SBA and SBDC

advertisement

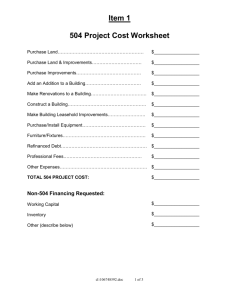

U.S. Small Business Administration The Three C’s of the SBA Created in 1953 by President Dwight D. Eisenhower Provide the Public with: • Mentoring • Government Procurement • Access to (3 C’s) (Counseling) (Contracting) (Capital) Small Business Resource Guide 2 Veterans are 45% more likely to be selfemployed. $2.4 million, or 9 percent of all U. S. small businesses are veteran owned. Veteran-owned small businesses generate owner $1 trillion in sales. 3 Rivera Consulting, Inc. • Information Technology Solutions Worldwide Filters, LLC • Wholesale Filters and Supplies Behavior Services & Therapy • Improvement in Quality of Life for Individuals with development disabilities. 4 Biomet, Inc. • Medical Device Industry Vera Bradley • Fashion Accessories Warm Glow Candles • Candles 5 NIKE Staples Apple Federal Express Ben & Jerry’s Ice Cream Outback Steakhouse Hewett Packard Panera Bread Callaway Golf 6 Counseling • Small Business Development Center (SBDC) • SCORE • Women’s Business Center (WBC) • Veterans Business Outreach Program Contracting • Partners In Contracting Corporation • SBA Economic Development Specialists • SBA Procurement Center Representatives 7 Capital • Banks • Credit Unions • Certified Development Companies (CDC) • Microlenders 8 SBA partners with financial institutions SBA’s role is primarily a guarantor of business loans made by financial institutions Disaster Loans - The SBA only offers direct loans in the event of a declared disaster order (separate division) No direct grants from SBA for starting or expanding a business www.grants.gov 9 Who is eligible for SBA loans? What criteria does the SBA evaluate? Where do you go to get an SBA loan? Why use the SBA loan programs? How do you get started? 1 0 Size of Business Type of Business Borrower Qualifications & Character Use of Proceeds 11 For-Profit business located in the U.S. Must qualify as “Small” per New Size Standard • Tangible Net Worth of Applicant Not more than $15,000,000 And • Average Net Income of Applicant Not more than $5,000,000 for the 2 full fiscal years before the date of application 12 U.S. Citizen, Lawful Permanent Residents, or Non-immigrant (documented) aliens Good Character • Criminal Record • Personal Credit Previous Federal Loan Payment History Personal Resource Test 1 3 Limited Membership Private Clubs Purchase Partial Ownership Repay Owners for their Investment Pay Delinquent Taxes/Refinance Loan Loan Packagers/Lenders Passive Income Speculative Ventures Pyramid Structures Illegal Activities Political Activities Religious Activities Gambling Activities Sexually-oriented Business ** Franchises = varies ** April 2010 | 14 Ability to repay the loan on time from the projected operating cash flow Feasible business plan Management expertise and commitment necessary for success Sufficient funds to operate the business on a sound financial basis Adequate equity invested in the business (no 100% financing) Sufficient collateral including personal guarantees 15 SBA guaranteed loans are made by business lenders at financial institutions No direct loans from the SBA Lenders have the forms necessary 1 6 Cannot qualify for conventional financing on reasonable terms Longer Maturities • Lowers Monthly Payment • Improves Cash Flow No Balloon payments on 7(a) loans No Prepayment Penalties on 7(a) loans 17 504 Certified Development Company (CDC) Loan Program and 7(a) Loan Program 18 Long-term, Fixed-asset Financing to: • Purchase Land and Existing Building • Purchase Land for New Construction • Building Renovation or Expansion • Purchase Major* Machinery / Equipment • Refinances are limited Occupancy Requirements: • • 51% of existing building 60% of new construction (80% long term) 19 7(a) Loan Guaranty Program 20 Most used SBA Loan Program Wide range of financing needs • Funding for start-up businesses • Purchase existing business • Expand/renovate facilities • Finance working capital/receivables • Construction • Refinancing* 21 ‣SBA Express ‣Veterans Advantage ‣Caplines ‣ Export Loans 22 Veterans Service-disabled veterans Soon to be discharged active-duty service members eligible for the military’s Transition Assistance Program Current Reservists and National Guard members Current Spouse of any of the above Widowed spouse of: • a service member who died while in service, or • a veteran who died of a service-connected disability 23 For members of the military community* (51% owned & controlled) Maximum Loan Amount: $350,000 Delegated Processing: Lender Underwriting Lender Closing Docs Collateral is not required up to $25,000 24 Approved Loan Amount • $350,000 or less = 0.00% of Guaranteed Amt • $350,001 to $700,000 = 3.00% of Guaranteed Amt • $700,001 to $1,000,000 = 3.50% of Guaranteed Amt • Over $1,000,000 = 3.75% of Guaranteed Amt on portion over $1Million • Short-term: Maturity 12 Months or Less = 0.25% 25 Borrower equity injection is required (100% financing is not available) All Borrowers must give Personal Guaranty Personal assets required to cover shortfall Loan is with the Lender not the SBA SBA Guaranty is for the Lender Borrower still liable for 100% of the loan 26 27 Veterans Business Outreach