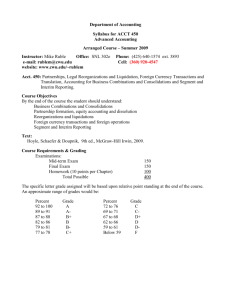

Concepts of Consolidated Financial Statements

advertisement

Concepts of Consolid. Statements - 1 2-1 Concepts of Consolidated Financial Statements Parent Subsidiary Consolidated financial statements are prepared. Concepts of Consolid. Statements - 2 CONSOLIDATED FINANCIAL STATEMENTS “Economic Substance Over Legal Form” Conditions for consolidation – Majority control • Parent company owns more than 50% of voting stock • Intent is long-term control • ALL majority owned subsidiaries MUST be consolidated (SFAS No. 94 - October 1987) – Effective control by majority shareholders • Not in bankruptcy or reorganization • Not in restricted foreign environment Concepts of Consolid. Statements - 3 CONSOLIDATED STATEMENTS General Concepts Same GAAP as separate statements Only external transactions Specific consolidation mechanics depend on Parent’s accounting for investment in subsidiary Concepts of Consolid. Statements - 4 CONSOLIDATED STATEMENTS Other Issues Classification of “noncontrolling” (minority) interest Elimination of intercompany items – Receivables and payables – Profits on intercompany sales Mechanics of consolidation Concepts of Consolid. Statements - 5 LIMITATIONS OF CONSOLIDATED STATEMENTS Limited relevance for certain users – Minority stockholders – Separate creditors – Regulatory authorities (related to subsidiary) Consolidation of highly diversified companies Difficult financial analysis Concepts of Consolid. Statements - 6 3-6 Consolidation - The Effects of the Passage of Time The parent can account for its investment in one of three ways: Equity Method Cost Method Partial Equity Let’s briefly compare the three methods Concepts of Consolid. Statements - 7 3-7 Method Equity Cost Partial Equity Investment Account Income Account Income accrued as Continually adjusted earned; amortization to reflect ownership and other of acquired company. adjustments are recognized. Cash received Remains at initially recorded as dividend recorded cost. Income. Adjusted only for Income accrued as accrued income and earned; no other dividends received adjustments from acquired recognized. company. Concepts of Consolid. Statements - 8 3-8 Method Advantages Equity Acquiring company totals give a true representation of consolidation figures Cost Easy to apply: measures cash flows Partial Equity Usually gives balances approximating consolidation figures, but is easier to apply than equity method 3-9 Concepts of Consolid. Statements - 9 Before the consolidation balances can be determined, the Parent’s investment account must be adjusted to reflect application of the Equity method. Record the Investment in Sub on the acquisition date. Recognize the receipt of dividends from the sub. Recognize a share of the sub’s income (loss). FMV adjustments and other intangible assets. Concepts of Consolid. Statements - 10 CONSOLIDATION MECHANICS Consolidation workpapers – No “set of books” for consolidated entity – Each party maintains their own books Eliminating entries – Necessary to eliminate “intercompany items” – Appear only on consolidation workpapers Concepts of Consolid. Statements - 11 CONSOLIDATION MECHANICS Parent Co. Other Assets (BOOK) Subsidiary Co. + Other Assets (FMV) Consolidated Entity = Other Assets Invest. In S (ELIMIN) Liab. (BOOK) Stk. Equity + Liab. (FMV) = Liab. Stk. Equity (ELIMIN) Stk. Equity Consolid – Other. Issues - 12 INVESTMENT ELIMINATION Investment account (Parent’s books) vs. Stockholders’ equity (Subsidiary’s books) Treatment of the differential – Cost of the investment – FMV of subsidiary’s net assets – Book value of subsidiary’s net assets Consolid – Other. Issues - 13 INVESTMENT ELIMINATION Continued Positive differential (Cost vs. Book value) – Errors or omissions on subsidiary’s books – Excess of FMV over book value of subsidiary’s net assets – Existence of goodwill Negative differential (Cost vs. Book value) – Errors or omissions on subsidiary’s books – Excess of book value over FMV of subsidiary’s net assets – Bargain purchase or “negative goodwill” Consolid – Other. Issues - 14 INVESTMENT ELIMINATION Continued Treatment of noncontrolling interest Cost vs. Equity methods on Parent’s books Intercompany receivables and payables Valuation accounts at acquisition – Accumulated depreciation – Allowance for change in FMV of investment securities – Allowance for uncollectible accounts – Discount or premium on bonds payable Negative Retained earnings of subsidiary at acquisition Other stockholders’ equity accounts – Accounts accruing to common stock 3-15 Concepts of Consolid. Statements - 15 Subsequent