Definitions: Types of Intergovernmental Transfers

Intergovernmental Transfers

Professor Roy Bahl

Georgia State University

(rbahl@gsu.edu)

Definitions

Why Use Transfers

How To Design A Transfer System

The Political Economy

2

Definitions

Intergovernmental transfers

– Grants

– Subsidies

– Shared taxes

Local taxes

Piggyback local taxes

3

Definitions:

Types of Intergovernmental Transfers

Unconditional or general

Conditional or specific (for capital and/or operating expenditures)

– Non-matching

– Matching

• Open-ended

• Close-ended

Direct cost reimbursement

4

Why Have

Intergovernmental Transfers?

5

Justifications for

Intergovernmental Transfers

Close the “ fiscal gap ”

Equalize fiscal capacity and need

Adjust for spillovers

Increase effectiveness of central expenditures

Political reasons

6

How To Close A Fiscal Gap

More Transfers

More Local Raised Revenue

Local Expenditure Efficiency

Re-Assign Expenditure / Responsibility

7

Equalization

The objective of an equalization transfer should be to protect (or guarantee?) some basic level of services

8

What Do We Equalize?

Fiscal Capacity

Expenditure Needs

Capacity – Needs Gap

9

The Special Case of Natural

Resources Revenue Sharing

10

Natural Resource Revenue

Sharing: The Case for More

Centralization

The Stability Argument

The Disparities Argument

The Local Capacity Argument

The National Treasure Argument

11

Natural Resource Revenue

Sharing: The Case for More

Decentralization

The Cost Reimbursement Argument

The Heritage Argument

The Conflict Resolution Argument

12

Design Issues For

Intergovernmental Transfers

13

How Can Intergovernmental

Transfers be Decentralizing?

Revenue Adequacy

Certainty

Unconditional

14

How Can Intergovernmental

Transfers be Centralizing?

No Transparency In Vertical Sharing

Ad Hoc Distributions

Uncertainty and Year-To-Year Changes

Strict Conditions

15

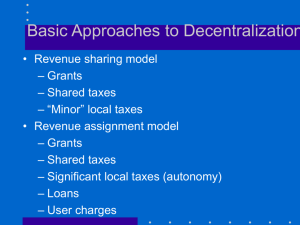

Alternative Forms of

Intergovernmental Transfers

Method of determining total to be distributed

Method of allocating total among eligible units

Specified share of central tax

Ad hoc decision

Reimbursement of approved expenditures

A ---- --- Origin of collection of the tax

Formula

Total/partial cost reimbursement

Ad hoc

B

C

D

F

G

H

---

K

---

16

Goals of Central Government

Control Local Finances

Equalize Services and Fiscal

Capabilities among Localities

Stimulate Expenditures for a Particular

Function or Overall Tax Effort

Increase Local Tax Effort

Minimize Administrative Costs

17

Goals of Local Government

Maintain Control over Local Finances

Plan Efficient Budget

Increase Adequacy of Local Revenue

Flow

Minimize Administrative Costs

18

Intergovernmental Grant Lessons

Desired outcomes should drive design

One grant/transfer instrument cannot accomplish multiple objectives

Expect changes over time

Is “ distributable pool ” a discretionary element in the central budget or an entitlement of local government?

19

Intergovernmental Grants: How

Not To Do It!

Deficit Grants

Complicated Formulae

No Transparency

No Continuity

Base it on The Amount Spent

No Evaluation

20

The Special Problem of Transition

The Need for a Phase-In Plan

Separating the Pieces

The Learning Curve for Local

Governments

Hold Harmless Provisions

Education

Implementation Planning

Central Leadership

21

The Political Economy of Transfers

President

Parliament

Ministry of Finance

MOHA

Line Ministries

Urban Local Government

Rural Local Government

22