Chapter 22– Public Finance in

a Federal System

Public Finance

1

McGraw-Hill/Irwin

© 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

Introduction

• This chapter will address questions

related to different levels of government:

– How should various responsibilities be

allocated to different levels of government?

– Is decentralized government decision making

desirable?

– Are locally raised taxes a good way to pay for

services provided locally?

2

Background

• A federal system consists of different

levels of government that provide public

goods and services and have some

scope for making decisions.

• Fiscal federalism explores roles of

different levels of government and how

they relate to one another.

3

Table 20.1

Table 20.2

Subnational government spending/revenue as a

share of total government spending/revenue,2001

Spending %

Greece

Revenue %

5.0

3.7

Portugal

12.8

8.3

France

18.6

13.1

Norway

38.8

20.3

United States

40.0

40.4

Denmark

57.8

34.6

OECD Average

32.2

21.9

5

Fiscal Federalism Abroad

• The higher level of centralization in other

nations exists because state/local governments

have almost no legal power to tax citizens.

• Many countries practice fiscal equalization,

whereby the national government distributes

grants to sub-national government in an effort

to equalize differences in wealth.

6

Fiscal Federalism Abroad

• There has been a move toward decentralization

around the world.

• In the U.S., there have been increased efforts to

shift control and financing of public programs

to the states, such as with welfare reform in

1996.

7

OPTIMAL FISCAL FEDERALISM

Public goods provision problem compounded with issues of

split levels of government

• What is the optimal division of responsibilities

across different levels of government?

• A theory of how the efficiency of public

goods provision may differ at different levels

of government helps answer this questions.

8

OPTIMAL FISCAL FEDERALISM

• Two of the major problems in public goods

provision are:

– Preference revelation: Difficult to design democratic

institutions to cause individuals to reveal their

preferences honestly.

– Preference aggregation: Difficult to aggregate

individual preferences into a social decision.

9

The Tiebout Model

• A number of activities are run primarily at the

state and local levels.

– Education

– Public safety

– Highways

– Public welfare

10

The Tiebout Model

• Tiebout (1956) argued that the ability of individuals

to move across jurisdictions produces a market-like

solution to the local public goods problem.

• Tiebout showed that the inefficiency in public goods

provision came from two missing factors: shopping

and competition.

• Shopping induces efficiency in private markets.

• Competition induces the right prices and quantities in

private markets.

11

The Tiebout Model

• With public goods provided at the local level,

competition naturally arises because individuals can

vote with their feet by moving to another town without

much disruption.

• This induces fiscal discipline for local governments

and creates a new preference revelation device: mobility.

• Tiebout argued that the threat of exit can induce

efficiency in local public goods production.

• Under certain (unrealistic) conditions public goods

provision will be fully efficient at the local level.

12

The Tiebout Model

• Voting with your feet

• Tiebout’s assumptions

– Government activities generate no externalities

– Individuals are completely mobile

– People have perfect information with respect to each

community’s public services and taxes

– There are enough different communities so that each individual

can find one with public services meeting her demands

– The cost per unit of public services is constant so that if the

quantity of public services doubles, the total cost also doubles

– Public services are financed by a proportional property tax

– Communities can enact exclusionary zoning laws—statutes that

prohibit certain uses of land

13

Problems with the Tiebout Model

• Tiebout competition may not hold because:

– It requires perfect mobility.

– It requires perfect information on the benefits

individuals receive and the taxes they pay.

– It requires enough choice of towns so that

individuals can find the right levels of public

goods.

14

Problems with the Tiebout Model

• Tiebout financing is problematic because:

– It requires lump-sum taxes that are independent

of a person’s income. This is viewed as highly

inequitable.

– It is more common for towns to finance public

goods through proportional taxes on homes,

leading to the problem of the poor chasing the rich.

– The use of zoning can ameliorate this problem.

15

Optimal Federalism: what level

should provide which services?

• What is the optimal allocation of

economic responsibilities among levels of

government in a federal system?

• Will discuss the advantages and

disadvantages of a decentralized system.

16

Optimal Fiscal Federalism

• First, the model implies that the extent to which public goods

should be provided at the local level is determined by taxbenefit linkages.

• Strong linkages (such as local roads) means most residents

benefit, and the good should be provided locally.

• Weak linkages (such as welfare payments) means that most

residents do not benefit, and the good should be provided at a

higher level.

• If residents can see directly the benefits they are buying with

their property tax dollars, they will be willing to pay local taxes.

Otherwise, they may “vote with their feet.”

17

Optimal Fiscal Federalism

• The second factor that determines the optimal level

of decentralization is the extent of positive

externalities.

• If the local public good has spillovers to other

communities, they will be underprovided. In this

case, higher levels of government have a role in

promoting the provision of these public goods.

18

Optimal Fiscal Federalism

• The third factor that determines the optimal level

of decentralization is the economies of scale in

production.

• Public goods with large economies of scale, like

national defense, are not efficiently provided by

many competing local jurisdictions.