Center Veterans Online Business Registry Service Disabled Owned Small Business Indiana’s Veteran Business Enterprise Program 28 Indiana – David Puls David.Puls@sba.gov or Eric.Armacost@sba.gov Illinois – Robert Paoni Robert.Paoni@sba.gov Kentucky – Tommie Causey Tommie.Causey@sba.gov Ohio – Joe Lauterdale - Cincinnati Joe.Lauterdale@sba.gov 29 U.S. Small Business Administration Indiana District Office Presented by Eric Armacost Lending Relations Specialist (317) 226-7272 ext. 120 Eric.Armacost@sba.gov www.sba.gov/in 31 Our Resources. Your Success. The S.W. ISBDC provides no-cost confidential business advising for businesses in the areas of: Business Planning Access to Capital Market Research Budgeting/Accounting Loan Packaging Assistance To have a positive and measurable impact on the formation, growth, and sustainability of small businesses in Indiana, and to develop a strong entrepreneurial community. S.W. ISBDC Office Client Portfolio Overview Status 23% established business > one year 21% in business < one year 56% “pre-venture” 56% Start-up assistance 16% Accounting/budgeting 10% Financing/Capital 6% Management/planning 5% Buy/sell a business 4% Market research Lucas Oil Products The first store by Lucas in the nation Investment exceeded $2.7 mil Hired x# of employees Expanding to 2nd store in fall 2012 ECS Solutions Patented new technology Increased company’s bottom line with new markets and new Revenues 2008-2012 77 – Purchased or started new business 781 – Jobs Created $3.1 million – Change in Sales $15.8 million – Cap Investment Other: identified new products, services and new markets, secured training dollars, etc. Call 812.425.7232 Go to the ISBDC.org website and complete the business survey Our Resources. Your Success. LEDOs Accounting & Law Banks ISBDC WorkOne Chambers Universities SBDC Summary New business creation Local investment Business expansion Job Creation Encourage entrepreneurship Regional engagement 49 50 Export Working Capital Program (EWCP) International Trade Export Express Maximum Loan Amount $5,000,000 $5,000,000 $500,000 Maximum Guaranty Percentage 90% 90% 90% for loans $350,000 or less 75% for loans Greater Than $350,000 51 504 Certified Development Company (CDC) Loan Program and 7(a) Loan Program 52 Long-term, Fixed-asset Financing to: • Purchase Land and Existing Building • Purchase Land for New Construction • Building Renovation or Expansion • Purchase Major* Machinery / Equipment Financing Structure: • SBA (CDC): up to 40% of total project costs • Lender: 50% of total project costs • 10%* of total project costs Borrower: 53 Project Size • Maximum: Unlimited 100% SBA Guaranteed Debenture (CDC) • Minimum: • Maximum: $25,000 $5.0 Million Standard $5.0 Million Public Policy Goal $5.5 Million Small Manufacturer or Energy Savings 54 Lender • • • 1st Lien Position with only 50% Loan-to-Value 90% financing increases potential opportunities CRA credit Borrower • • Lower down payment preserves capital Fixed Rate with full amortization Community • Creates or retains jobs 55 Maximum Loan Amount: $5.00 Million Maximum Guaranty Amount: $3.75 Million Maximum Guaranty Percentage: • 85% up to $150,000 • 75% over $150,000 Multiple loans permitted up to $3.75 Million Guaranty Maximum 56 Real Estate • Up to 25 years Equipment • Up to 10 years or expected useful life Working Capital • Generally 7 years, but may be extended to 10 years depending on cash flow 57 $100,000, 10 year term Fixed Rate Option: • Base Rate: 5.47% + 2.75% = 8.22% Variable Rate Option: • Prime: 3.25% + 2.75% = 6.00% 58 7(a) Program = 827 Loans @ $265,834,000 504 Program = 143 Loans @ $189,050,000 Combined 7(a) and 504 Statistics • 12,740 Jobs Created or Retained • 270 Loans to Start-Ups • 103 Veteran-Owned 59 Step 1: Create / Update your Business Plan Free Counseling Available from SBA Resource Partners • SCORE • Small Business Development Center (SBDC) • Women's Business Center (WBC) 60 Step 2: Visit a Lender Lists are available from the SBA • Approved Lenders and Most Active Lenders Lender makes initial credit decision • May or may not need SBA Guaranty • Lender has right to say ‘no’ Lender chooses appropriate SBA Loan Program • SBA decision to lender in 0-15 business days Be Prepared • Treat meeting like a job interview • Having supporting financial documentation 61 Business Plan History/description of business Management experience/resumes Cash flow projections Last 3 years of income statements and balance sheets with interims to date Last 3 years of filed business tax returns and personal tax returns Aging of receivables; inventory listings 62 Quotes/purchase contracts for items to be purchased with loan proceeds Listing with terms of other business debts Franchise agreements Leases Details of criminal history: type of offense, dates, etc. (if any) 63 $500 Billion Spent Annually 23% Goals For Small Business ($115B) DNS # Data Universal Numbering System Register with System for Award Management SAM.gov Register at Vetbiz.gov 64 65 66 + MARGIN Maturity Maturity < 7 years > = 7 years LOAN AMOUNT BASE RATE* Over $50,000 Fixed or Variable + 2.25% + 2.75% $25,000 to $50,000 Fixed or Variable + 3.25% + 3.75% $25,000 or less Fixed or Variable + 4.25% + 4.75% 67