The contemporary needs of general and earmarked grants in Korea

advertisement

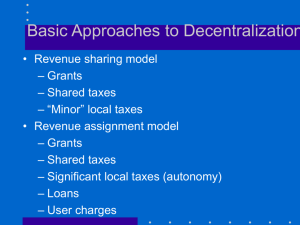

KIPF The contemporary needs of general and earmarked grants in Korea: Assessment Hyun-A Kim Korea Institute of Public Finance 2009 Copenhagen Seminar, Sept. 17-18 KIPF Introduction Political decentralization • Fiscal decentralization began again in 1991 with the appointment of council members, and established in1995 by the election of local representatives in Korea • Hypothetically, in an electoral process, people articulate their demands by their voting preference • Local representatives has to obtain voters’ preference • Some empirical results : the relationship between election and fiscal expansion 2009 Copenhagen Seminar, Sept. 17-18 KIPF Introduction Fiscal decentralization… • Given the political, global and fiscal trends as well as other hosts of reason, local government’s role has to be expanded alongside the increase of its fiscal size. • Intergovernmental fiscal transfers has steadily grown • However, fiscal power of local governments has not symmetrically grown. 2009 Copenhagen Seminar, Sept. 17-18 KIPF Increasing local expenditure by using grants The budget size and expenditure share of general government Education Local Central Total expenditure 120% 300 100% 250 80% 50.50% 48.40% 47.20% 46.10% 42.30% 40.30% 60% 200 150 40% 35.90% 37.70% 38.60% 40.50% 43.60% 45.10% 20% 100 50 13.60% 13.90% 14.20% 13.40% 14.10% 14.60% 2003 2004 2005 2006 2007 2008 0% 0 2009 Copenhagen Seminar, Sept. 17-18 Increasing local expenditure by using grants Transfer to total government expenditure in 2005 Source: OECD (2009) 2009 Copenhagen Seminar, Sept. 17-18 KIPF Limited local tax share and taxing power Limited local tax share and low taxing power • While the majority of expenditure are done at the local level, only very limited autonomy is available in local spending decisions. • Local politicians tend to avoid increasing tax rate • Flexible tax rate is not activated… • This tendency exacerbate soft budget problem and lower taxing power. 2009 Copenhagen Seminar, Sept.17-18 KIPF KIPF Limited local tax share and taxing power The steady share of local tax 20.2% 20.8% 20.5% 20.7% 20.5% 20.8 % National 166 147 Rotio to the National 122 131 135 29 32 34 35 38 44 2003 2004 2005 2006 2007 2008 114 2009 Copenhagen Seminar, Sept.17-18 Local Limited local tax share and taxing power Revenue assignment • Local revenue is composed of own source revenue such as local tax(33%), non tax revenue (29.7%), local bonds (2.7%) • Intergovernmental fiscal transfer such as revenue sharing (LST, 20.9%) and National subsidy (13.8%) in 2007 • Without non-tax revenue, the share of local taxes is around 50%. General and earmarked grants are 29.5% and 19.6% respectively 2009 Copenhagen Seminar, Sept.17-18 KIPF An overview of intergovernmental fiscal transfer KIPF Revenue composition of local governments 130 120 110 100 90 Own source revenue Earmarked Grant General Grant Expenditure 80 70 60 50 40 30 20 10 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2009 Copenhagen Seminar, Sept.17-18 KIPF An overview of intergovernmental fiscal transfer Types of grants in Korea NonEarmarked Mandatory General grants (LST, DRS 2010) Mandatory (SABND, LTF) Matching Grants Earmarked Nonmatching Discretionar y (NTS) Matching Nonmatching 2009 Copenhagen Seminar, Sept.17-18 KIPF Steady increase in local tax Local taxes and grants share 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Earmarked 2009 Copenhagen Seminar, Sept.17-18 General TAX Intergovernmental fiscal transfers Local Shared Tax • Major fiscal equalization system by revenue sharing a fixed percentage (19.24%) of Domestic National Tax • The objective of ordinary LST is to equalize the fiscal capacities of local governments • Notably, dependence of LST to local revenue has increased significantly from 15.0% in 2002 to 20.9% in 2007. • 2.5% share of LST to GDP ( Japan 4%, Northern European countries 2-4% share…) 2009 Copenhagen Seminar, Sept.17-18 KIPF Intergovernmental fiscal transfers Decentralization Revenue Sharing • From the perspective of grant design, DRS is an example of changing funding system • Mainly, funding source of social welfare programs has been changed from specific to general grants (0.94% of National Domestic Tax) • Central local management and operation • It is scheduled to return to LST in 2010 • It is easily expected that under-provision of welfare spending since money is fungible under the general grants 2009 Copenhagen Seminar, Sept.17-18 KIPF Intergovernmental fiscal transfers Decentralization Revenue Sharing • DRS programs are from NTS projects such as mainly social welfare related expenditure. • The rationale of the implementation of DRS was the devolution of welfare provision from central and local governments • Under the lower fiscal capacity and political incentive, the reduction of social service budget will happen • Now, it is evaluated that DRS failed to be operated in its real sense 2009 Copenhagen Seminar, Sept.17-18 KIPF Intergovernmental fiscal transfers Local transfer fund • Local transfer fund was introduced in 1991 as a conditional block grant • Contribution : around 70% of the LTF is to be used for local road maintenance. • Tax-sharing: the fund was transferred directly to local govts without first being accounted for in the central budget. • Qualitatively, it was almost same with the NTS • This was abolished in 2005 LST • Earmarked General way 2009 Copenhagen Seminar, Sept.17-18 KIPF Intergovernmental fiscal transfers National treasury subsidy • National treasury subsidies are categorical grants provided by the central government to local governments for specific projects • Social welfare and the increase of fiscal needs after local autonomy are the reasons of expanding NTS from 1995 to 2002 The reform of NTS in 2005 • Finally, reliance on earmarked grants has been reduced from 22% in 2002 to 13.8% in 2007. 