• Public goods without large economies of scale,

like police protection, may be provided more

efficiently in Tiebout competition.

19

Optimal Fiscal Federalism

• The Tiebout model therefore predicts that

local spending should focus on broad-based

programs with few externalities and relatively

low economies of scale.

• Examples include road repair, education,

garbage collection, and street cleaning.

20

The Property Tax

• In 2005, $320 billion collected in property

taxes, almost all at the local level.

• Plays key role in local public finance.

• In many western states with public lands,

feds make payment in lieu of taxes

• Many non-profits also make payments in

lieu of taxes

21

22

The Property Tax

• Property tax liability is the product of the tax rate

and the property’s assessed value.

– Value the jurisdiction assigns to property.

• In many cases, assessed values correspond to

market values, but more difficult if a property has

not been sold recently.

• Wide range of credits and rollbacks can change

the effective tax rate

23

The Property Tax

• Table 20.2 shows that effective tax rates

on residential property vary widely.

24

Table 20.2

26

Property taxes

• American system of local property taxes originates

with British traditions

• Importance linked to growth of frontier

• Feasible source of revenue

– Equal taxation of wealth

– Overlapping and special districts had revenue sources

• Colonial era had several taxes

– Excise and tariffs

• Post revolutionary war saw a uniformity clause added

to property taxation

27

Property taxes

• Property taxes applied to real estate and

personal property

• Individuals paid for government services

in proportion to their wealth

28

Property tax and local governments

• 87,500 local governments in 2002

– Special districts increasing

• “reserved powers” clause of 10th amendment to

US Constitution

– States can permit anything not excluded by Feds

– Local governments are creatures of State govt.

• Diversity of local government related to history,

settlement patterns and state legislatures

29

Local government trends

• Local government structure continues to evolve

– De-volution or de-centralization trends

– Number and scope of local governments

– Style of state legislature

– Political culture of the state.

• Local government will continue to be important

– Local government revenue will be needed

– Property tax will continue to be important

30

Evolution of the property tax system

• In agricultural economy, wealth mostly tied to land and

buildings

• In modern commercial society, wealth in many other

forms (stocks, bonds, investments,

• Local assessors often played favorites with property

valuations

• Auditor, treasurer are separate elected offices

• Wages and earnings as new form of wealth

• Increased demands for revenues for services

31

Property tax history

• Post WW2 saw dramatic changes in

growth and demand for services

• Assessments and revenues grew

• Local programs and services also grew

32

California Tax Revolt

• Proposition 13

– Froze assessments at 1975 levies (until next

transaction)

– Ceiling on the property tax rate any locality

could impose

– Forbade localities raising property taxes

without a 2/3 majority

• State stepped in with more revenue

sharing

33

Why property taxes are

controversial in US and Iowa

• Property tax is highly visible

• Perceived as regressive

• May be more accessible for changing

• Iowa has uneven effective rates across

classes of property

34

The Property Tax

• Incidence and Efficiency Effects

– Who ultimately bears the burden of the

property tax? Three views:

• Property tax as an excise tax

• Property tax as a capital tax

• Property tax as a user fee

35

The Property Tax

• Incidence and Efficiency Effects

– Property tax as an excise tax

• Traditional view

• Excise tax on land and structures

• Incidence depends on shapes of supply and

demand curves for land and structures

36

The Property Tax

• Incidence and Efficiency Effects

– The supply curve for land is viewed as being

perfectly inelastic and, thus, the landowners

bear the entire burden of the tax.

– Figure 22.1 illustrates this.

37

Figure 22.1

The Property Tax:

Value-adding structures

• Incidence and Efficiency Effects

– The supply curve for structures is viewed as

being perfectly elastic and, thus, the tenants

bear the entire burden of the tax.

– National market for capital, construction

industry can obtain all the capital it demands

at the market price.

– Figure 22.2 illustrates this.

39

Figure 22.2

The Property Tax

• Thus, incidence falls partly onto

landowners and partly onto tenants.

41

The Property Tax

• Incidence and Efficiency Effects

– Property tax as a user fee

• Communities use property taxes to purchase

public services like education.

• Thus, not really a tax at all.

• Implications:

– Incidence is meaningless

– No excess burden

– Deductibility of property taxes subsidizes

consumption of local public services.

42

Intergovernmental Grants

• Federal grants important source of

revenue to states and localities.

• Grants from federal and state

government are about 34% of total local

general revenues.

43

44

Table 1. State and Local Government Finances by Level of Government and by State: 2003-04

(Dollar amounts are in thousands. Coefficients of variation (CV) are expressed as percents. For meaning

of abbreviations and symbols, see note below table.)

