What makes for good risk management?

April 2015

www.bakertilly.co.uk

….fingers crossed….

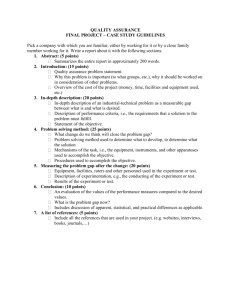

Why establish an enterprise risk management

framework?

What makes for effective risk management? – the

differentiator.

How you can establish an effective enterprise risk

management framework?

Sets out a view on 28

global risks in the report’s

traditional categories economic, environmental,

societal, geopolitical and

technological.

Also considers the drivers

of those risks in the form

of 13 trends.

“There is a significant failure of some kind that was within our control

or we could have prevented, but didn’t.

As a result of the failure there could be any or all of the following harm, injury or death to an individual, a significant financial loss or

waste of resources.

Then there will be the investigation, blame, reputation damage and

embarrassment, rectification time and costs….some of this could result

in irrecoverable damage at a corporate and personal level.

All this, as a minimum, distracts us…and at worse de-rails us from our

main mission….”

A client non executive director

(January 2014 – Board Discussion regards Risk Management & Assurance)

We manage risk all the time!

• Patchy risk management processes leading to an

“Incomplete picture”

• Lack of accountability amongst individuals responsible for

managing risks

• Risk management inertia

• Lack of engagement with the organisation’s risk

management

• Of course one of the main symptoms is untoward and/or

unwanted “stuff” happening

Let’s be honest….

Value adding

What are the risks?

• A risk that is managed

through existing control

framework and

corporate processes.

• Corrected through the

rectification of an

existing

control.

• Monitoring focuses on

assurances in place.

Managed through the

assurance framework.

Business as Usual Risks

Exceptional Risks

• Have a finite life.

• Require the establishment

of a new or enhanced risk

mitigation/control.

• Upon mitigation becomes

business as usual.

• Managed at appropriate

level through either

strategic or operational risk

registers.

Example - Group Risk Capture Hierarchy

Group Business

Objectives

The Baker Tilly 4Risk Risk

Management & Assurance

System: This system can be used

to enable efficient and effective risk

and controls capture, assessment,

reporting and monitoring at

individual establishment level

through to Group and Board level.

Strategic Risks: These risks will have a fundamental effect on

the achievement of the Group business objectives. They will be

material in nature. They will be both determined by the Board as

well as very high areas of risk that might emerge from operations

across the Group.

High Group Risks: Areas of high risk exposure will be escalated

into the Group risk register to enable specific monitoring. It may be

the case that there are common areas of high risk being escalated

across the Group. In this case it may be appropriate for a Group

level action to be agreed, rather than action by each

Establishment.

Operational level Risks: A risk and controls profile will be

established for each establishment in the Group. Action

required to address risks or issues will be determined by the

establishment and progress monitored at Group level. Areas

of high risk will be escalated within the Group.

Individual Establishment Risk Assessments: On a cyclical basis, each

establishment undertakes a self-evaluation of risk exposure and risk mitigation /

controls effectiveness against a set of standard criteria, both financial and nonfinancial. This will assist with ensuring a consistent approach across the group.

10

Does this sound familiar?

The Board to focus on strategy

Rigorously & energetically plan for the future

Recognise that you are part of a wider system

Build trust and confidence

Don’t be driven by events

Reflect on fitness for purpose

A need for thinking time

Seek out best practice – be innovative

Definition of a strategic risk

“Those risks that if realised could fundamentally affect the

way in which the organisation exists or provides services

in the next one to three years.

These risks should they occur will have a detrimental

effect on the achievement of one, some or all of the

organisation’s strategic objectives.

The risk realisation will lead to material failure, loss or lost

opportunity.”

What does the future hold?

1. What would be the worst thing that could happen at the

organisation? (right now / tomorrow)?

2. What is your greatest fear for the organisation? (in the

next 12 – 36 months)?

3. What is the greatest challenge the organisation faces (in

the next 12 – 36 months)?