Consolidation Worksheet Entries 5 basic entries are posted to the worksheet. The Sub’s equity accounts are eliminated. Other intangible assets are recorded and the Sub’s assets are adjusted to FV. The Equity in Sub Income account is eliminated. The Sub’s dividends are eliminated. Amortization Expense is recorded for the FMV adjustments and other intangible assets associated with the consolidated entity. Consolid – Other. Issues - 16 ELIMINATING ENTRIES First Subsequent Period (Equity Method) Impact of current equity method entries – Ignore any impairment of goodwill Assignment of income to noncontrolling interest Investment account – Stockholders’ equity of subsidiary – – – – – Including identification of noncontrolling interest Identification of differential Allocation of differential Depreciation/amortization of appropriate differentials Impairment of goodwill Consolid – Other. Issues - 17 ELIMINATING ENTRIES Further Subsequent Period (Equity Method) Impact of current equity method entries – Ignore impairment of goodwill Assignment of income to noncontrolling interest Investment account – Stockholders’ equity of subsidiary – – – – Retained earnings of subsidiary at BEGINNING of current year Including identification of noncontrolling interest Identification of REMAINING differential Allocation of REMAINING differential • Including appropriate valuation accounts – Depreciation/amortization of appropriate differentials – Impairment of goodwill 3-18 Concepts of Consolid. Statements - 18 Applying the Cost Method If the COST METHOD is used by the parent company to account for the investment, then the consolidation entries will change only slightly. Remember . . . 1. No adjustments are recorded in the Investment account for current year operations, dividends paid by the subsidiary, or amortization of purchase price allocations. 2. Dividends received from the subsidiary are recorded as Dividend Revenue. Concepts of Consolid. Statements - 19 3-19 Consolidation Entries Cost Method Adjust Investment in Sub to equity method as of the beginning of the period This would be necessary for periods after the year of the Investment in the Sub. This entry is NOT REQUIRED under the Equity Method CONSOLIDATION RECORD Date Description Investment in Subsidiary Retained earnings (Parent) Page Debit ## Credit $$$ $$$ Concepts of Consolid. Statements - 20 3-20 Consolidation Entries Cost Method Eliminate the sub’s equity balances as of the beginning of the period. This entry is the same under both the Equity Method and the Cost Method. CONSOLIDATION RECORD Date Description Common Stock - Subsidiary APIC - Subsidiary R/E-Beg.(Subsidiary) Investment in Subsidiary Page Debit ## Credit $$$ $$$ $$$ $$$ Concepts of Consolid. Statements - 21 3-21 Consolidation Entries Cost Method Adjust sub’s assets and liabilities to FV. Set up the Goodwill account and the other intangible assets. This is part of the elimination of the Investment in Subsidiary account. This entry is the same under both the Equity Method and the Cost Method. CONSOLIDATION RECORD Date Description Asset #1 Asset #2 Asset #3 Investment in Subsidiary Page Debit ## Credit $$$ $$$ $$$ $$$ Concepts of Consolid. Statements - 22 3-22 Consolidation Entries Cost Method This entry is different under the Cost Method. Eliminate the Parent’s Dividend Income account. Also, eliminate the Sub’s Dividends Paid account. CONSOLIDATION RECORD Date Description Dividend Income Dividends Paid Page Debit ## Credit $$$ $$$ Concepts of Consolid. Statements - 23 3-23 SFAS No. 142 - Goodwill and Other Intangible Assets For fiscal periods beginning AFTER December 15, 2001, goodwill is no longer amortized. The “nonamortization” rule is applied to both previously recognized and newly acquired goodwill. Any unamortized goodwill arising from pre-SFAS 142 combinations is carried on the books as a permanent asset (subject to impairment). Concepts of Consolid. Statements - 24 3-24 SFAS No. 142 - Goodwill and Other Intangible Assets Generally, once goodwill has been recorded, the value will remain unchanged. Two circumstances exist that will result in adjusting the amount of goodwill on the consolidated balance sheet. Sale of all or part of the related subsidiary. A determination that goodwill has experienced a permanent impairment of value. Any impairment in the value of goodwill should be reported as an extraordinary item. Concepts of Consolid. Statements - 25 3-25 Goodwill Impairment Test Step 1 – Compare fair value of REPORTING UNIT to carrying value of the REPORTING UNIT Step 2 – Compare fair value of GOODWILL to carrying value of GOODWILL (SEE HANDOUT)