Iowa

State & local

State & local

State

Local

Local

government

government

government

government

government

amount1

CV

amount

amount1

CV

1

2

3

4

5

2,953

(X)

2,953

2,953

(X)

22,544,565

0.17

15,363,015

10,639,521

0.43

18,396,343

0.20

11,916,703

9,937,611

0.45

4,304,225

0.16

4,038,220

3,723,976

0.86

4,304,225

0.16

3,911,906

392,319

1.78

From State government1

(1)

0.00

0

3,331,657

0.93

From local governments1

(1)

0.00

126,314

(1)

0.00

14,092,118

0.25

7,878,483

6,213,635

0.56

9,018,748

0.34

5,214,602

3,804,146

0.81

3,188,869

0.44

0

3,188,869

0.44

Description

Population (July 2004, in thousands)

Revenue1

General revenue1

Intergovernmental revenue1

From Federal Government

General revenue from own sources

Taxes

Property

45

46

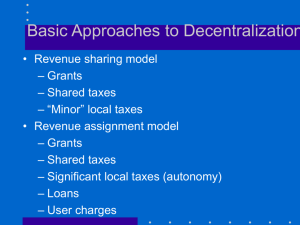

Roles of Intergovernmental

Grants

• Correct for externalities (services or tax

costs cross boundaries

• Redistribution of resources among

regions

• Substituting one tax structure for another

• Macroeconomic stabilizing tool (fiscal

policy)

47

Economic effects of grants

• Income effects

– Increasing the resources available for local

services

• Price effects

– Reducing marginal costs of providing the

service

48

Intergovernmental Grants

• Essentially two types of grants:

conditional and unconditional.

• Conditional grants

– Also known as categorical grants.

– Donor specifies the purposes for which the

recipient may use the money.

• Usually earmarked

– Several types of conditional grants:

• Matching grant

• Matching closed-ended grant

• Nonmatching grant

49

Intergovernmental Grants

• Conditional grants

• Matching grant

– For every dollar given by the donor to support a

particular activity, a certain sum must be expended

by the recipient.

• Changes relative price of the public good, G.

• Figure 22.4 illustrates the potential effects.

50

Figure 22.4

Intergovernmental Grants

• Conditional grants

• Matching closed-ended grant

– For every dollar given by the donor to support a

particular activity, a certain sum must be expended

by the recipient. Donor specifies ceiling, that is, a

maximum contribution.

• Changes relative price of the public good, G,

on part of the budget constraint. Budget

constraint is non-linear.

• Figure 22.5 illustrates the potential effects.

52

Figure 22.5

Intergovernmental Grants

• Conditional grants

• Nonmatching grant

– Donor gives fixed sum of money with the stipulation

that it is spent on public good.

• Does not change the relative price of the

public good, G. Budget constraint is

nonlinear.

• Figure 22.6 illustrates the potential effects.

54

Figure 22.6

Intergovernmental Grants

• Unconditional grants (Block grant)

– Sometimes referred to as revenue sharing.

Money is unrestricted.

– Similar to budget constraint in Figure 22.6,

except that the budget line is now JM rather

than AHM.

56

Intergovernmental Grants

• Flypaper effect

– The budget constraint analysis shows that much of

the money that was intended to be spent on the local

public good may actually be spent on other

consumption.

– Surprisingly, virtually all studies conclude that a dollar

received by the community in the form of a grant

results in greater public spending than a dollar

increase in community income.

– “Money seems to stick where it initially hits.”

57

Recap of Public Finance in a

Federal System

• Community Formation

• Tiebout Model

• Optimal Federalism

• Property Tax

• Intergovernmental Grants

58

59

Revenue Picture: Iowa’s Ranking

for State and Local Taxes

• Measuring per capita taxes

• Assessing financial burden on state

residents

60

61

62

Tax burden (tax as % of personal income)

63

64

65

66

67

Iowa property tax system

• Tax on real property in 5 classes

– Residential

– Agricultural

– Commercial

– Industrial

– Utilities

68

69

Property taxes

• Properties are assessed every two years

• Each county has an assessor, towns over

10,000 may have their own

• How do they assess?

– Based on market valuation

– Recent sales, comparable properties

• Assessments summed for each class of

property

• State Dept. of Revenue equalizes among

jurisdictions

70

Assessment process

• Budgets are established

• Tax rates are established

• Credits subtracted

– Homestead, disabled, farmstead, veterans

• Rollbacks applied

• Levy and consolidated levy

• Roles of assessor, auditor, treasurer

• Opportunities for appeal

71

Property taxes: Rollbacks

• —30 years ago high inflation led to limitations

on valuation increases

– -residential and ag land received limitation

formula

– Ag land assessed on productivity

– Statewide valuations limited to 4% for these 2

classes

– Rollback from assessed valuations gives taxable

valuation.

– Residential rollback at 46.28% currently

72

73

74

75

Property tax reform proposal

• Steady growth of rollback percentage

means property tax bill shifting to

commercial and industrial classes

• Businesses want tax relief

• HF2771 proposes to limit increases to

commercial and industrial by linking

increases across classes

76

77

78

79

Assessment of Iowa Taxes

• Very average in terms of per capita and

per income basis

• State and local taxes declining on a per

income basis

• Slight increase on a percapita basis

• Percapita spending also very average

80