Arbitron PowerPoint Template

advertisement

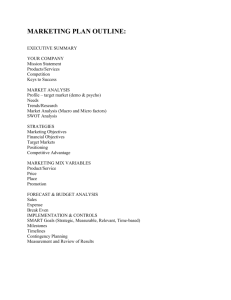

Selling with Numbers Applying Scarborough and Arbitron Data Jenny Griffith Nat’l Agency Training Consultant Arbitron Inc. Los Angeles, CA Special Guest: Monica Narvaez Agenda »Who is Arbitron and why is it important? »Methodology and Terminology »Using Arbitron as a resource for sales »Additional Training Resources Who is Arbitron? Arbitron is….. A media research company that measures network and local market radio audiences across the United States How does Arbitron Impact you? Radio stations and radio groups use Arbitron’s local and regional radio ratings services to demonstrate the value of their audience to advertisers Where do Ratings Come From? © 2011 Arbitron Inc. 4 How would you know if this lake is contaminated? The Sample in Los Angeles Arbitron: February 2013 © 2011 Arbitron Inc. 6 PPM (Portable People Meter) The PPM Hardware Encoder Recharging Base Unit Portable People Meter (PPM) Data Collector/ Modem TM PPM 360 The Next Generation PPM 360 is a bridging technology that creates a path to leveraging emerging mobile platforms and creating the ability to provide new services. The newly designed meter: • Has a sleeker, smaller design • Is easier for panelists to set up, use and charge • Marries PPM technology with a mobile wireless platform for mobile data retrieval— anytime, anywhere • Gives Arbitron the ability to send messages to panelists with a new text screen PPM Measurement System “Three Simple Rules” » Keep your meter with you » Keep the green light on » Recharge your meter at bedtime Note: PPM detects codes even when docked and regardless of green light status L.A. Median Carry Times by Sex/Race Out-of-Dock Time Carry Time 15:52 15:03 Men 16:12 15:55 15:45 14:45 Women 14:58 Other Source: Los Angeles PPM , Weekday 15:38 15:04 Black 14:50 Hispanic Turning Data into Dollars QuaNtitative vs. QuaLitative NUMBERS LIFESTYLE Arbitron Scarborough HOW MANY people are WHO is listening to my station listening to my station? and what are their shopping/lifestyle behaviors? How Will You Use Arbitron Data…. »Uncover strengths & weaknesses of your station • Provide your station’s insights to clients • Understanding your competition • Ability to understand individual daypart and demo performance »Price radio ad time • CPP’s (Cost Per Point) Quantitative Radio Estimates Cume Persons (Cume) Time Spent Listening (TSL) Average-Quarter-Hour Persons (AQH) Average-Quarter-Hour Rating (Rating) Average-Quarter-Hour Share (Share) Reach Frequency Cume Persons TOTAL DIFFERENT The number of people who tune in to your station for at least 5 mintutes How many potential customers What is the benefit of a large Cume to the client? You can invite a large number of potential customers to buy your product or use your service Use it with: Local/direct clients; Cume drives reach in a campaign schedule For Cume Listeners have to tune in only once to be counted CUME = 7 Different Listeners Time Spent Listening AVERAGE listener The amount of time the spends with a station within a daypart High TSL can be translated to listener loyalty Expressed in Hours and Minutes What is the benefit of having long TSL to the client? The customer will hear your message enough times to remember it and to act on it. AQH Persons AVERAGE The number of people listening to a particular station for at least five minutes within a 15-minute period of time The number of people who will hear a commercial each time it plays Average Persons 12:00-12:15 = 200 12:15-12:30 = 300 12:30-12:45 = 100 12:45-1:00 = 500 1,100 1,100 4 Qtr. Hours = 275 Average Persons © 2011 Arbitron Inc. 21 The Basic Building Blocks of Arbitron Radio Data Cume TSL AQH (Avg Qtr Hour) AQH Rating The AQH Persons estimate expressed as a population being measured % of the The % of people listening to a particular station compared to the population AQH Persons Population X 100 = Rating Share % The of those listening to radio and are listening to a particular station This measurement is only taking into consideration a universe of people listening to the radio Rating vs. Share Everyone in Market (Universe/Population/Metro) Those Listening to Radio Those Listening to a Particular Station Rating Your listeners expressed as a % of the TOTAL MARKET population Everyone in Market (Universe) Those Listening to a Particular Station Share Your listeners expressed as a % of the RADIO LISTENING population Those Listening to Radio Those Listening to a Particular Station Together the Blocks Build…. TSL Cume AQH (Avg Qtr Hour) Rating Share Reach DIFFERNT people who are EXPOSED to a commercial at least once The number of during an advertising schedule The higher a station’s Cume, the easier it is to build message Reach Expressed as a % Frequency AVERAGE The number of times a listener hears a commercial throughout a schedule The higher