𝑖𝑒𝑠, 𝑐𝑜𝑛𝑠𝑢𝑚𝑜𝑝𝑡𝑖𝑜𝑛 𝑝𝑟𝑒𝑓𝑒𝑟𝑒𝑛𝑐𝑒𝑠, 𝑟𝑖𝑠𝑘, 𝑎𝑛𝑑 𝑖𝑛𝑓𝑙𝑎𝑡𝑖𝑜𝑛)

b. But, what can we use to measure these components?

i. Baseline: _________________________

ii. Inflation Premium: _________________

iii. Default Risk Premium: ______________

iv. Liquidity Premium: _________________

v. Maturity Risk Premium: _____________

c. Baseline Rate

i. Hypothetical

ii. Captures time preferences and investment opportunities

iii. US Short-Term Treasury Bills are typically used as a proxy

d. Inflation Premium

i. What are market expectations of inflation over the period?

ii. Calculated as the average expected inflation for the period.

1. Example

e. Default Risk Premium

i. Compensation for the probability of default.

f. Liquidity Premium

i. How easily can the asset be converted to cash at “fair market value?”

ii. Greater liquidity leads to lower LP

1. Ex: IBM Public Debt to ADA County

g. Maturity Risk Premium

i. Compensation to the investor for the increased risk that comes with

maturity.

1. Ex: Are default probabilities easier to predict in the short-run or

long-run?

h. All together now: 𝑞𝑢𝑜𝑡𝑒𝑑 𝑟𝑎𝑡𝑒 = _____________________________________________

Office: MBEB 2210

2

garrettmcbrayer@boisestate.edu

FINAN303

Principles of Finance

Spring 2016

6. Who pays what?

7. Example:

a. Assume:

𝑟 ∗ = 3.5%

𝐼𝑃 = 𝑇1−5 {2%, 2%, 3%, 3%, 4%}

𝐷𝑅𝑃 = 2%

𝐿𝑃 = 1%

𝑀𝑅𝑃 = 1.5%

b. Price the following:

i. US Govt. 6-mo T-Bill

ii. Bank of America 1-year note

iii. US Govt. 5-year T-Bill

iv. Bank of America 5-year note

8. Cool rates…now what?

a. Knowing how to price debt (apply an interest rate), we can construct a yield curve

(term structure). Yahoo Finance

b. Knowing the components, what would you expect a normal yield curve to look like?

c. Other yield curves:

Office: MBEB 2210

3

garrettmcbrayer@boisestate.edu

FINAN303

Principles of Finance

Spring 2016

d. What can we do with a yield curve?

i. Back out the market expectations of future rates.

ii. Example: Suppose an investor wants to invest over a 2-year period and faces

the following two options:

1. Option 1: Buy and hold a 2-year bond that yields 5.5%

2. Option 2: Buy a 1-year bond that pays 5%, hold it for a year, and

then reinvest the proceeds for another year.

3. Using “Pure Expectations Theory,” we can price the 1-year bond, 1year from now.

e. Pure Expectations Theory

i. Two assumptions:

1. Focus on US Treasury Bonds

2. Assume Treasury Bonds contain no maturity risk

a. Reasonable assumption given trading markets

f. Example Continued…

i. Option 1: 𝐹𝑢𝑛𝑑𝑠𝑡=2 = ______________________________________

ii. Option 2: 𝐹𝑢𝑛𝑑𝑠𝑡=2 = ______________________________________

iii. How can we solve for "𝑥"?

1. ___________________________________

iv. Why does this work?

1. ____________________

a. Suppose the 2-year rate is 5.25%, what would you do?

9. The 4.487 Trillion Dollar Elephant in the Room…i.e., the Fed

a. What is the Federal Reserve?

b. What does it do?

i. Think “Bumpers on a bowling alley”

c. Suppose we have too much (little) money available for investment. What happens?

i. The Fed exists to help keep the balance

1. Monetary policy

2. The Fed issues (buys) securities to affect the demand/supply of

money thus influencing interest rates.

Office: MBEB 2210

4

garrettmcbrayer@boisestate.edu