Justifications for Intergovernmental transfers

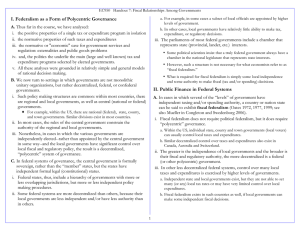

advertisement

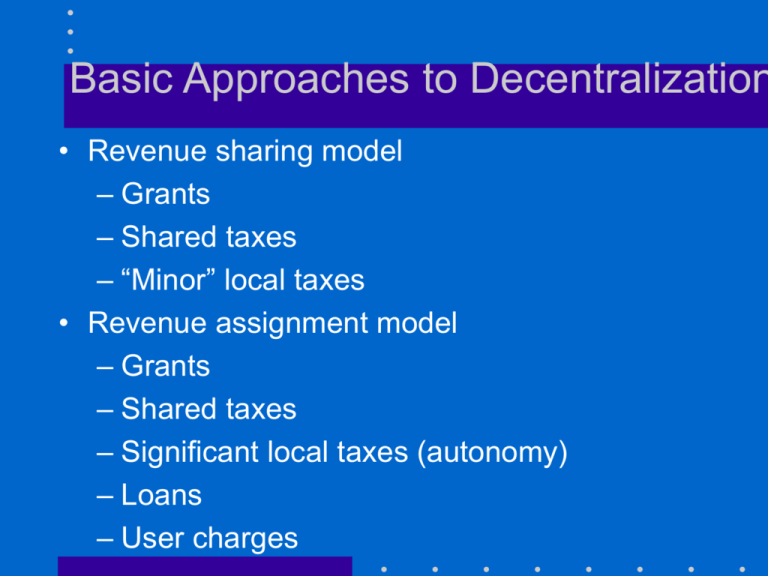

Basic Approaches to Decentralization • Revenue sharing model – Grants – Shared taxes – “Minor” local taxes • Revenue assignment model – Grants – Shared taxes – Significant local taxes (autonomy) – Loans – User charges Justifications for Intergovernmental Transfers • • • • Close the “fiscal gap” Equalize fiscal capacity and need Adjust for spillovers Increase effectiveness of central expenditures • Political reasons Transfers are merely instruments Policy outcomes are key: what gets done, for whom and at what cost Closing the “Fiscal Gap” Cause of “Fiscal Gap” Means to Close the Gap Greater expenditures assigned Change the revenue or to local governments than expenditure mix among revenues or too few revenues levels of government Local governments are spending beyond their means Introduce controls or restraints on local governments Local governments are not making use of the revenue sources available to them Enhance local fiscal effort Equalizing Fiscal Capacity • Equalize the position of governments, not people • Allocate unconditional grants: give funds to government and let them spend as they choose • Allocate conditional grants: allocate funds for specified purpose • Avoid “gap filling” Adjusting for Spillovers • • • • Importance of spillovers Alternatives to transfers Getting public sector “prices” right Varying price with capacity “Spillover” grants do not always induce additional local spending How Can Intergovernmental Grants Promote Decentralization? • Revenue adequacy • Certainty • Unconditional Alternative Forms of Intergovernmental Grant Programs Method of determining total, distributable pool Method of allocating pool among eligible units Specified share of national or state gov’t tax Ad hoc decision Reimbursement of approved expenditures Origin of collection of the tax A ---- --- Formula B F --- Total/partial cost reimbursement C G K Ad hoc D H --- Appropriateness of Various Grant Types Objective Of national government Maintain control over local finances Stimulate expenditures for a particular function/overall tax effort Equalize services and fiscal capabilities among localities Increase local tax effort Of local government Maintain control over local finances Plan efficient budget Increase adequacy of local revenues Joint Minimize administrative costs Grant Type A B C D F G H K - - - ? + + + + ? ? + ? ? + ? + - + ? + + ? + ? ? ? + + ? + ? + + + ? ? - + + ? ? - + + + ? - - - - - + + ? - ? ? - ? - Designing & Managing Intergovernmental Grants • Determine the “distributable pool” • Design transparent and simple formulas that reflect the purpose of the grant – tax sharing/general grants for closing the fiscal gap – specific, matching (conditional) grants for correcting spillovers – general, formula (unconditional) grants for equalizing fiscal capacity • Specify terms and conditions • Establish financial reporting, program monitoring, evaluation Intergovernmental Grant Lessons • Outcomes should drive design • Expect changes in formula over time • Is “distributable pool” a discretionary element in the central budget or an entitlement of local government? Improving Capital Grant Allocations • Encourage good practices (e.g., O&M) through eligibility terms and conditions • Establish objective, clear and transparent process for project selection • Provide adequate technical assistance • Implement procedures to monitor and evaluate local activities (e.g., progress reports, field visits) • Assess future infrastructure needs through periodic surveys