a station’s TSL, the easier it is to build message Frequency Putting it all Together in a Ranker REACH FREQUENCY How Does the Ranker Change with a Hispanic Audience…. © 2011 Arbitron Inc. 32 Hour By Hour Reports What are your peak times of the day? • Consider non-peak times to help small budget Advertisers • If their budget does not allow them to own a station they may be able to own a daypart Understanding the Geographical Strengths of Your Station Compositions Reports © 2011 Arbitron Inc. 34 Benchmark Reports How efficient is your station comparatively Duplication Grids »Do you share an audience with a more premium priced station? © 2011 Arbitron Inc. 36 Scarborough © 2011 Arbitron Inc. 37 Scarborough Measures… Shopping/Retail Behavior • Shopping Centers • Malls • Department Stores • Drug Stores • Supermarkets • Convenience Stores • Discounters • Mass-Merchandisers • Specialty Shops • Clothing Stores • Sporting Goods • Furniture Stores • Coupon Usage • On-line and Off-line Product/Service Consumption • Alcoholic/Non• • • • • • • • • • Alcoholic Beverages Automotive Banking & Financial Computers Fast Food & Restaurants Home Improvement HealthCare/Insurance Travel Business-to-business Internet Usage Telecommunications Entertainment/ Lifestyle • Sports Involvement • Events Attended • Leisure Activities • Personal Activities • Voting Behavior Demographics • 24 Individual & HH Level Measures • Lifestyle Changes Media • Newspaper • Radio • TV-Broadcast • TV-Cable • City/Regional • • • • • Magazines Out-of-Home Direct Mail Yellow Pages Computer On-Line/Internet How Might You Use Scarborough Data… »Show the value of your listeners in the category • Great for Cold Calls • Sell your listeners, not a Ranker • Show WHY advertising is needed »Calculate a Return On Investment (ROI) • Let clients see what they could get for their investment • Allows you to build better promotions and co-op opportunities • Create directed copy to send the RIGHT message to your audience they are more likely to tune into Prospecting by Category Products KAMP Listeners Plan on Buying in the Next 12 mos. Market/Release: Los Angeles, CA 2011 Release 2 Total (Aug 2010 - Jul 2011) Base: Total Adults 18+ Projected: 13,593,028 Respondents: 9,208 Target: KAMP FM KAMP FM 6AM - MID M-S CUME Projected: 2,692,692 Respondents: 1,401 Percent of Base: 19.8% Where are KAMP Listeners buying furniture? Did you know that… Over 1.6 Million Consumers Plan on buying a mattress in LA this year? One out of four of mattress buyers are Hispanic! Top 5 stores for mattress shoppers! X Radio Listeners are 88% more likely to buy a mattress than the average Hispanic! Last year our listeners spent over $2.8 million dollars in mattress purchases! For more information on attracting mattress buyers to Your Store, contact: Account Executive Source: Los Angeles, Scarborough R2 2010 Phone Number Selling the Quality of your Listeners for a Particular Brand (Trader Joe’s) Ranker Report Export from TAPSCAN Web Market: LOS ANGELES Survey: Arbitron February 2013 Geography: Metro Stations: Qualitative Survey: User Selected Qualitative: Purchased most groceries at Trader Joe's (wk) Scarborough R2 2012: Aug11-Jul12 Socioeconomi c Pop Intab Avg Daily: Adults 25-54 5,610,200 Avg Daily: 1,315 Avg Weekly: Adults 25-54 5,610,200 Avg Weekly: 1,139 Age/Gender Age/Gender Adults 25-54 Qual Pop Avg Daily: 322,800 Qual Intab Adults 25-54 Avg Weekly: 322,800 214 © 2011 Arbitron Inc. 43 1.6Mil people have been to a Dodgers game in the past year And they are heavy RADIO consumers Index 122 48.2% 119 98 40.4% 105 86 39.9% 113 How can you position this data? Where is radio in your media mix? Let us partner to help you increase your attendance. © 2011 Arbitron Inc. 44 WHO: Choose an event or brand as the target in order to provide demographic insight on their consumers What: % of attendees that listen to your station weekly Ways to Use on a Cold Call How to Read: 18.3% of HHs that plan to buy a new car in the next year listen to your station! Market KAAA-FM TIP: Change view to Persons to see how many potential buyers are found on your station! Things to Consider When You are Looking for a Story in the Data…… »Geographic Strengths »Demographic Strengths »Loyalty Listening Strengths »Composition Strengths »Helping the Buyer Buy Additional Training »Schedule trainings with your Training Service Consultant • Denise Kaduri – denise.kaduri@arbitron.com – 410-794-2867 »Sign up for virtual training online • Check out arbitrontraining.com – Live Lead – On Demand »Arbitron Training has a YouTube Channel • http://www.youtube.com/user/ArbitronTraining – Spanish Language Radio Today – Country Radio Today – Training Videos There are lot’s of Resources at your Disposal…..Take Advantage! © 2011 Arbitron Inc. 49 Questions Thank you! Jenny Griffith Sr. Training Service Consultant Jenny.griffith@arbitron.com © 2011 Arbitron Inc. 50