4. What is the greatest opportunity the organisation has (in

the next 12 – 36 months)?

13

Example Risk Scoring

Impact

5

1

1

4

Risk

Classification

Description

Primary

Primary risks should require immediate

attention. The risk should be regularly

monitored for change and also to ensure

prescribed actions are being completed

4

Contingency

5

3

Monitor and obtain assurance over

existing controls and look to introduce

cost effective mitigation.

2

House Keeping

Action should be taken to introduce or

improve controls to reduce the likelihood

of the risk. Assurance should be

obtained over any mitigations in place.

Low

Activity should concentrate on obtaining

assurance on those controls and

mitigations in place that are reducing the

risk.

2

Likelihood

Key

Inherent Risk

Residual Risk

Application of

Controls & Mitigations

Highlights

Good Practice Risk Register Template

Risk, Cause, Effect, Controls, Assurance and Actions………….?

Risk

Owner /

Lead

Review

and

updates

Risk,

Cause,

Effect

Controls +

Assurance

Full

Action

Plan

Example Correlation map

Strategic objectives vs. 2014/15 strategic risks

Strategic risks with

assurance strength

A) Quality, safety,

outcome &

experience

5

3

4

12

B) Cultural change

5

4

4

13

C) Engagement with

the estates strategy

5

2

3

10

D) Transformation of

Services

4

3

5

12

E) Sustainable local

economy with partners

3

2

3

8

F) Leadership and

workforce capacity and

capability

2

5

5

12

G) Define and

capitalise on our

USPs

2

5

2

9

H) Balance financial

sustainability with

quality & affordability

5

4

4

13

The correlation map demonstrates the linkage and strength of the relationship between each risk and each strategic objective.

This is demonstrated on a 1-5 scale, with 1 indicating a weaker relationship with the strategic objective in question and 5

indicating a stronger relationship.

16

Example Risk radar

Proximity of strategic risk impact with assurance strengths

H) Balance

financial

sustainability with

quality

E) Sustainable local

economy with

partners

F) Leadership and

workforce capacity

and capability

24 – 36

months

12 – 24

months

Now –

12 months

A) Quality &,

safety, outcome &

experience

Now

D) Transformation of

Services

B) Cultural change

C) Estates strategy

Key:

G) Define and

capitalise on our

USPs

High assurance

strength

Medium assurance

strength

Low assurance

strength

17

The three ‘lines of assurance’

Risk Controls & Assurance Dashboard (RCAD)

Case study - National Treatment Agency

Objectives of the RCAD:

• Using a systematic approach provide for an overall understanding of the NTA

risk exposure and level of assurance over the effectiveness of the control

environment in the NTA key activities / functions;

• to provide a basis for early warnings, particularly during the transition

period; and

• to identify actions for improvement (above and beyond those already

identified / being pursued) and / or confirm progress of actions.

This provides the NTA with a snap-shot of its risk, controls and assurance profile at

intervals through out the year across a number of defined activities and processes

falling under 4 dimensions: key services, performance, compliance and governance

(covering 29 pre-determined activities).

The RCAD is updated quarterly, usually at a mid-way point in the period, therefore

providing for both a retrospective and forwards look to form a view as to the expected

risk profile and effectiveness of controls across the NTA.

19

Risk Controls & Assurance Dashboard (RCAD)

Case study - National Treatment Agency

Board

Executive

Key

Services

Performance

Compliance

Governance

Management Responsible for NTA activities, functions and

processes.

Risk Controls & Assurance Dashboard (RCAD)

Case study - National Treatment Agency

RCAD Extract:

Area of activity /

Responsibility

2. Compliance

Framework

2.1 Information

Governance / data

confidentiality and

access

(Disclosure in the

public domain)

IT Manager

Risk Profile

Controls

Evaluation

Contingency

Very

Effective /

• Assurance #1 (3rd Line) - Positive

Substantial

Evidence

• Assurance #2 (3rd line) - Positive

Impact = 5

Likelihood =

3

Risk, Controls & Assurance: Governance

Commentary

• Assurance #3 (2nd Line) - Positive

Previously

Impact = 5

Likelihood =

2

• Assurance #4 (1st Line) - Positive

Overview Commentary:

Reviews by IA / ALB / DH have provided

positive outcomes.