2009 Copenhagen Seminar, Sept.17-18 KIPF Intergovernmental fiscal transfers Special Account of Balanced National Grants • Implementation of new formula to distribute for provincial bases : NTS earmarked block grant • The discretionary power of the line ministries had been reduced because nearly half of the SABND grants are formula based • Fiscal flexibility in local government • However, the three-year implementation evaluation did not manifest local efforts to promote high quality of public delivery 2009 Copenhagen Seminar, Sept.17-18 KIPF Intergovernmental fiscal transfers KIPF Political needs : Tax-sharing or general grants? • With a long debate, new ‘tax-sharing’ way of revenue increasing in local govt. are determined by the Introduction of Local Consumption Tax and Local Income Tax • For example, 20% of VATLCT • Arguments : urban concentration of tax bases, qualitatively same with LST….. • Despite of many problems, political meaning of LOCAL TAXES dominate rather than GRANTS…. 2009 Copenhagen Seminar, Sept.17-18 KIPF System change of intergovernmental fiscal transfers Reform of the specific grants: Comparison of transfers from 2005 Determination Method of Financial Resource Distribution Method among Regions LST, DRS Constant Portion of Domestic Tax Revenue Formula Based • 100% of Liquor tax • Specific Transfer • Other Fees Formula Based SABND NTS Determined Every Year 2009 Copenhagen Seminar, Sept.17-18 at discretion KIPF Intergovernmental fiscal grants Contrasting figure after 2000 (among 16 regions) General Grants 8% Capital area Earmarked Grants Non capital area 8% 7% 7% 6% 6% 5% 5% 4% 4% 3% 3% 2% 2% 1% 1% 0% 0% 1997 2000 2009 Copenhagen Seminar, Sept.17-18 2005 Capital area 1997 Non capital area 2000 2005 Intergovernmental fiscal transfers Recent change turns to the way of general grants…. • NTS DRSLST , NTS SABND, LTFLST • Tax sharing or general grants : The introduction of Local Consumption Tax and Local Income Tax • ‘Federalist approach’ : simple lump-sum transfers with no conditionality would be desirable • Korea is one the leading countries to expand general grants for fiscal federalism • Easy money dependency is getting bigger 2009 Copenhagen Seminar, Sept.17-18 KIPF KIPF Discussion Would this trend be desirable in Korea? • This paper tends to focus more on the effectiveness of earmarked grants in Korea as a developing economy • The reasons are following : • 1) Korea is not a developed country, but in an immature stage in local autonomy • 2) Soft budget relations between donor and recipient 3) Welfare expenditure needs rises 2009 Copenhagen Seminar, Sept.17-18 KIPF An assessment Soft-budget problem • Intergovernmental risk sharing might be fundamental issue • Soft budget relations between donor and recipient may exacerbate the effectiveness of grant purpose regardless of the choice of grants • To smooth soft budget problem, tight linkage between marginal increase of revenue and their works should be done • Now, local governments are not main providers of education, health, social services to be the ultimate fiscal charger, expenditure assignment should be rearranged 2009 Copenhagen Seminar, Sept. 17-18 An assessment KIPF Fundamental incentive effect in LST • “Tax effort problem” : Intrinsically, local gvts have incentive to enlarge local needs while reduce local revenue • The process of calculating the incentive revenue is not legally binding. The ambiguity leads local gvts. to believe that efforts to boost their tax revenue reduce the amount of the LST that they receive • Accountability and responsibility of general grants? 2009 Copenhagen seminar, Sept. 17-18 KIPF An assessment Welfare expenditure rises… • Fiscal needs Social welfare • Intergovernmental welfare arrangement in function and money is the hottest issue • Asymmetric information problem between central (revenue source) and sub-central (local information) governments is growing especially in welfare service program • Under-provision of public good such as politically unattractive service (disabled supports, low income people…..) would happen 2009 Copenhagen Seminar, Sept.17-18 KIPF Enlargement of social service in local expenditure Composition of local expenditure between OECD and Korea 35% Korea OECD 30% 25% 20% 15% 10% 5% 0% Public·admin Econ·develop 2009 Copenhagen Seminar, Sept. 17-18 Housing Health Education Social protect KIPF Enlargement of social service in local expenditure Per capita social expenditure in Seoul 90 Public Admin Social Expenditure Economic Expenditure 75 60 45 30 15 0 1995 1996 1997 1998 1999 2009 Copenhagen Seminar, Sept.17-18 2000 2001 2002 2003 2004 2005 2006 2007 KIPF Conclusion Findings and policy suggestion • Own purpose of grants is established from 2000, especially in earmarked grants. • Soft budget issue and the introduction of tax- sharing with the same source of money seem to impede the justification of the increase of general grants. • My conclusion : with these observations, the function of earmarked grants in comparison with general grants might be more suggestive in Korea. 2009 Copenhagen Seminar, Sept.17-18