As the civil service requirements are more

stringent this means the NTA is not…..This

is currently being progressed.

Disclosure required

/ Actions Required

Escalation into

Strategic Risk

Register

Transition:

The current

disclaimer

regards data

gathering will no

longer be valid on

the transfer …..

This may

have…… It is

expected that by

….. a legal

judgment will

have been

reached on this

matter.

Monitor, but

no

escalation to

the strategic

risk register.

Increasing risk profile due to above.

21

Risk Controls & Assurance Dashboard (RCAD)

Case study - National Treatment Agency

NTA – Risk Profile: Period to 30th September xxxx

1.4

Previous profile

1.6a

5

2.1

3.1

2.1

Current profile

3.2 1.5

Impact

4

3.4

4.5 4.14

4.8

4.1

3

2

1.3

1.3

1.5

3.4

Transition related

1.6b

4.6 4.7

4.12 4.10

4.4

4.11

4.2

4.3

2.5

4.13 2.2

3.3

2.4

2.3

1.2

4.9

1

1

2

3

4

Likelihood

5

Risk Controls & Assurance Dashboard (RCAD)

Case study - National Treatment Agency

NTA – Internal Control Evaluation: Period to 30th September xxxx

1.6a

Control

Very Effective

5

3.1

4.6

3.4 2.5 3.3 2.1 4.9 4.84.13 4.14

1.5

4.11 4.2 1.4

4.1

4.12 4.4

1.2

4.5 4.7 2.4 1.6b 4.3

2.3

4

4.10

2.2

3.2 1.3

1.1

3

2

Ineffective

1

1

Limited

2

3

4

Assurance

5

Substantial

Risk Controls & Assurance Dashboard (RCAD)

Case study - National Treatment Agency

Extract - Overall Summary of disclosures / action required:

Key Services:

Performance:

1. Executive / Strategic risk:…..NTA in this

final phase.

1. Transition: The Head of Communications

will….

2. Transition: Transition risk management has

now become the main focus of the NTA in

this final phase…...

2. Transition: Corporate services

resilience…

3. Transition: Ineffective….of drug treatment.

4. Human Resources: There remains…..

Compliance Framework:

1. Transition: The current disclaimer…..

reached on this matter.

Corporate Governance:

1. Transition: Move towards….the

transition process with representation

from all …..

24

Risk Register Extract - Example

25

Risk Management Action Plan Extract - Example

26

Risk Controls Assurance Report Extract - Example

27

Key ERM Components

Ensuring the profile of risk management in the business

A risk management strategy that delivers value

Risk management directly informs business planning &

activities

Use of risk management information systems (MIS)

Risk assurance direction is driven by the business risk profile

Your thoughts, comments, questions?

Matt Humphrey

Partner

Risk & Governance Consulting

matthew.humphrey@bakertilly.co.uk

07764 688248

www.bakertilly.co.uk

www.insight4grc.com/demo

Baker Tilly Corporate Finance LLP, Baker Tilly Restructuring and Recovery LLP, Baker Tilly Risk Advisory Services LLP, Baker Tilly Tax and Advisory Services LLP,

Baker Tilly UK Audit LLP and Baker Tilly Tax and Accounting Limited are not authorised under the Financial Services and Markets Act 2000 but we are able in certain

circumstances to offer a limited range of investment services because we are members of the Institute of Chartered Accountants in England and Wales. We can

provide these investment services if they are an incidental part of the professional services we have been engaged to provide. Baker Tilly Creditor Services LLP is

authorised and regulated by the Financial Conduct Authority for credit-related regulated activities. Baker Tilly & Co Limited is authorised and regulated by the Financial

Conduct Authority to conduct a range of investment business activities.© 2015 Baker Tilly UK Group LLP, all rights reserved

This communication is intended to provide general guidance on matters of interest and you should not act or refrain from acting upon any information contained in it

without seeking appropriate professional advice